Items such as corporate culture, diversity, talent and brand reputation are difficult to value, but may play a key role in a company’s success.

Investment in such intangibles, therefore, may be difficult for chief financial officers to recommend to the board when there is no obvious return on investment. Yet the long-term investment case can be compelling.

“The way in which many organisations currently measure value and returns can often fail to reflect the social, fiscal and environmental considerations that are increasingly critical to business success,” says Malcolm Preston, partner at global consultancy PwC.

“The public and wider stakeholders now expect organisations to look beyond the bottom line, both in their goals and reporting, to get a more holistic view on which to base decisions and judge performance.

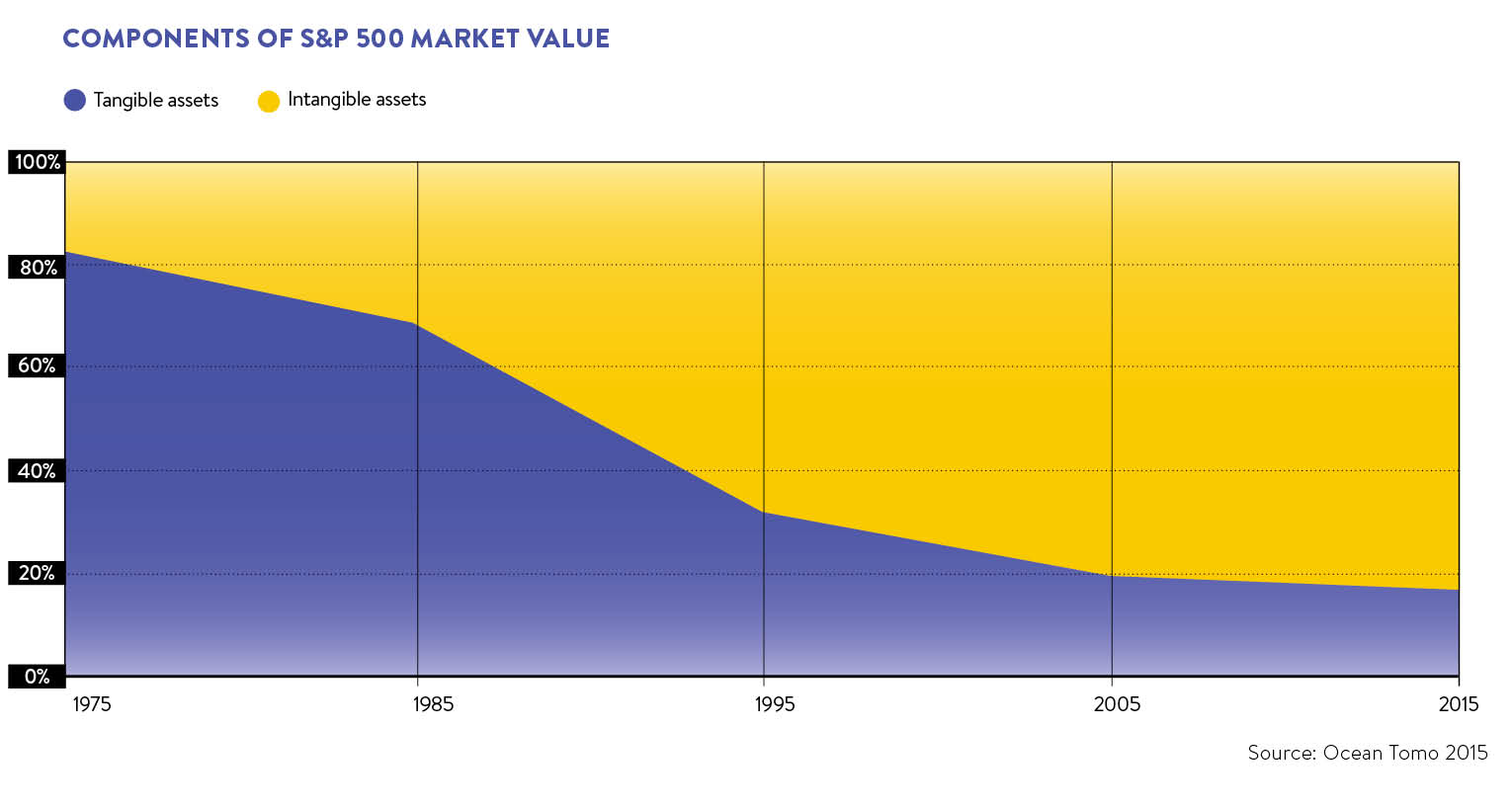

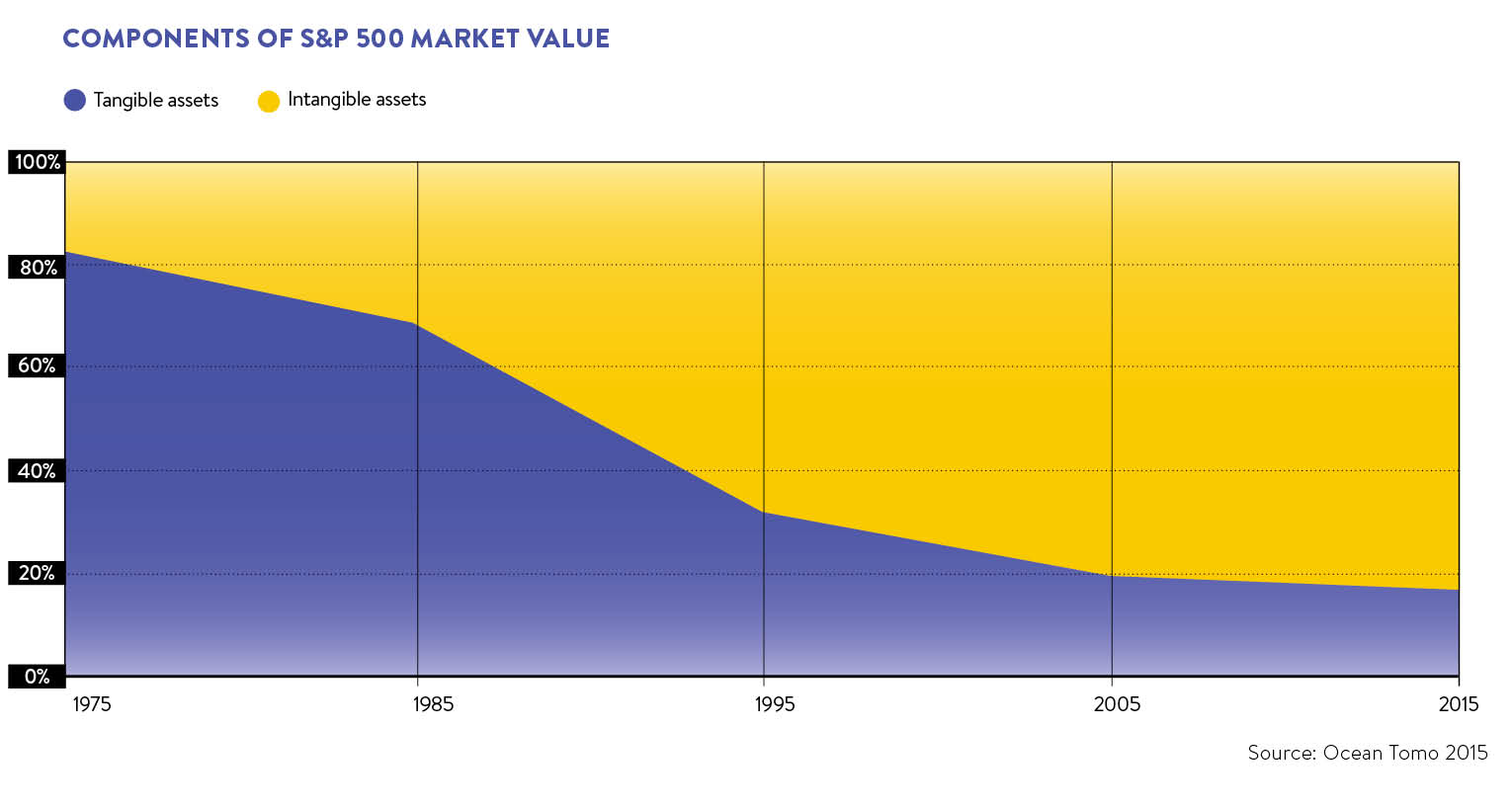

“It’s not just the balance sheet that’s important to the CFO, but also the market capitalisation. Thirty years ago, around 80 per cent of a company’s market cap was supported by its net assets, but today that’s flipped to only 20 per cent. So the rest is made up of ‘intangible’ value, including brand reputation, culture and human capital.”

