When the International Monetary Fund holds its spring meetings this month it will welcome back its re-elected managing director, the former French finance minister Christine Lagarde. Lagarde’s election was something of a foregone conclusion — she was the only candidate. It is almost unheard of that anyone challenges the incumbent, who is selected by the fund’s 24-member executive board.

The fund, which was formed as a mechanism to stabilise economies in the aftermath of the Second World War, is a critical part of the global financial system.

In January, the fund’s firepower was doubled to nearly £462 billion. With the commodity price crash leading more countries to call in the IMF for help in 2015 and 2016, and the echoes of the Greek financial crisis still being heard across Europe, the institution’s relevance is undiminished. In 2015 alone it opened a £12.4 billion programme for Ukraine; a £644 million facility for Ghana and a £13 billion credit line for Poland, as well as billions in smaller loans and credit facilities.

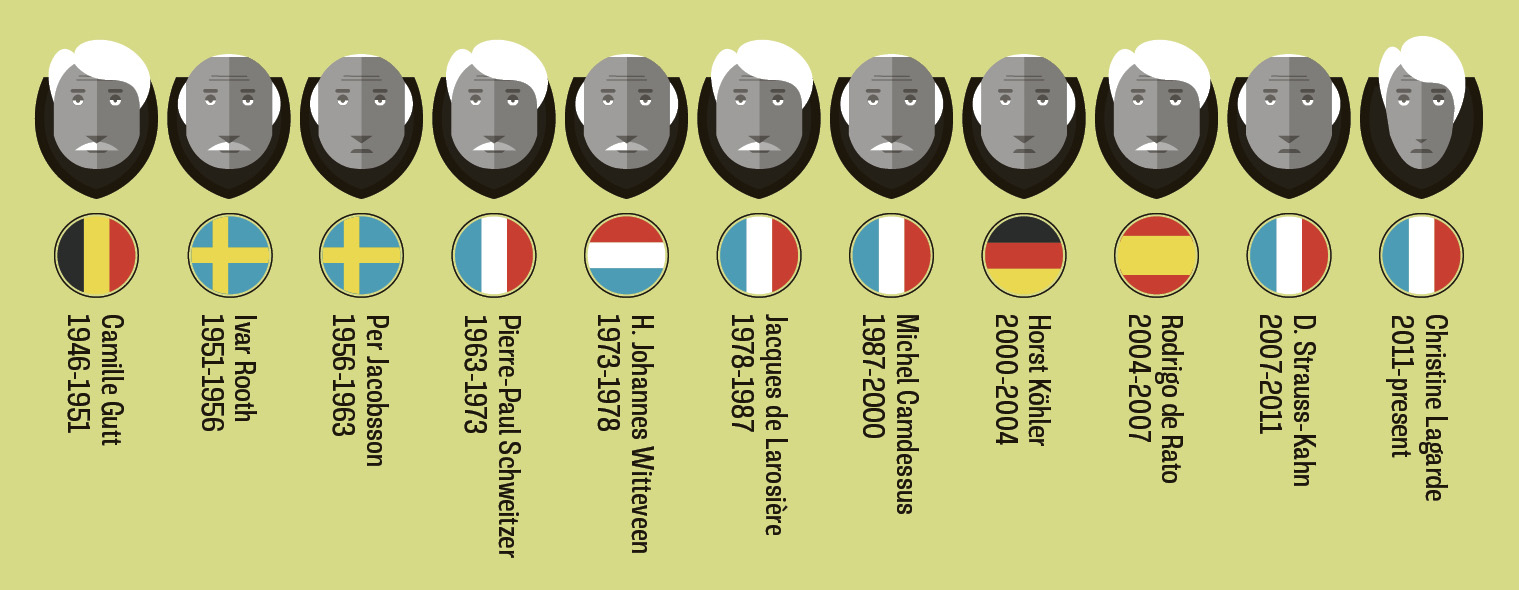

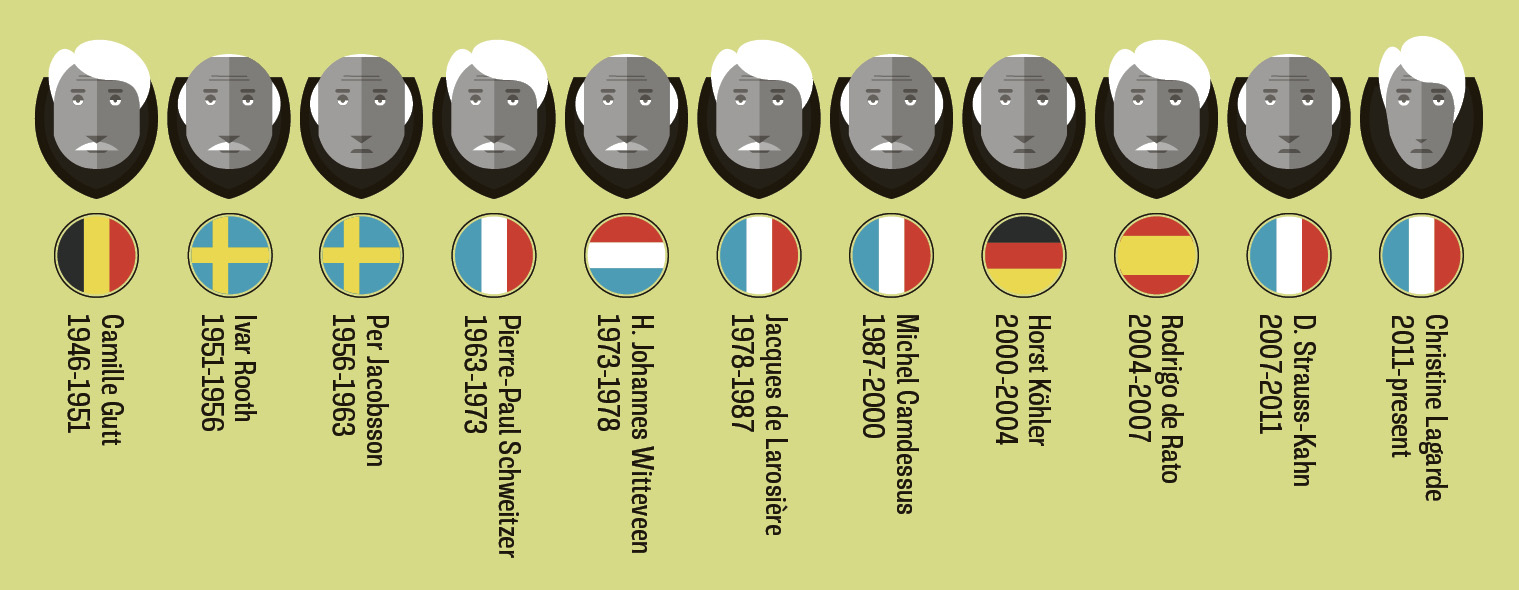

Although in theory the managing director’s selection is an open process, in reality it is governed by an unwritten but strictly observed rule. Of the past 11 heads of the IMF (see timeline above), five have been French. All have been European; all but one have been male. The IMF’s sister organisation, the World Bank, has only ever had US citizens at its helm.

For the fund’s critics, this represents a disconnect between the countries that borrow from the fund and those who control it. For recipients, from Ireland to Ghana to Greece, the medicine of public sector cuts and privatisations the IMF prescribes with its bailouts — “structural adjustment” — has been difficult for many to swallow.

