If you’ve ever played ten pin bowling, you’ll be familiar with the image of a family playing in a lane flanked by inflatable guiderails. The premise is usually to give half a chance to one of the younger children.

The guiderails are there to assist the child (or adult, for that matter) so they hit more skittles more regularly than they would otherwise manage. It doesn’t guarantee success, but it minimises the chances of failure and narrows the range of outcomes as each ball is bowled.

To a large extent, the governance framework for pensions serves the same purpose. The government introduced a savings initiative called automatic enrolment back in 2012. Starting with the UK’s largest employers, all eligible employees must be enrolled into a suitable workplace pension and employers must contribute, alongside their employees.

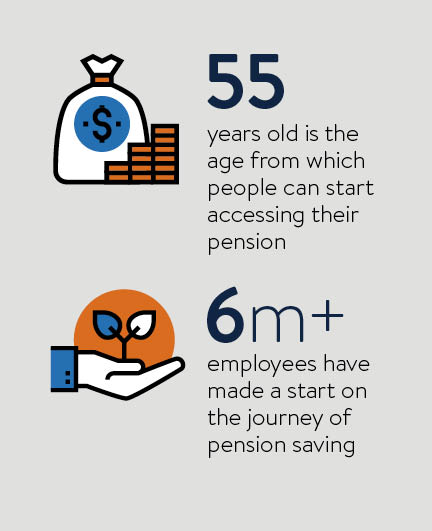

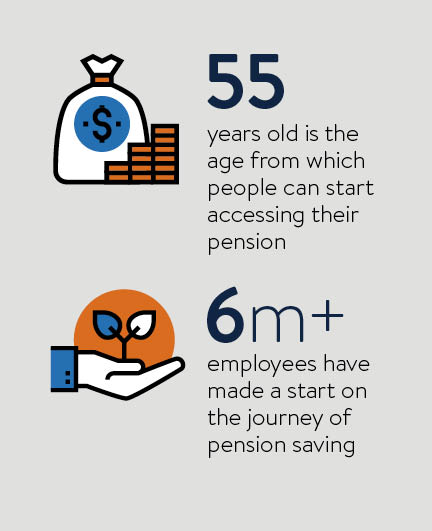

People can opt out, but only around one in ten of the first six million or so employees enrolled have chosen to do so. By 2018, all employers will have had to set up a scheme.

In the context of automatic enrolment, we have rules and regulations in place to ensure schemes meet certain standards. Eligibility is defined and eligible employees must be enrolled. Contributions must be paid to specified levels and within specified timescales.

Default investments can vary in construction and design, but must be fit for purpose and deemed suitable for a diverse range of needs. Custodians must adhere to certain rules in order to ensure assets and investments are secure.

The responsibility for retirement has shifted dramatically from state to employer and then to individuals in recent decades

The purpose is to narrow the possible range of outcomes for savers; to limit the chances of things going wrong and to improve the chances of things working well. A bit like those bowling guiderails. You get the picture.

Workplace pensions don’t have to conform to a singular design, but they have a common framework of standards that ensure there is some consistency to the governance; standards that reduce the risks and protect the interests of pension savers.

In pensions, though, the objective isn’t knocking down as many skittles as you can; it’s about achieving a decent standard of living in retirement.

The responsibility for retirement has shifted dramatically from state to employer and then to individuals in recent decades. Changes to the state pension have removed any remaining reference to earnings and defined benefit schemes offering a link to salary have all but closed. In place of the latter, we have defined contribution schemes with no direct link to income during work and no requirement now to secure an income in retirement. People can take money from the age of 55 as they wish, following a government freedom and choice initiative.

To a large extent then, the objective for pension savers now is simply to amass as large a pot as they can before they start to slow down or finish working.

[embed_related]

So we have some guiderails in place to help people amass a large pension pot. Perhaps the most tangible of these is the charge cap, whereby the rail will prevent annual product charges above 0.75 per cent. There are other costs incurred in managing investments and regulators are considering some consistent ways of disclosing these to ensure there are some guiderails in place there.

