The proliferation of consumer-friendly technology has seen the payments industry accelerate and reshape itself at unprecedented speed in a short time period. The customer journey now consists of more touchpoints than ever. People check prices online before they visit stores, price compare via mobile when they’re out shopping and seek out reviews on social media. Facebook and Twitter have already announced plans to move into the payments space, enabling users to pay using just a wall post or a tweet.

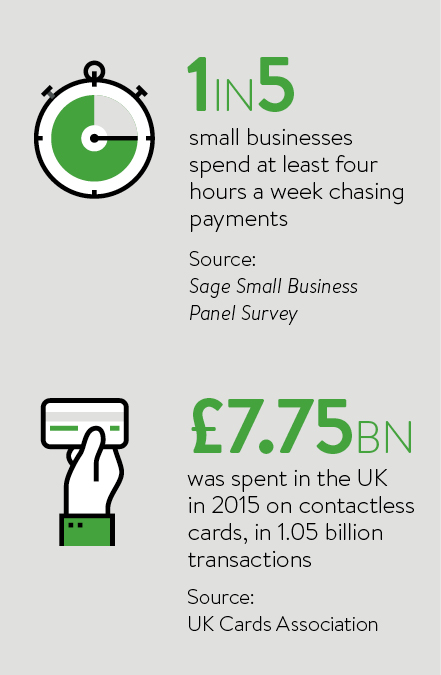

Businesses are being presented with evermore numerous methods of getting consumers to pay for goods and services. Contactless payment is part of this disruptive force pushing the payment sector forward. Widespread adoption in the UK has done much to whet consumers’ appetite when it comes to innovative ways to pay. The technology that enables consumers to pay for goods up to the value of £30 with just a tap of their bank card is also the driving force behind connected watches, smartphones and wearables. In 2015 alone, £7.75 billion was spent in the UK via contactless cards in 1.05 billion transactions.

Sage Payments is an innovative new service that seamlessly integrates control of outgoing payments to suppliers and employees into the core accounts or payroll software

According to research we carried out for the Sage Pay Payments Landscape Report 2015, providing greater choice for consumers has proven to increase sales, profit and loyalty. Our research found that more than one in four consumers say they are more likely to shop somewhere that offers a greater range of payment methods. However, there are now more payment channels than ever before for businesses to manage. Orders coming in from the web or mobile, over the phone or face to face, all need to be processed, recorded, distributed and paid for. And that’s just the payments coming into a business.

Managing the entire payments life cycle, whether incoming, outgoing or both, can be a time-consuming challenge for many small businesses. Since 2014, the number of businesses that say their payment channels are integrated has grown. According to our research, in 2015, 43 per cent of businesses said their online and offline channels were integrated. A fifth of those who had not integrated their offline and online channels said they were planning to do so in the next six months.

Diversification and disruption in the payments industry has made it hard for smaller companies to manage efficiently the money coming in and going out of the business. Thankfully, solutions that integrate the ability to make and receive payments with the technology small businesses use to manage their finances are making this possible for more and more companies.

For example, Sage Payments is an innovative new service that seamlessly integrates control of outgoing payments to suppliers and employees into the core accounts or payroll software, such as Sage 50 Accounts, Sage 50 Payroll and Sage 200 Standard Online. For businesses trading overseas, it also enables outgoing payments in 11 currencies to 24 countries and takes care of time-consuming exchange rate calculations.

Businesses can improve the movement of money by managing finances holistically. By integrating control of incoming and outgoing payments into the core accounting software, businesses can simplify the way money is managed, making payments more secure, more accurate and more efficient. This could hand businesses back hundreds of hours each year. According to our research, one in five small businesses spend at least four hours a week chasing payments.

However, businesses won’t only get back time by consolidating their view of payments. They can also transform the service they offer customers.

With many of its customers browsing web and mobile sites before visiting stores, the management team at Office Shoes adopted connected mobile electronic point-of-sale (ePOS) units in the form of in-store tablets, supported by Sage Cloud Connect, a fully integrated cloud payments system. This allows them to provide a seamless experience for customers by integrating data collected through its website.

Customers can order any item from Office’s entire online product range, in any store. If an item isn’t in stock within that store, it will be shipped to the customer free the next day, decreasing the number of lost sales. The use of tablets also means customers can pay wherever they are within the store, cutting down on long queues.

A connected mobile ePOS solution that runs from the cloud enables businesses to integrate online channels so all business data from products, stock, customer details, coupons, offers and refunds can be held in one place.

With a connected cloud ePOS, mobile devices such as tablets or smartphones can communicate with multiple payment terminals which can be used at any place to take payment. It also reduces the amount of time spent on manual data entry, cutting errors and saving time.

In addition, the payment system is integrated into a till system so businesses can reduce paper-based processes and manage stock more effectively. This sort of innovation helps cut queues and make services such as personal shopping much easier to offer.

The key to creating a customer experience like the one introduced by Office is consistency.

Businesses need to stop thinking about channels and start thinking in terms of experiences. As customers, we now have one constantly evolving experience of a brand and, such is our familiarity with technology, we’ve stopped registering how that experience is delivered, unless it disappoints or frustrates. Whether we’re online, on our mobiles or in store, it should all feel like one consistent and seamless experience, rather than different stages in a purchase cycle.

Businesses need to provide customers with a consistent experience that intuitively takes into account how customers behave and interact with technology. In practical terms, this means customers must be able to engage through a variety of channels, regardless of what stage they are at in the buying cycle. This could mean browsing the product on websites, in a shop or in a catalogue. It could also mean allowing customers to ask questions about products and services in store, via Twitter, a chat service or on the phone.

Businesses need to provide customers with a consistent experience that intuitively takes into account how customers behave and interact with technology. In practical terms, this means customers must be able to engage through a variety of channels, regardless of what stage they are at in the buying cycle. This could mean browsing the product on websites, in a shop or in a catalogue. It could also mean allowing customers to ask questions about products and services in store, via Twitter, a chat service or on the phone.

The starting point to achieving this is having a single view of money coming in and out of the business; something that can simplify all those separate channels and enable management teams to understand easily how money is moving around the business.

The future of payments needn’t be as challenging as it first appears. Small businesses should view it as an opportunity. An opportunity to level the playing field with their larger, better resourced competitors by transforming the customer experience, but also to improve and simplify the movement of money across their entire organisation.

See www.sage.co.uk/payments for more information or call 0800 336633