Maximising employee engagement in pension schemes has become the top priority for business leaders, according to research conducted by the Confederation of British Industry (CBI) and consultancy Mercer.

Their report, A view from the top: CBI/Mercer pensions survey 2015, found engagement was the chief concern for 29 per cent of respondents, putting it ahead of attracting and retaining talent (25 per cent) as an issue.

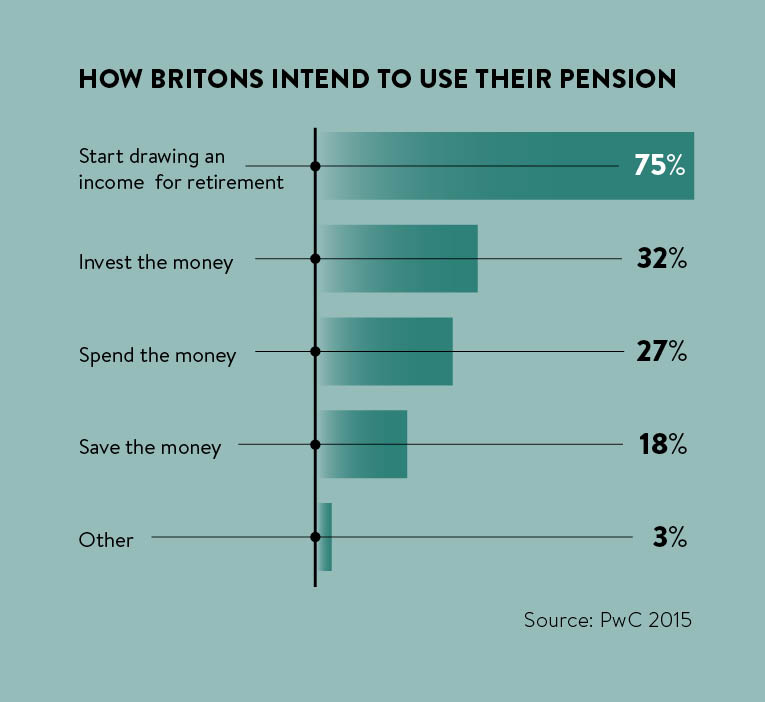

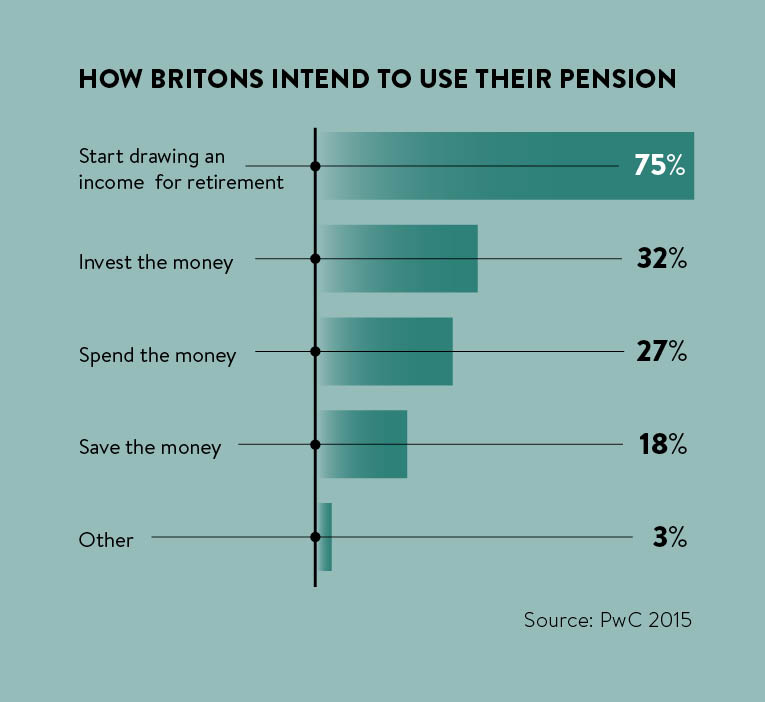

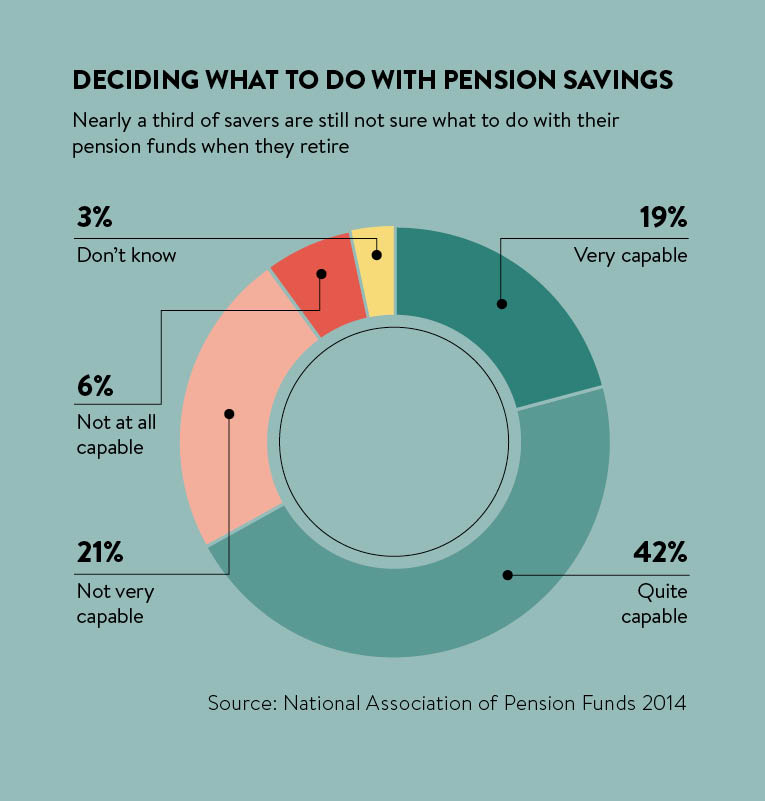

As part of the April 2015 Budget, the government allowed private pension scheme members to withdraw their pension savings as a lump sum – the first 25 per cent tax free – in order to provide more “freedom” around managing retirement. In doing this they effectively put savers in the driving seat for managing their retirement money. Unfortunately, no one had taught savers to drive.

