Before the first industrial revolution, economic transactions were effortful. Haggling over prices, for example, was the norm. Now, in the fourth industrial revolution - the ongoing automation of traditional practices, using smart technology - many economic transactions need no human intervention at all.

The huge quantities of data collected by the internet of things – with IDC expecting devices to generate 79.4 zettabytes by 2025 – and analysed in real time by artificial intelligence (AI) can enable accurate decisions to be taken by computing systems faster than people blink.

Think of looking for a book online. As if by magic, suggestions pop up that can be acquired with a couple of clicks.

Great expectations

Designing and implementing a customer-centric journey for buying paperbacks is relatively straightforward. It was already feasible 20 years ago when online data was limited and computing power expensive. The problem is that it has set a high bar for other segments, such as insurance, where smooth customer support is a complex undertaking.

“There is a huge correlation between customer satisfaction from a claims perspective and how that translates to retention,” says Paul Dixon, UK head of claims proposition and market insight at Zurich Insurance. “We are acutely aware of this and investing heavily in both technology and in our people so claims can play an even bigger part in demonstrating to a customer why they should want to stay.”

There is a huge correlation between customer satisfaction from a claims perspective and how that translates to retention

Insurers face a two-pronged challenge: an online claims experience that the user really likes and needs, and that is accurate and compliant with regulation. However, it is only in the last few years that insurance computer systems have been able to access the quantity of data they need to make “autonomous” decisions well.

ERGO, a subsidiary of Munich Re, set up pure-play digital insurer Nexible in 2016 as an experiment “to explore the boundaries of digitisation”, says Mark Klein, chief data officer and chairman of ERGO Digital Ventures.

There is no call centre support. We offer chatbots, email and the online portal. All sales are purely digital via aggregators and our own website.” Nexible currently has around 60,000 customers for car insurance in Germany and Austria and around €30 million in premia.

Automation assistance

Will ERGO automate all its processes? In particular, will it be possible to sort out claims with just a couple of taps on a mobile?

“We don’t believe in the 100 per cent automation of claims,” says Klein. “For example, where personal injury is involved there can be very complex situations that require the empathy of another human being to fully understand. We believe we can get to 60 per cent.”

He points out that even simpler claims, which could in principle be automated, such as cover of minor damage to a car, have potential challenges. “Where an external lawyer is consulted, the process becomes too complex and makes full automation inefficient,” he says.

Dixon at Zurich says: “There has been and continues to be a big push towards digital, submitting claims online via portals being one example. For our personal lines property claims we have seen about 14 per cent of all new claims submitted this way.”

But he adds it should not matter how a claim is presented and points out an online claim does not necessarily equate to better service. “That being said, we now see a significant amount of claims settled within 24 hours and usually by those who have embraced digital opportunities,” says Dixon.

Imagining what needs to be intuitive

Because intuitive interfaces are everywhere, the challenges of developing a really smooth online process can be underestimated. For insurers, it means reimagining the claims journey.

When ERGO set out to do this it asked customers to give feedback and ran a number of workshops. “We spent a lot of time rewording information, sequencing questions, choosing one-tap pictograms and making the layout as intuitive as possible,” says Klein. “We deliberately launched a mobile website rather than an app so the customer would not face the hurdle of a download.”

One particular challenge was presenting information in a way that is unambiguous. “For example, damage to cables in vehicles from small rodents, especially martens, is a common problem in Germany and typically included in car insurance,” says Klein. “When we asked people what they understood by major damage caused by an animal bite some thought it meant car accidents caused by being bitten in the leg by a dog in the car.”

A personal experience

So what would the optimal claims journey look like? “For some customers the claims journey would involve no human interaction at all, everything would be done digitally, including payment and they would want their claim settled on the same day,” says Dixon.

“For others, an optimal claims journey would be much more about the opportunity to engage and speak to someone, for them to be helped and supported throughout the journey. And then there are those who want a hybrid version.”

But even when customers like their claim processed automatically, as quickly as possible, many still want the feel of human intervention.

