The cloud is having its “national grid moment” as ubiquitous access to scalable and configurable computing resource, offered as a service, is transforming the way businesses compete and operate. Just as electricity grids ushered in industrial productivity on a scale previously unimaginable, cloud is morphing from efficient IT hosting platform to business innovation platform.

A vendor race for world domination of cloud is pushing prices down and accelerating this transformation of business model and mindset. Incumbents and startups alike are scrambling for share of the cloud infrastructure-as-a-service (IaaS) market as well as software, processes and emergent technologies delivered as a service. Analysts estimate the total cloud market will nudge $178 billion (Forrester) or $259.8 billion (Gartner) in 2018.

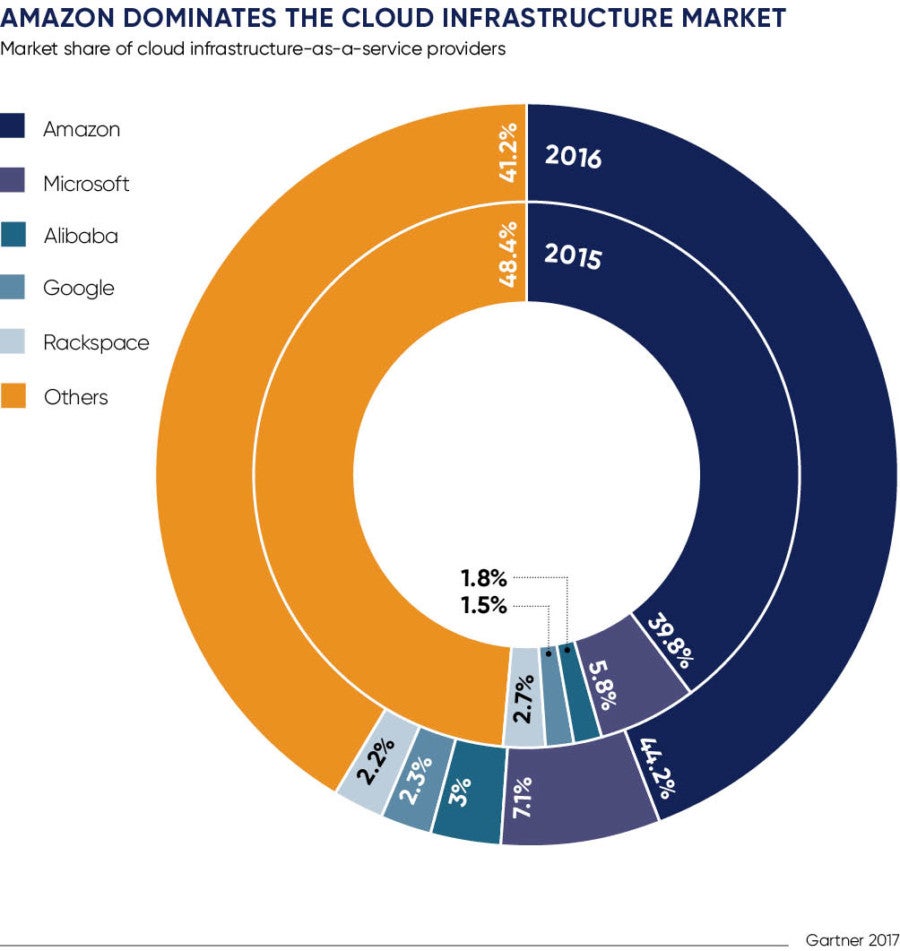

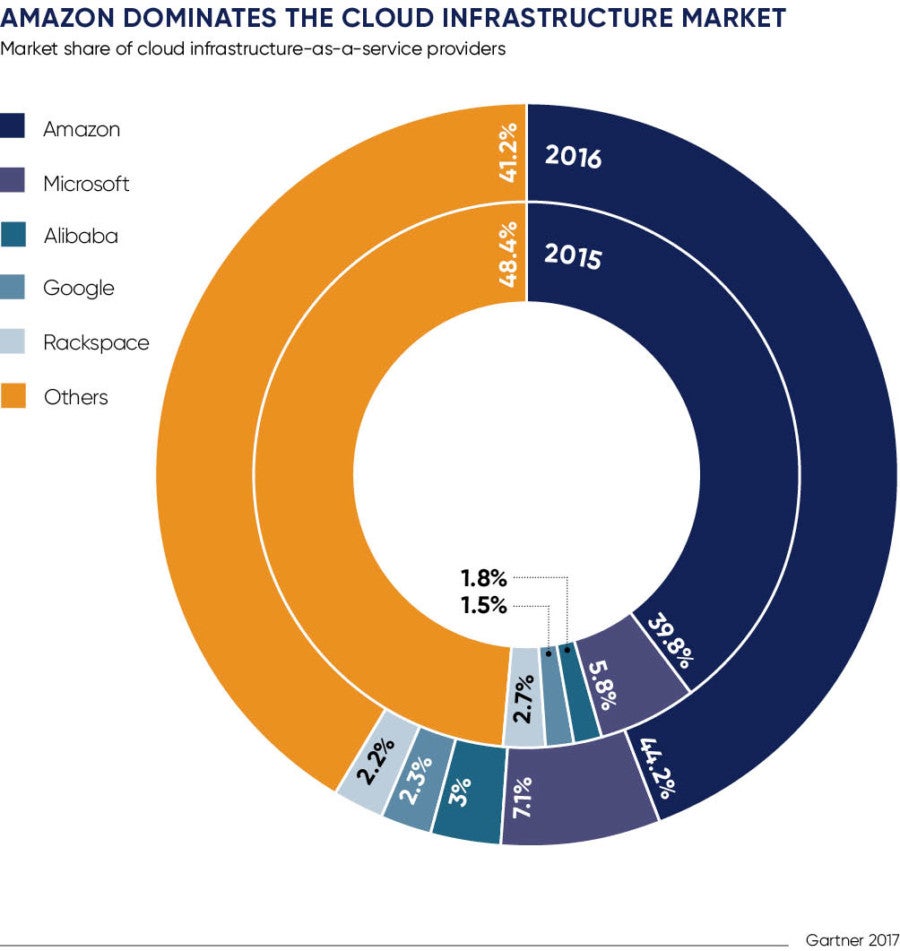

At the start of the year, it’s clear the IaaS race has already been won: Amazon Web Services (AWS) and Microsoft’s Azure are comprehensive leaders, according to just about everyone. Forrester predicts the duo, with Google, will capture 76 per cent of all cloud revenue in 2018 and expand its share to 80 per cent by 2020. Gartner’s most recent Magic Quadrant confirmed the two leaders, chased by Google in third place and Alibaba, featured as an insurgent for the first time.