New technology-based models of engagement are emerging to assist workplace pension scheme members in understanding their obligations and that can act upon them in an informed manner

“I would go further than that; they also do not know where they are supposed to be going,” says Peter Strudwick, pension and benefits partner at LV=. “I am passionate about giving people a target to aim for. Scheme members will not always know what ‘good’ looks like in this context.”

There were drivers for freeing pension scheme members from the constraints their schemes place upon them, for example in December 2014 the Financial Conduct Authority (FCA) found evidence that pension providers’ sales practices contributed to consumers not shopping around and switching for annuities. Annually consumers would have to collectively save between £115 million to £230 million extra to make up the difference they could have got from shopping around.

Focusing on engagement

In the CBI/Mercer report, 47 per cent of businesses reported they were looking at additional propositions, such as providing guidance to employees, as a result of the increased pension freedoms. The difficulty is in getting scheme members interested. New technology-based models of engagement are emerging to assist workplace pension scheme members in understanding their obligations and that can act upon them in an informed manner.

Debbie Falvey, defined contribution proposition leader at Aon, says: “We really want people to focus on engagement and the key points in their life, but it is incredibly difficult. People are still frightened of pensions. I think giving them extra choices and responsibilities wouldn’t make that any easier. So the development of digital tools and services are to help people make these decisions.”

Two types of digital tools are typically used to draw in scheme members. The first are designed to create a greater interest in managing a pension by making the process more interesting. An example of this is LVPensionsVillage.co.uk, developed in 2012 by communications and design firm AHC for the company pension scheme of insurer LV.

Prior to the site, information about the pension scheme was not in a single location and could be difficult to locate. Where useful information was available it was presented in a formal way that could be hard to penetrate.

“A lot of the other written communications were very technical, not particularly user friendly, and promoting it internally was difficult,” says Mr Strudwick. “We felt people weren’t maximising the value of benefits because it wasn’t front and centre enough.”

Following a review by trustees, the village was created, focusing on a fresh approach to presenting data, such as using weather forecasts instead of graphs, and a highly interactive interface. AHC reports visits to the website increased by 1,882 per cent.

In August 2016, LV took a major stake in Wealth Wizards, a robo-adviser that can support the decision-making process for scheme members. These types of tools map the requirements of the investor through a series of questions, with asset allocation based on patterns that the firm has established through analysis of the asset management industry.

The advice is available on screen via PCs, mobile devices or in a report that can be printed out and read. Firms that use the tool can offer a more controlled and consistent experience for people than is on offer with human advisers, says Tony Vail, chief innovation officer at Wealth Wizards.

“Once they accept the advice, then they can ask us to sort it out for them,” he says. “So the simplest model involves going through that online process, accepting the advice and then we will make the changes they want.”

The government, having chosen to steer the boat rather than row it, is performing a delicate ballet, seeking to nudge the industry to lead

The advice model works most effectively when it has a very clear objective, Mr Vail notes, such as how to invest the user’s pension, how to plan contributions for a good retirement or how to understand changing salaries.

Aggregators

The other type of tools is aggregators. These are used to gather information together from multiple financial sources and create a single view of them, making overall management of funds easier. In 2015, the FCA proposed creating a “pensions dashboard” to fulfil this function for consumers’ retirement products. In the 2016 Budget, this was slated to be in place by 2019; however, a report by the Centre for Policy Studies made the case that the dashboard was falling between the cracks.

The report’s author Richard Walker says: “An air of politically accommodating ambiguity surrounds the dashboard’s development, particularly in respect of accountability and responsibility. The government, having chosen to steer the boat rather than row it, is performing a delicate ballet, seeking to nudge the industry to lead.”

If it is developed, it could overcome some of the challenges that dog commercial developments of aggregators, where competition can limit the ability of different firms to allow interoperability.

Richard Llambias, head of product strategy at Equiniti Pension Solutions, says: “We have been looking at a wealth app ourselves, combining all aspects of a person’s financial life. Bringing it altogether in one spot is quite complicated. If we have got different bank accounts with different banks, we don’t have a single app that brings them altogether; it is separate apps and we have separate apps for our pensions.”

At present, the use of digital technologies to enable engagement is offering scheme providers more presence in the lives of scheme members, ensuring they can be reached more effectively when decisions need to be made.

“Push notifications are really good because with defined contribution members, their investments are changing month on month,” says Mr Llambias. “At the end of each investment cycle you push a notification out to anybody who has downloaded the app, so it’s clear for them to see their latest balances.”

Ms Falvey says financial dashboards, which include all other aspects of finance including live feeds from banks and building societies, will ultimately engage pension scheme members more because they are bringing pensions into the day-to-day management of finance.

“I can look at my debts, at my other investments, and then I can use that to think about where am I invested?” she says. “So actually I can, depending on where I am in my life, use these tools to help me think about my pension because pension is not the only asset. The aggregation tools allow you to dig down into that detail; it categorises your spending, looking at how much you spend on Starbucks on the way to work, and uses that to help you think about saving.”

Focusing on engagement