In an increasingly digital world, the need for clarity and vision from regulators, government departments and businesses to ensure consumers are protected has never been greater. At the same time, the pressure is on the providers of digital services to reassure customers that the key issues of ethics, governance and trust are respected.

Advances in digital technology have created huge benefits for businesses, enabling them to be more agile, flexible and responsive to customer demand. This has also led to a proliferation of digital and online services modelled along similar lines to disruptive brands such as Airbnb and Uber. Regulatory processes to protect consumer interests, however, are not as fleet of foot.

A lack of regulation

There is legislation in place to protect online consumers in the UK and Europe, including the new UK’s Consumer Rights Act 2015, but some of the biggest challenges have arisen from the lack of international regulation around online and digital services, resulting in uneven protection for digital consumers.

“In Europe, for example, website terms and conditions are required to be fair and easy to understand,” says David Marchese, a partner at law firm Gordon Dadds. “In the United States, this requirement does not exist, resulting in complicated ‘terms of use’ that would require a lawyer to interpret. Until the changing global standards of online consumer protection are addressed, consumers using such sites might be caught out by the small print.”

Other legal experts have argued that the digital business space is less of a minefield than it used to be and the old adage describing the internet as the “Wild West” is simply not true.

Until the changing global standards of online consumer protection are addressed, consumers might be caught out by the small print

“As a general rule, users are more protected in the online world than the physical one,” says Kolvin Stone, partner, technology companies group, at international law firm Orrick. “Rules relating to e-commerce, for example, are quite prescriptive in terms of what you are required to tell consumers, what rights they have and the contractual terms you are allowed to include in your online terms of sale.”

Digital transactions and behaviour are also recordable and traceable. This gives consumers a degree of protection, particularly in relation to fraud, that is not necessarily available in the physical world. The trade-off, says Mr Stone, is that users have to accept the lower privacy standards inherent online.

[embed_related]

Fraudulent online activity

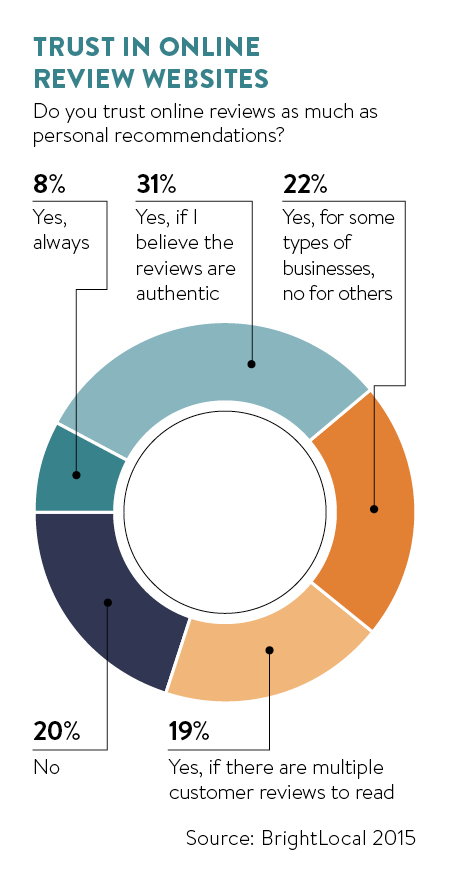

Fraudulent online activity poses another threat to digital business, often directly to the companies themselves. Posting of fake negative reviews on online websites such as TripAdvisor and Yelp, in some cases by competitors, can inflict damage on the brand and the business. While the UK Consumer Protection Act in theory covers users against false or liable reviews or statements, when it comes to online review sites, the main issue is enforcement.

Dr Gerhard Knecht, global head of information security services at Unisys, explains: “If a user cannot be sufficiently identified, then they cannot be held responsible for any false or defamatory reviews. Also, websites like TripAdvisor and Airbnb attract reviews from users from across the globe, so enforcement would be difficult because of the differing international laws, even if you can identify the user.”

The problem is compounded further by the fact that many of these websites are averse to any form of censorship of reviews, because the viability of their service could be compromised if they are filtering or removing reviews.

Some of the larger platforms are using sophisticated software to identify and weed out fake reviews. They also rely on their vast networks of internet users to self-police sites and report fake reviews.

Ashley Hurst, partner at law firm Osborne Clarke, says: “The European Commission is looking at this as part of its Digital Single Market initiative, but these international issues are difficult to legislate for. Technical solutions and policy-based initiatives will probably have greater success in the long run than increased regulation.”

Keeping data under control

While the regulators play catch-up, there are steps that individual companies can take to reassure their customers that governance and ethics are in hand, including creating their own data ethics framework.

Harry Armstrong, senior researcher at UK innovation foundation Nesta, says: “Companies such as HP have been championing a big data code of ethics and have created their own. The government has also launched its own data ethics framework, so there are a growing number of resources to pull from and businesses do not have to start from scratch.

Harry Armstrong, senior researcher at UK innovation foundation Nesta, says: “Companies such as HP have been championing a big data code of ethics and have created their own. The government has also launched its own data ethics framework, so there are a growing number of resources to pull from and businesses do not have to start from scratch.

“It is important to involve as many people within the company as possible in creating the framework to get more buy-in, which demonstrates that the company is actively exploring the legal and ethical side of data.”

Simply displaying a trust seal can go a long way to building and strengthening trust between a company and its customers. “A trust seal shows that connections between customers and a company’s web server are encrypted and hence secure, using the https protocol,” says Gavin Hammar, founder of social media management firm Sendible. “The added bonus is that the displaying of badges, such as Norton, Verisign and McAfee, has been shown to increase customer conversion rates.”

The genie of consumer empowerment is well and truly out of the bottle and, as consumers, we expect more socially responsible behaviour

Perhaps the most effective way for digital businesses to demonstrate their commitment to online governance, ethics and the protection of their customers is to have greater clarity around their social responsibility agenda. Consumers are more socially aware and more discerning about which brands they engage with and are far more likely to choose digital businesses with a strong, authentic social purpose at their core, over those that have one as an afterthought.

As Kerim Derhalli, chief executive at fintech company Invstr, points out, abidance with the letter of the law is no longer sufficient as a measure of ethical business standards.

“The recent remarks by a well-known former retailer in the UK that he broke no laws are redolent of an out-of-date mindset,” he concludes. “The genie of consumer empowerment is well and truly out of the bottle and, as consumers, we expect more socially responsible behaviour.”

A lack of regulation

Fraudulent online activity