By their very nature, lawyers are a cautious bunch. So when a topic hits the radar of the sector’s professional bodies, it is taken a little more seriously.

Electronic signatures have become one such topic, as the profession awaits guidance expected from the Law Society and City of London Law Society endorsing the use of electronic signatures.

The general rule under English law is that a contract may be made informally, with nothing required in writing for the contract to be legally binding. Although there are some types of contract where there is a statutory requirement for writing or a signature.

We live in a digital age. Yet the law often lags behind technology and lawyers have wondered whether an electronic transaction could fulfil these statutory requirements.

DocuSign is much more than an e-signing platform – it allows you to prepare, execute and manage the life cycle of business transactions in a fully digitised environment

Fortunately, English courts have given a clear signal that an electronic transaction can satisfy the statutory requirement for writing or signature just as effectively as a paper transaction (Golden Ocean Group Ltd v Salgaocar Mining Industries PVT Ltd and another 2012).

Some electronic transactions are concluded via e-mail or by clicking an “I accept” button on a website. But these signatures provide a low level of security and authentication, therefore the more digitally mature enterprises are turning to companies such as DocuSign for something a little more sophisticated.

DocuSign runs a digital transaction management platform enabling its customers to eliminate paper, and transact their business more quickly, efficiently and securely.

“DocuSign is much more than an e-signing platform – it allows you to prepare, execute and manage the life cycle of business transactions in a fully digitised environment,” says Richard Oliphant, Europe, Middle East and Africa general counsel at DocuSign.

“You have access to a real-time audit trail, tracking every step of the transaction, who signed, when they signed and, in some cases, where they signed. It generates the ‘proof’ of signature that you can rely on in court to establish the authenticity and integrity of the electronic transaction.”

In a world where accountability, transparency and legal certainty are key, that has to be reassuring.

And this can only be reinforced by upcoming changes in European Union law. Notwithstanding the Brexit bombshell, a new eIDAS (electronic identification and trust services) Regulation will come into force on July 1 across the EU including, initially at least, the UK.

eIDAS aims to build more trust in electronic transactions across the EU member states and create a more predictable regulatory framework for “trust services” including electronic signatures.

The move is very welcome. It will replace the eSignature Directive, in place since 1999 and the subject of much criticism, having been implemented inconsistently across the EU.

The European Commission believes this fragmentation has made it far harder to conduct cross-border electronic transactions. Cross-border e-commerce is the focus of the commission’s flagship Digital Single Market programme. Introduction of eIDAS will boost this initiative, encouraging the wider adoption of platforms such as DocuSign to make the digital transformation to conduct business transactions 100 per cent digital.

When assessing whether to use electronic signatures, for Mr Oliphant, risk analysis is a critical factor.

“Lawyers are often too cautious and overstate the risk of using an electronic signature. But, in actual fact, you can use an electronic signature to create a legally enforceable contract unless that contract is one of the very limited categories of contracts under English law that should not be signed electronically, such as transfers of land,” he says.

“Customers are always surprised when I tell them that there has not been a single case in which the English courts have ruled on whether a document was validly signed via an electronic signature platform.”

That offers some genuine reassurance; not only are contracts rarely challenged over the signature, but in the event of a challenge, the audit trail that comes with an e-signature lends it significant evidential weight, making any challenge, unless fraud-related, difficult to pursue.

Notwithstanding that legal certainty, however, for many enterprises across a multitude of sectors, the conversation is far simpler.

“Digitising your workflow is integral to a successful business model these days. For the more agile enterprises, operating in different hemispheres or time zones, they can authorise and sign contracts without the need for a power of attorney, for example,” says Mr Oliphant.

“And there’s the efficiency and cost-savings through going paperless – you remove the need for printing, faxing, scanning and mailing. These outdated services not only eat up money, they don’t belong in the digital era.”

With added certainty, speed, efficiency, security and backed by a comprehensive digital audit trail, the quality of the user experience will skyrocket.