Change could be coming, however. In February, the fund finally adopted a new governance structure that increases the voting power of developing countries, although the US still has an effective veto on any decisions. The change may have been prompted by the rise of some new competition. The “BRICS” countries — Brazil, Russia, India, China and South Africa — have created their own development bank, while another institution, the China-led Asian Infrastructure Investment Bank, is also taking shape.

Mario Draghi

European Central Bank president Mario Draghi. Photo: Ralph Orlowski/Bloomberg via Getty Images

The European Central Bank head may have played the last card in his hand as he tries to restore confidence in the eurozone

Forget the size of Donald Trump’s hand, it’s Mario Draghi who has the big bazooka. The president of the European Central Bank released a huge economic stimulus in March, cutting interest rates to zero and increasing “quantitative easing” — essentially printing money — by another €20 billion (£15.8 billion) per month to €80 billion, in an attempt to stave off deflation in the eurozone.

Draghi’s tenure at the ECB began at the apogee of the eurozone’s existential emergency, and since then he has had to work hard to calm markets and prevent fears of the eurozone’s demise from becoming self-fulfilling. The bank’s challenge was that of the eurozone as a whole: the single currency area’s individual governments had different priorities and were pulling in different directions.

Stronger economies, in particular Germany, are again pulling away from the rest of the eurozone, while Greece has slipped back into recession.

There is only so much the ECB can do until those challenges will need to be solved at the political level in Brussels, and although markets eventually reacted positively to Draghi’s new stimulus, some economists fear that the bank has run out of options, and this latest injection could prove the last throw of the dice.

Mario Draghi