The growing popularity for alternative methods of payment is transforming the traditional shopping experience. A boom in digitalisation, coupled with growing demand for versatile, more efficient payment methods, is spelling a new era for commerce.

Fifty years on from the launch of the first ATM, the financial ecosystem is virtually unrecognisable. Where coins once jangled happily in consumer’s pockets, their popularity is on the wane, with card payments surpassing cash payments for the first time in 2016.

While cash undoubtedly still has its role to play, today’s consumer has come to expect a multitude of payment options. From digital wallets, prepaid cards and cash vouchers to payment apps such as Apple Pay and Samsung Pay, and the advent of cryptocurrencies, consumers have a wealth of choice. It’s a trend that businesses must adapt to or risk being left behind.

New research by Paysafe, a leading global payments provider, has revealed that more than half of UK, US and Canadian consumers expect to use digital formats of cash in the next two years. Lost in Transaction found that a third of people in the UK only visited a cash machine once a month or less and feel increasingly comfortable paying with the “tap and go” method.

Oscar Nieboer, chief marketing officer at Paysafe, says: “Today, people have more ways than ever to spend cash online or offline and this challenges businesses to reimagine the shopping experience to allow for behaviours and payment models unthinkable a decade ago.”

The evolution of mobile technology has undoubtedly triggered this shift, with nearly a quarter of those surveyed in the UK now using mobile wallets and perhaps, more surprisingly, 12 per cent opting to pay with cryptocurrency. The findings echo developments in the United States, where almost a third of consumers use mobile wallets.

Unsurprisingly, the introduction of contactless in 2007 paved the way for this demand, with three out of five consumers now preferring to tap and go, and it’s not difficult to see why. In an age where most things can be found at the click of a finger, a payments environment where cash is merging with digital formats is redefining the shopping experience. Its appeal is not limited to British shores either, with 71 per cent of Canadians preferring contactless methods of payment and 49 per cent of Americans also citing it as more convenient, despite it not yet being introduced in the US.

While the sheer speed of developments can undoubtedly pose a challenge for businesses, those who fail to stay on top of this changing landscape risk becoming obsolete.

Mr Nieboer explains: “In order for businesses to succeed, they must offer choice, convenience, reach and flexibility in their payment solutions. Businesses thrive or die on their ability to forecast market trends and adjust accordingly.”

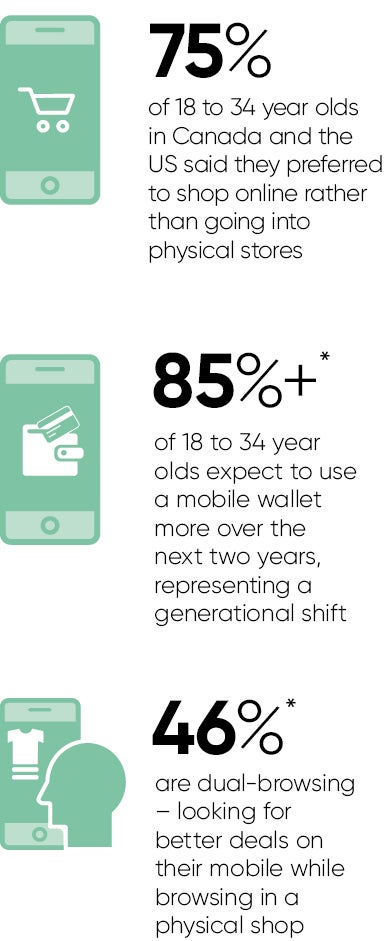

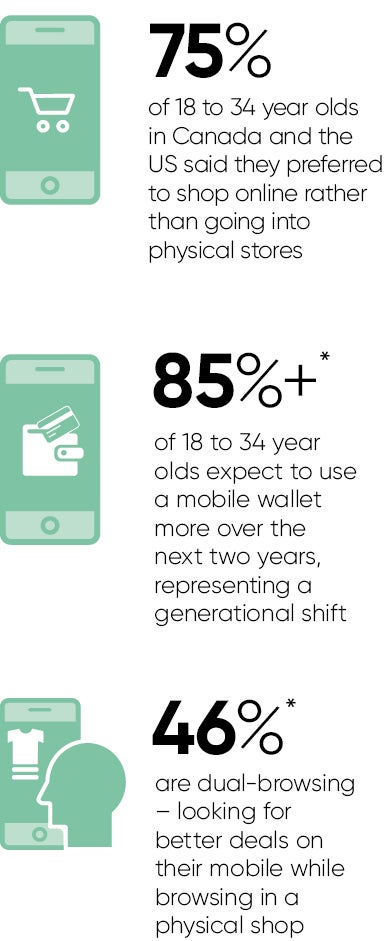

Millennials are at the forefront of the march; for them a cash-free society is not tomorrow’s world but today’s. Across the UK, US and Canada, those under the age of 34 were most comfortable looking online while browsing in-store simultaneously, while three quarters of 18 to 34 year olds in the US and Canada said they preferred shopping online rather than in-store.

As the line between online and offline blurs, merchants need to invest in emerging technologies to stay ahead of consumer demand

Daniel Kornitzer, chief product officer at Paysafe, says: “It’s our younger generations forging the path to a cash-free society. As the line between online and offline blurs, merchants need to invest in emerging technologies to stay ahead of consumer demand.”

According to Paysafe, a business’s success relies on them understanding and adopting the emerging payment technologies their customers prefer and this rings especially true for smaller companies.

Mr Nieboer adds: “Being able to provide similar payment and security capabilities as their larger competitors can help level the playing field for smaller companies. It will be those merchants seizing the opportunities before them who will be best placed to capitalise on their customer journey.”