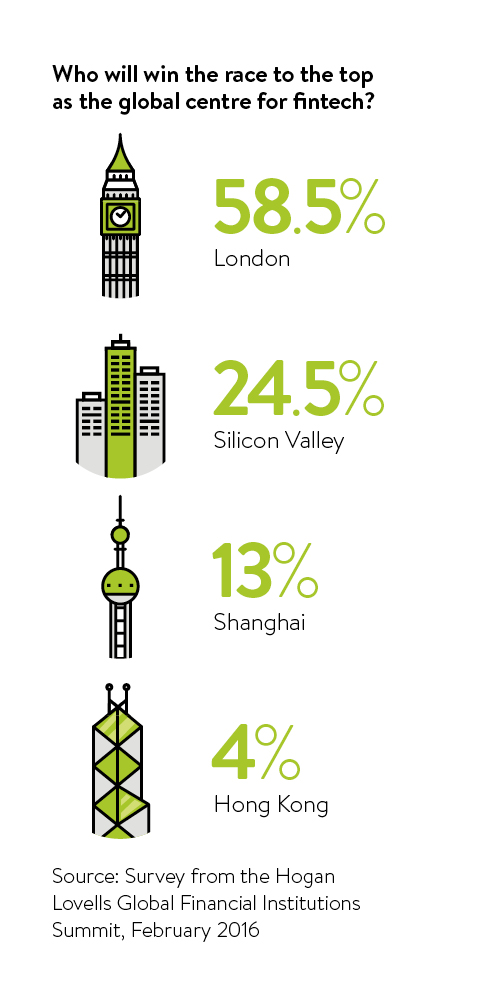

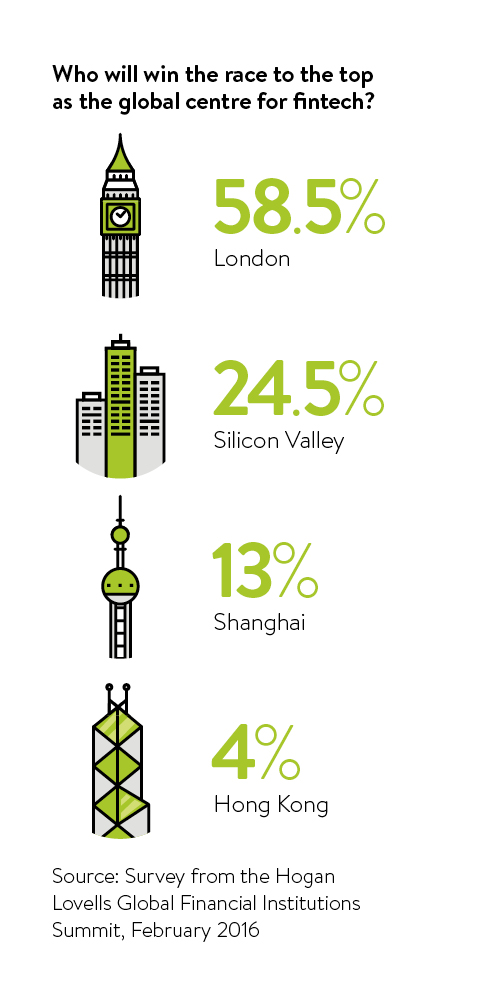

Crucial to London’s position as the fintech capital of the world, besides it being a global centre of excellence for financial services and a leading technology hub, is the speedy, pro-innovation response to the burgeoning industry from the UK’s regulator, the Financial Conduct Authority (FCA).

The FCA is leading the way among world regulators with its flexible, common-sense approach to the challenges thrown up by the new models that are set to revolutionise the banking industry, says Rachel Kent, global head of Hogan Lovells’ financial institutions sector.

Fintech startups, says Ms Kent, are by their nature, small, agile, businesses set up by bright entrepreneurs with the aim of making financial products and processes simpler and more accessible.

The FCA is leading the way among world regulators with its flexible, common-sense approach to the challenges thrown up by the new models that are set to revolutionise the banking industry

“For these emerging businesses, the complex regime, designed to apply to large, traditional financial organisations, can appear daunting, unnecessary and difficult to interpret,” she says.

But, says Ms Kent, the FCA has sought not only to understand the regulatory requirements that inhibit innovation, through its Barriers to Innovation consultation, it has also put in place innovations of its own to provide support in a co-operative and creative manner to foster engagement and two-way learning.