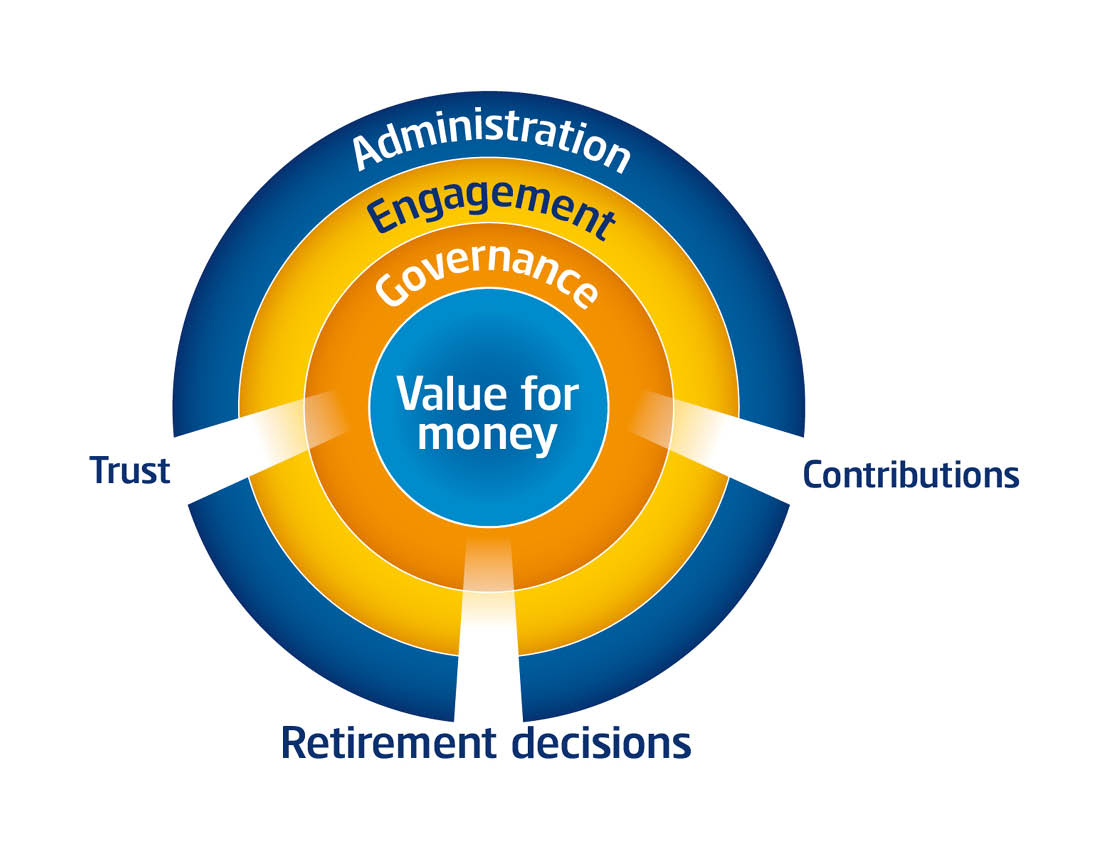

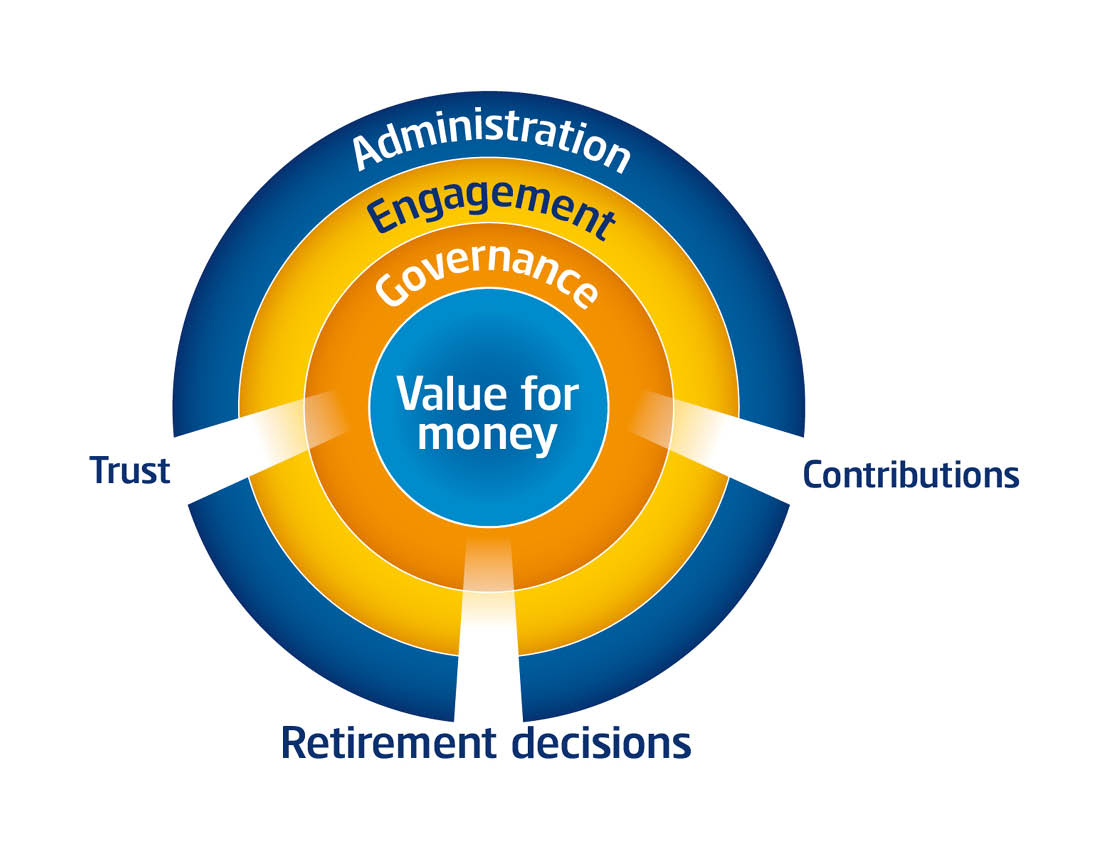

All this governance is hugely important, but we need to look beyond some of these factors if we want to understand what really delivers value for money.

A recent report from the Pensions Policy Institute looked at the whole subject of value for money in pensions, concluding that there are three key areas that will make the biggest difference: contributions, retirement decisions and trust.

The link from the first two is fairly obvious; people can improve their outcomes dramatically by saving more and making good decisions at retirement. Trust is a little different. If people don’t trust the pension they’re in, they’re less likely to make decisions that are in their best interests, for example they may fail to pay enough in, or take money out when it would be better not to.

This is undoubtedly true when it comes to investments. While most people will find themselves in a default strategy (a ready-made investment solution that doesn’t require anyone to make a choice) at the outset, there are some decisions to make further down the line, particularly as people start to look towards retirement, or simply the point at which they start accessing their pension, any time from the age of 55.

The variation in return and volatility from default investment strategies alone is wide. When you compound this with the appropriateness, or otherwise, of investments in the lead-up to retirement, it can have a significant impact on people’s outcomes – a significant impact on what people may judge to be good value for money.

And many people now remain invested well into retirement, only drawing on their pension pot as and when required. Choices of investment here can be crucial. Making withdrawals when investment values have temporarily dipped is similar to selling investments when the value is down. It can have a very negative impact on how long the fund will last.

So, in practical terms, it is the behaviour and decisions of the member that will make the biggest impact on the value for money they get from their workplace pension.

Automatic enrolment is centred around inertia, but it still relies on trust. People generally trust their employer and take solace in knowing they are doing what others are doing. That’s great for getting people into a pension scheme, but we must build on this and get people to a place where they are actively engaged, and actually feel good about their finances. This will give them a much better chance of making the right decisions about their financial future and getting value for money from the scheme they’re in.

Maybe automatic enrolment is the bowling ramp we so badly needed to start the savings habit and everything else constitutes the inflatable guiderails. And maybe it’s those guiderails that now need more attention – more air.

For more information please visit www.standardlifeworkplace.co.uk