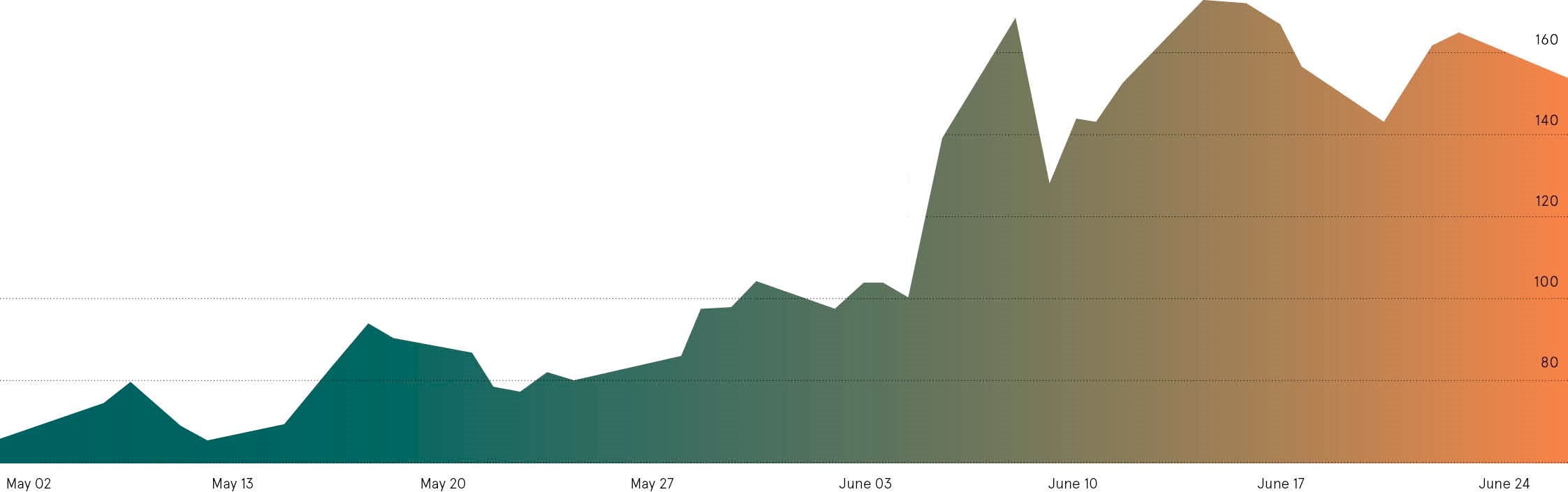

The share price of Beyond Meat, the vegan meat company, has increased six-fold since its initial public offering in New York this May. And while Wall Street investors are excited about the earnings potential of its plant-based meat substitutes, the stock’s explosion is representative of a wider shift among younger investors towards companies that offer more than just good returns.

After listing its IPO at $25 a share and peaking at $168 in June, Beyond Meat’s shares are now trading in the $150 range, valuing the business at around $10 billion, which is around 40 to 50 times predicted earnings.

According to Adam Vettese, an analyst at multi-asset investment platform eToro, Beyond Meat was the most traded stock on its platform in May.

Millennials and Gen Z are interested in investing in businesses that are socially and environmentally sustainable and positive

Impossible Foods, another plant-based food company, is also believed to be considering an IPO. Meanwhile, the popularity of cannabis stocks has swelled as investors eagerly anticipate strong business growth in those countries or states where use of the drug for medicinal purposes is legal.

“The Cannabis CopyPortfolio that we launched in 2018 was oversubscribed in just eight hours,” says Mr Vettese, who thinks that the potential for significant profit in some of these stocks is what attracts investors.

“With passion brands like Beyond Meat, it’s very possible that retail investors in particular intend to support the company for the long-haul, because of their good credentials.

“However, investors are not blindly investing in companies simply because they are ethical. The top picks among younger investors are also extremely profitable.”

The popularity of passion brands

Ty Montague, co-founder of strategy and innovation consultancy co:collective, and a former co-president and chief creative officer of J Walter Thompson, says a huge shift is taking place in investor mindsets, and claims “impact” investing is the future of all investing.

“We’re in the middle of the greatest intergenerational transfer of wealth in US history, from Boomers and Gen Xers to Millennials and Gen Z,” he says.

“This fundamentally changes not only investing but the practice of capitalism itself, because millennials and Gen Z are interested in investing in businesses that are socially and environmentally sustainable and positive.”

Younger investors are also attracted to high-growth businesses “with a disruptive streak and that are mission led”, according to Luke Lang, co-founder of Crowdcube.

“They value a closer relationship with the brands they love. Often the most successful businesses on the platform are creating their own tribe, are purpose driven and community focused,” he says.

In fact, younger investors are nearly twice as likely to make purchases because of a brand’s environmental or social impact, says Marga Hoek, an international speaker and global thought-leader on sustainable business and author of The Trillion Dollar Shift.

“This means they also do not really care about all the rather complex technical stories, but have a much more positive, active investing approach: invest only in what is good and what we need,” she says.

The ethical angle of investing

Socially responsible investing totalled $26 trillion in 2018, a 2018 study from Harvard University’s Kennedy School of Government found. This is more than a quarter of all assets under professional management worldwide.

Toby Belsom, director of investment practices at the Principles for Responsible Investment (PRI), says that there has been a fundamental shift in the way that investors view the companies that they are thinking of buying shares in.

“Twenty years ago, ethical investment largely meant avoiding companies involved in animal testing or nuclear weapons,” he says.

“Things have moved on. Rising concerns on climate change, the use of plastics and board pay, combined with the realisation that asset owners and savers can influence business behaviour, has meant new savers want to see where their money is invested and how it is used to promote better practices.”

The need for genuine change

While it is easy for companies to jump aboard trends, if they are going to survive long term and continue to attract customers and investors then they need to be committed to change and to sustainability, says Francesca Rivett-Carnac, co-founder and director at Stand Agency, a communications agency that works with brands and charities.

The success of impact investing has already helped to challenge perceptions that purpose comes at the expense of profit.

“Global businesses like Ikea, Unilever and Patagonia are demonstrating that it’s possibleto make a positive social and environmental impact while maintaining a healthy bottom line,” she says.

But with the promise of stronger social capital and customer loyalty, it’s tempting for some brands to aim for the ‘purpose halo’ without genuine commitment to social or environmental change.

“Businesses who are beginning to think and talk about social and environmental impact should of course be encouraged,” says Ms Rivett-Carnac. “But consumers are quick to spot ‘woke-washing’ when they see it, and even quicker to vote with their feet if they feel a brand is jumping on the purpose bandwagon with no substance behind it. Cue damaged reputations and falling sales.”

Beyond Meat share price

Price action since the vegan meat company’s initial public offering on the Nasdaq in May 2019 (USD).