Loosing out

Protection of the brand and promotion of a strong company culture can help prevent small issues from snowballing into larger ones.

Alon Domb, head of corporate at legal and professional services firm Gordon Dadds, says the correlation between underinvestment in company culture and poor brand reputation with a decline in revenues or a rise in claims against a company can sometimes be overlooked.

“The key for CFOs is to change their approach to persuading their board to invest in intangible assets by focusing on what they could lose by not investing, rather than the returns they could make,” he explains.

“In light of the current economic unpredictability, investing in intangible assets might be more prudent than traditional tangible investments.”

Brand reputation should also be a priority for companies, says Mr Domb, particularly online where challenges to intellectual property rights can sometimes go unnoticed.

“Companies should view legal protection for their intellectual property rights and taking action against defamatory statements as protecting their investment in their brand reputation,” he says.

“Managing the company’s reputation, especially on the internet, requires continual attention. Bad reviews will happen from time to time and should not be treated heavy handedly.”

Investment in diversity and company culture, through regular reviews of the employee handbook, can reduce the risk of disputes, which can sometimes lead to costly tribunal claims, he adds.

In light of the current economic unpredictability, investing in intangible assets might be more prudent than traditional tangible investments

It can also be important in attracting and retaining staff, particularly in competitive labour markets, says Peter Richardson, managing director and head of Protiviti UK, a consultancy focused on internal audit, risk, business and technology.

“Investing in intangible assets shows employees that organisations care, and they feel higher value in their work and are more committed to their performance,” says Mr Richardson.

“Employee attrition is expensive and damages morale. Keeping employees engaged and retaining them is more cost efficient in the long run.”

The education process

Yet for intangible assets to be taken seriously by chief financial officers and their boards, a change in international accounting standards may be necessary.

Setting out its work programme for the next five years in November, the International Accounting Standards Board removed specific references to intangible assets, saying: “Any attempt to address recognition and measurement of intangible assets… would require significant resources, with very uncertain prospects for any significant improvement in financial reporting.”

Nigel Sleigh-Johnson, head of the Institute of Chartered Accountants in England and Wales’ financial reporting faculty, says: “Few intangibles meet the criteria for recognition on company balance sheets, except in the context of the acquisition of a business, and some would argue that as a result financial reporting fails to provide a clear picture of a company’s resources to investors and other users of financial reports.

“There is, however, some room for optimism. In the UK, the quality of narrative and non-financial disclosures in the ‘front half’ of the annual report by many listed companies about the business model, strategy and drivers of long-term value creation has improved significantly in recent years.”

Mr Richardson adds: “One of the key challenges CFOs face is that return on investment in such things as culture; brand does not happen overnight and it often takes months, if not years to see the benefits coming through. It’s also hard to measure and therefore to quantify.

“So, when faced with demands from a range of stakeholders – shareholders, investors, even employees – who will still be demanding strong financial performance, it’s easier to focus on activities that give immediate more tangible results.

“As measuring the success of investment in intangibles is more difficult and without that obvious line of sight to ‘justify’ the spend, it’s easier to focus on the more mechanical components of running the business.”

CFOs becoming innovators

While international standards may yet take time to reflect the challenges of modern accounting practices, a change in the chief financial officer’s approach to the issue may already be underway.

“We review the business case for every investment which also includes intangible assets,” says Andrew Merrick, chief financial officer at law firm Irwin Mitchell. “Investment in intangible assets, such as people, company culture and brand reputation, is capable of improving the business and therefore generating a strong return.

“However, as with other types of investment, it is essential to be clear about the outcomes that will create value, plan to deliver them and measure the results.”

Indeed, having an investment plan will often help financial chiefs identify the value of intangible assets and contribute to the ongoing success of a company.

“Too often, CFOs are seen as number crunchers rather than innovators,” says Robert Held, Americas regional director of strategy execution consulting at international consultancy Palladium.

“But successful organisations are recognising to maintain success they must become the driving force of change. And the result is proving to be the difference between average performance and extraordinary social and economic results.

“With its in-depth knowledge across all departments, the CFO’s office is perfectly positioned to identify trends and help drive growth in an organisation. But to truly become a game-changer, CFOs must focus on two core elements – strategy and customers.”

Loosing out