US research firm Raymond James confirms the lead is unassailable: “Strong September quarter growth from hyper-scale cloud vendors Microsoft and AWS suggests the cloud spoils are going to those with scale.” It reported Azure and AWS grew 90 per cent and 42 per cent to an estimated $5.4 billion and $18.3 billion in run-rate revenue respectively, outpacing Gartner’s forecast for 35 per cent for IaaS and 25 per cent for PaaS or platform-as-a-service industry growth in 2017.

This depiction of the big three, the insurgents – Oracle, IBM, Alibaba Cloud – and the “also rans” is an oversimplification of how cloud services will be chosen and consumed, however. In individual markets there will continue to be plenty of choice, says Dave Bartoletti, vice president and principal analyst at Forrester. ”European providers will co-opt and extend the cloud offerings; they are not competing at platform level, but for partnership,” he says.

With price per unit going down because of the capacity coming on-stream, it’s difficult to enter the market unless you have a specialism

Nonetheless, newcomers and insurgents cannot compete with the hyper-scalers’ ability to invest billions of dollars of capital in building capacity, and take a view on balancing price with volume. “With price per unit going down because of the capacity coming on-stream, it’s difficult to enter the market unless you have a specialism,” notes Matt Caffrey, a partner with private equity cloud specialist Livingbridge.