“We learnt customers do not want the claims journey to be as fast as the algorithms can make it,” says Klein. “They prefer a two-hour wait for a decision. Otherwise they feel that it hasn’t been thought through, even though the decision is the same.”

Keeping insurance buyers happy, at least for now, then is not just about automation. But that could change quickly. Coronavirus lockdowns have made millions of people much more willing to “live” online. At the same time, the insurance industry is battling a number of headwinds. Those include tight regulation, the ability of retail customers to cherry pick services, and the threat of online competitors from just outside the regulatory perimeter, as the Association of British Insurers (ABI) points out. Withstanding the gales will require heavy investment in smart online processes.

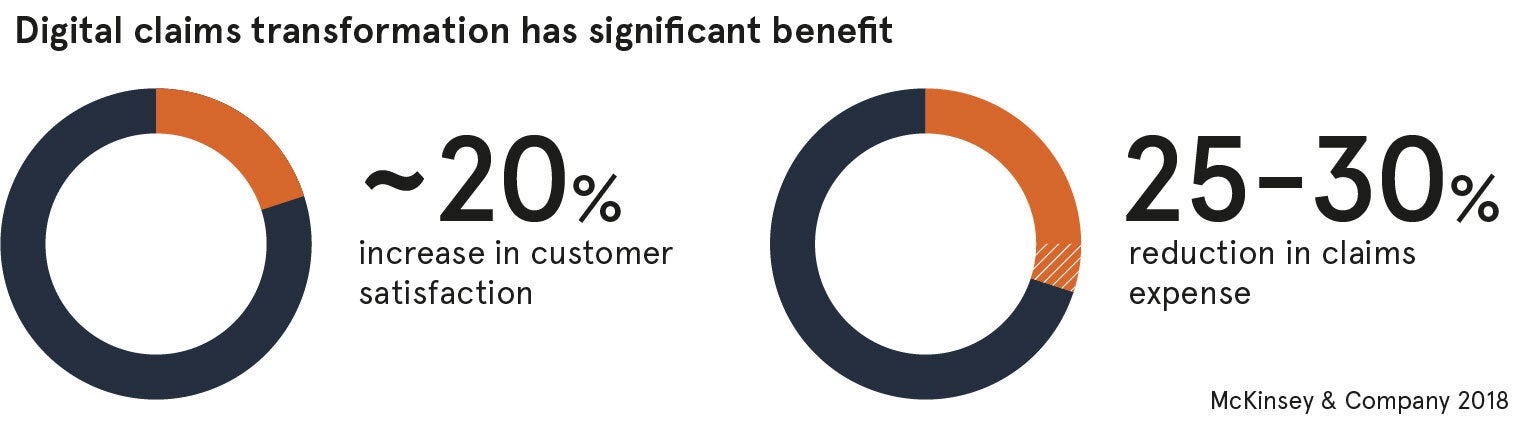

In the short term, it looks as though it will be investment in getting customer service right that will be the best use of capital – and not just because it improves the front-end customer experience: “One of the biggest cost drivers in insurance is the cost of managing the claims process,” says Klein. “So having a faster process with good customer consent can lead to significant savings.”

The best claims journey will be easy and highly personalised, which will boost satisfaction and retention as well as cutting costs, but it will be far from easy to implement. It will also have to constantly evolve as more data and more analytical capacity come on-stream.

It looks as though the insurers that thrive will be the insurers that can make all of their systems work together to deliver an agile experience that customers love – one fit for the fourth industrial revolution.

To find out more, read Consumer Financial Services 2025

Before the first industrial revolution, economic transactions were effortful. Haggling over prices, for example, was the norm. Now, in the fourth industrial revolution - the ongoing automation of traditional practices, using smart technology - many economic transactions need no human intervention at all.

The huge quantities of data collected by the internet of things – with IDC expecting devices to generate 79.4 zettabytes by 2025 – and analysed in real time by artificial intelligence (AI) can enable accurate decisions to be taken by computing systems faster than people blink.