One important initiative is Project Innovate, launched in October 2014, to offer early advice and support to innovative businesses to guide them through the regulatory process.

Phoebe Hugh is the co-founder and chief executive of Brolly, an insurance mobile app, powered by artificial intelligence that automatically shops the market to find the best products for retail consumers.

Currently applying for a full broker licence to enable Brolly to provide insurance advice, Ms Hugh says she has found Project Innovate invaluable.

“Navigating the complex regulatory landscape as a startup is challenging, particularly without the resources to spend on legal or compliance fees,” she says.

‘The FCA’s help will contribute to our success as it provides direct support throughout the application process and assists in interpreting the compliance procedures that we need in place to protect our customers.”

The most innovative project, says Ms Kent, has been the FCA’s own “startup”, the Regulatory Sandbox. It provides a safe space for businesses to test new products, services, business models and delivery mechanisms in a “live” environment with real consumers for a limited period, without having to go through the full-blown authorisation process.

All of this, says Emily Reid, Hogan Lovells’ head of commercial and retail banking, should reduce the cost and time taken to bring new ideas to market, enabling promoters of new products to hit the ground running, making the UK an attractive place to do business.

The FCA is keen to spread its approach and put in place reciprocal agreements – fintech bridges – with overseas regulators, to facilitate co-operation and information-sharing in order to encourage inward and outward investment.

Having been slower to address the new scene, overseas regulators are shifting towards greater engagement.

Across the pond, those working in the various US fintech hubs, such as New York and Silicon Valley, have praised the FCA’s light touch, says Richard Schaberg, corporate and regulatory partner in Hogan Lovells’ Washington office.

But, he notes, the US 50 state regulation and multiple federal regulators adds complication. And while the Office of Comptroller to the Currency has issued a white paper encouraging the federal regulators to collaborate and the Consumer Finance Protection Bureau has introduced a very modest US-style sandbox, compared to the UK, Mr Schaberg says US regulators are still lagging behind their overseas counterparts.

Germany’s financial regulator, the Federal Financial Supervisory Authority (BaFin), has been profoundly critical of the FCA’s light-touch regulatory sandbox approach and made it clear no similar regime will be introduced there, says Richard Reimer, banking and finance partner in Hogan Lovells’ Frankfurt office.

Germany’s financial regulator, the Federal Financial Supervisory Authority (BaFin), has been profoundly critical of the FCA’s light-touch regulatory sandbox approach and made it clear no similar regime will be introduced there, says Richard Reimer, banking and finance partner in Hogan Lovells’ Frankfurt office.

“BaFin’s standpoint can be summed up as same business, same risks, same rules,” he says. But in recognition of the need for a more approachable and transparent regime, it has published brief guidelines on the licensing and additional requirements for fintech and other startups.

Regulators in the Asia-Pacific region do not want to get left behind, says Mark Parsons, Hogan Lovells’ corporate and commercial partner in Hong Kong. In particular, Hong Kong, Singapore and Australia are pushing for status as centres of financial services innovation, with the introduction of tax incentives and funding for accelerator programmes, he says.

Hong Kong’s Monetary Authority, and Securities and Futures Commission, says Mr Parsons, have announced the creation of fintech facilitation offices charged with offering guidance to startups on compliance and possible exemptions, which would allow them to operate without regulatory authorisations.

Proposals to relax the regulatory burden for fintech startups in Australia and Singapore, he says, are being considered. The Australian Securities and Investments Commission (ASIC) and Singapore’s Monetary Authority have entered co-operation agreements with the UK, and ASIC has launched a consultation to introduce a UK-style regulatory sandbox.

The FCA is also trying to engage with another new kid on the block – regtech companies that use artificial intelligence to provide technological solutions to facilitate regulatory requirements, from ID verification to anti money-laundering systems and programmes using algorithms to detect fraudulent activity.

One exciting regtech startup is Behavox, which uses big data to detect non-compliant and illegal practices from insider trading to sexual harassment and IP theft. Alex Viall, head of regulatory intelligence at Behavox, says they work with investment banks, hedge funds and asset managers. The startup uses detection algorithms to analyse communications and other data to report suspicious activity.

The FCA is looking how to encourage enterprises to embrace these new technologies by collaborating with the fintech community, as well as how it might adopt some of these solutions itself.

For more information please visit www.hoganlovells.com