Ten years ago, Amazon’s Elastic Compute Cloud was a compute rental proposition for small businesses, Google apps were a novelty and Azure wasn’t even a twinkle in Microsoft’s eye. Now, says Mr Caffrey, the cloud landscape has evolved and been populated so fast that Livingbridge sees investment opportunity only in plugging complementary, specialist services into the hyper-scalers, such as security or load balancing.

While infrastructure and software cloud players hustle for world domination or lucrative crumbs, the drivers of cloud adoption – agility, speed to market and access to innovation – only get more compelling. “If you think about cloud as a financial optimisation, you’ve missed the point. It stops wasting time and helps you focus on advancing your business,” says Greg DeMichillie, director of product management in the office of the chief technology officer at Google Cloud.

Embracing its potential

Sectors that were cautious about the cloud are now embracing it, especially as regulators such as the UK’s Financial Conduct Authority give the green light, issuing cloud guidelines last July. While enterprises house their new workloads in the cloud, legacy and data will be a harder migration – Deloitte estimates 50 per cent will remain in on–premise datacentres – none of which makes cloud shopping an impulse buy.

Oracle and IBM, incumbent insurgents, are going after their own niche and aim to be the natural choice for customers seeking a staged migration to cloud. “These insurgents are betting on the fact that large enterprises can’t throw everything out and start over. It’s too hard to change everything about an application, database and middleware. First, get the stuff to the cloud, then examine alternatives in the cloud,” says Forrester’s Mr Bartoletti.

Of the big three, businesses using open source would logically pick AWS, while Microsoft appeals to customers with an installed stack. Google’s pedigree in analytics and search engine optimisation has real pulling power, says Mr Bartoletti. “Driving insight from data will drive the next wave of cloud adoption,” he predicts, but adds corralling dispersed corporate data on to the cloud represents a major challenge.

Former easyJet chief information officer and director of Futurice Trevor Didcock agrees and hankers after a business service wrap for cloud services. “As we move into the world of the internet of things and big data, harvesting, cleansing and analysing data will become more critical and mainstream. Services that deliver pre-packaged data for complex analysis and to power automation and artificial intelligence, will enable organisations to understand and use insights,” he says.

Cloud-enabled insight will also boost consumption, says John Winstanley, a partner in technology consulting at Deloitte. “Most forecasts are based on traditional IT models and consumption. People have not factored in how voice, machine-learning and artificial-intelligence technologies will change the way we interact with corporate services,” he says, anticipating that the internet of things will be crucial for driving volume in IaaS.

Driving insight from data will drive the next wave of cloud adoption

Gartner’s research director Tiny Haynes concurs: “One aspect of cloud that is seriously underestimated is the change of mindset which accompanies adoption. With cloud, IT becomes a utility rather than an investment and fuels innovation – a taste for innovation can seriously boost consumption.”

Migration to the cloud may be inevitable, but the prospect of a painful journey still delays many, including Gavin Scruby, chief information officer of Smart Debit. The financial management company currently runs its own datacentre and its customers remain wary of the cloud. Mr Scruby would only consider AWS and Microsoft in terms of accreditation, and Smart Debit would also need to acclimatise to the new budgetary model of pay as you go.

His concern about too-easy usage is shared by big enterprises, as Google acknowledges. “That’s one thing traditional companies like about the cloud – they pay for what they use – but they find the unpredictability scary too. A lot of it is about giving visibility and control to customers. We help them ramp up quickly, but help them keep discipline,” says Mr DeMichillie at Google Cloud.

His observation on consumption patterns sums up the dilemma of cloud for enterprises and why the market is hard to call. “Typically, there’s an initial ramp-up at proof of concept, an inflection point when the customer has an ‘aha’ moment, gets the value, and then usage really increases,” he concludes.