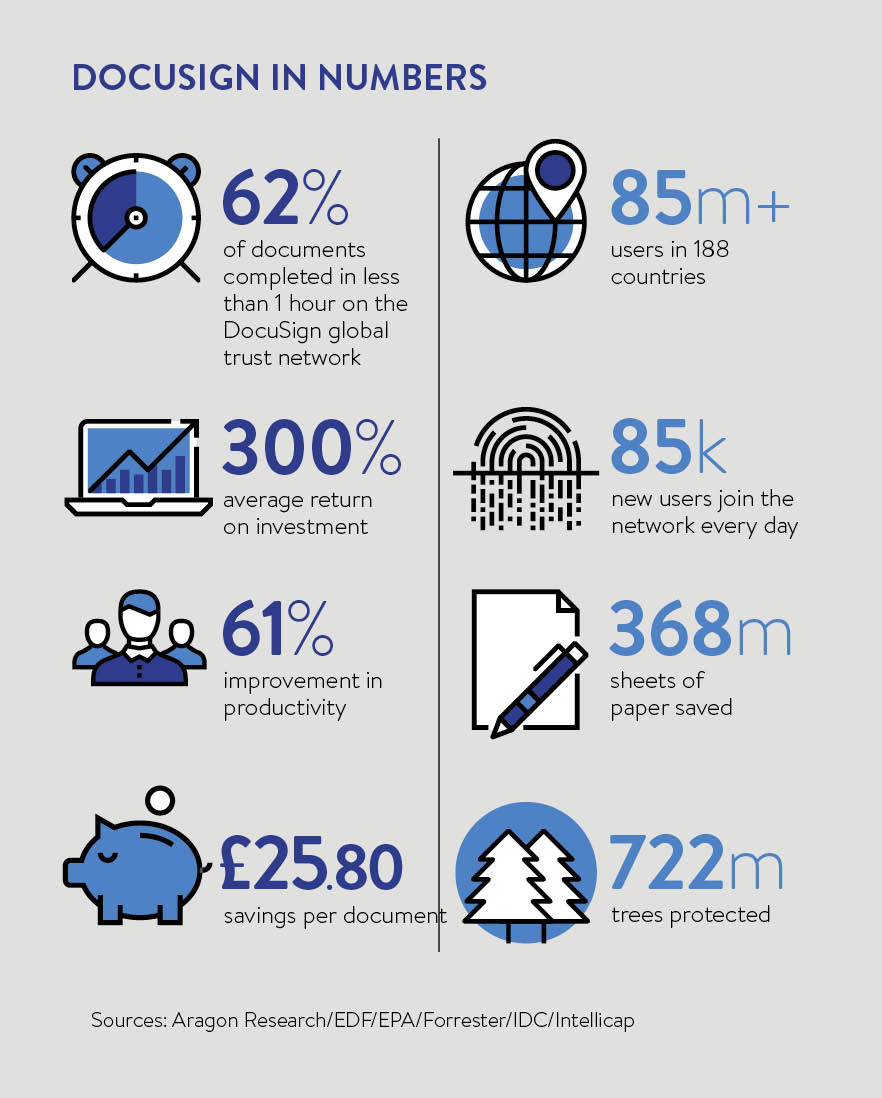

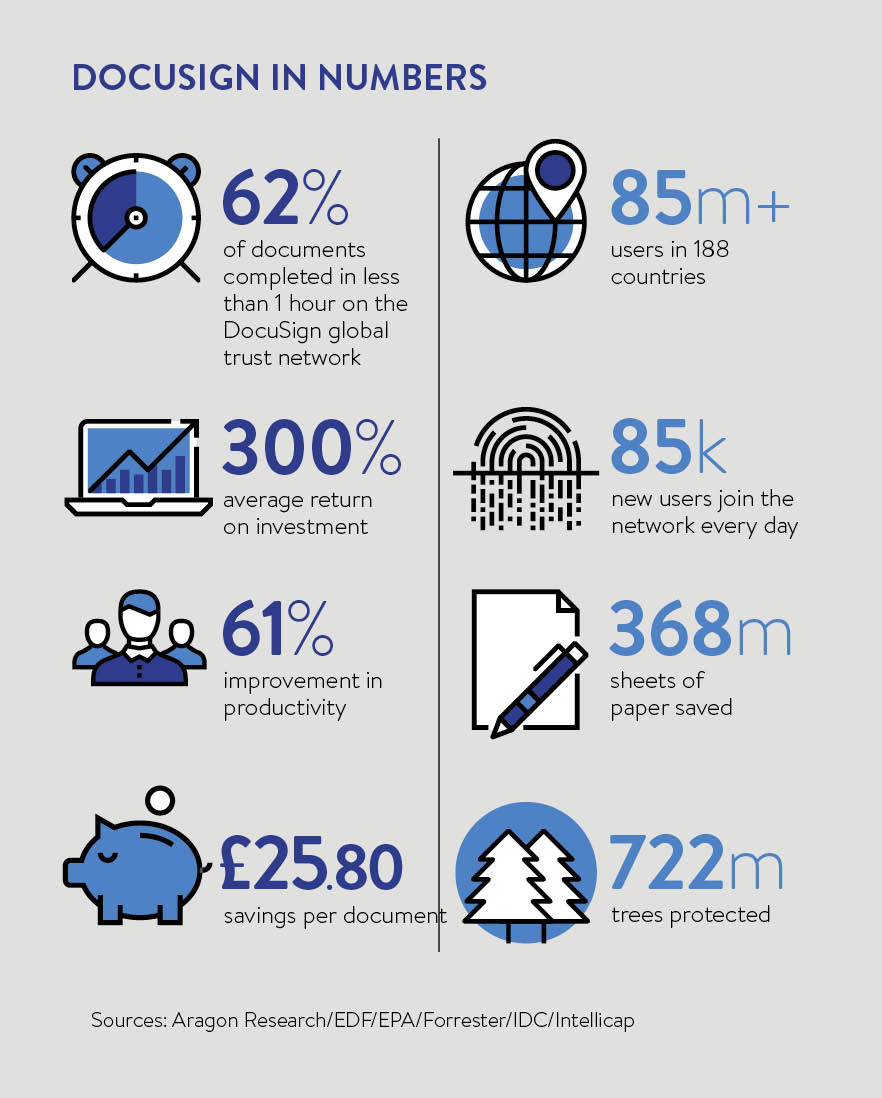

We know time is money. More than 62 per cent of documents administered through DocuSign were completed in under an hour, project turnaround time was reduced by almost two weeks and, unsurprisingly for a global leader, return on investment increased by 300 per cent.

The term no-brainer is often overused in the corporate world, yet for those digitally mature businesses, the ones with the confidence to embrace the use of electronic signatures, the numbers speak for themselves.

Digital leaders can improve their profitability by more than 50 per cent. Their market capitalisation can rise by a fifth. The ability to generate more revenue increases significantly.

While the perception of electronic signatures might be they offer a lower degree of authenticity and integrity than a handwritten signature, it seems that for electronic signatures produced by a secure, reputable platform, the opposite is true.

In an increasingly globalised world, the level of cross-border, cross-time zone, cross-cultural business being conducted has never been greater. Standards are crucial and DocuSign’s platform runs in adherence with ISO 27001, the international best-practice framework for an information security management system.

As Mr Oliphant says: “Trust in the cloud today is absolutely paramount. Our reputation hinges on our ability to keep our customers’ business information and data confidential. We therefore invest heavily to ensure we comply with the best-in-class IT security standards.”

DocuSign has 225,000 corporate customers and 85 million users. On the back of the Law Society’s guidance and the new EU regime for trust services under eIDAS, this is set to rise. More and more enterprises will trust DocuSign’s platform to prepare, execute and manage their electronic transactions – and consign pen and paper to the past.

For more information please visit www.docusign.com