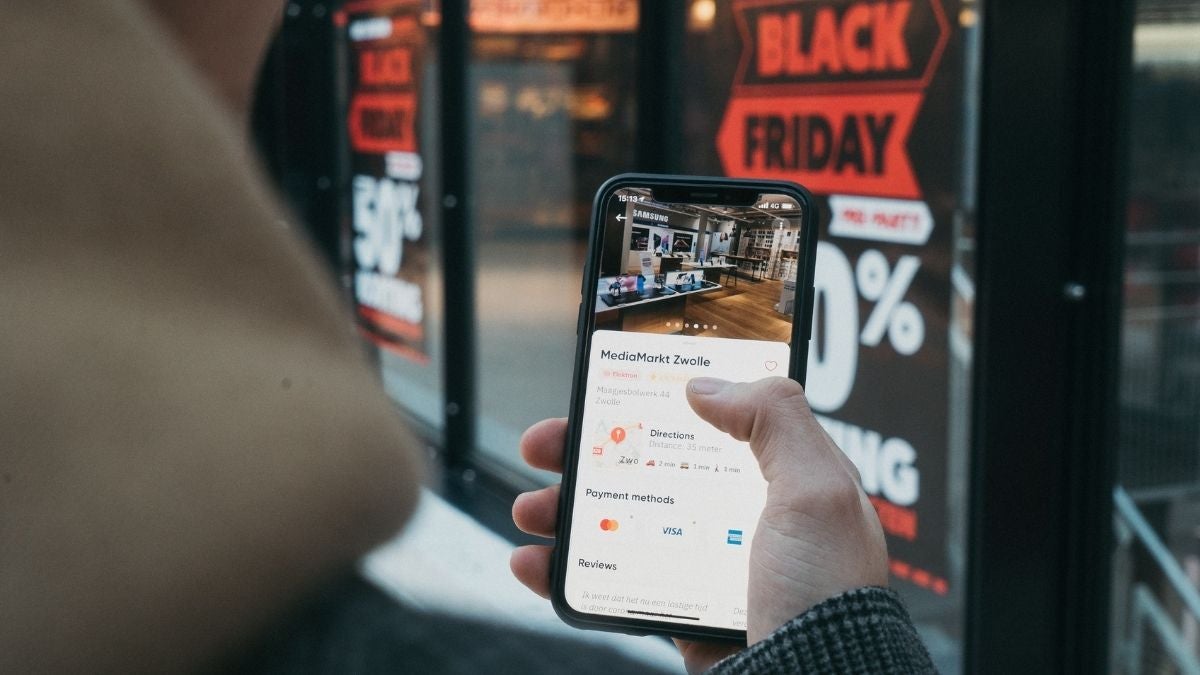

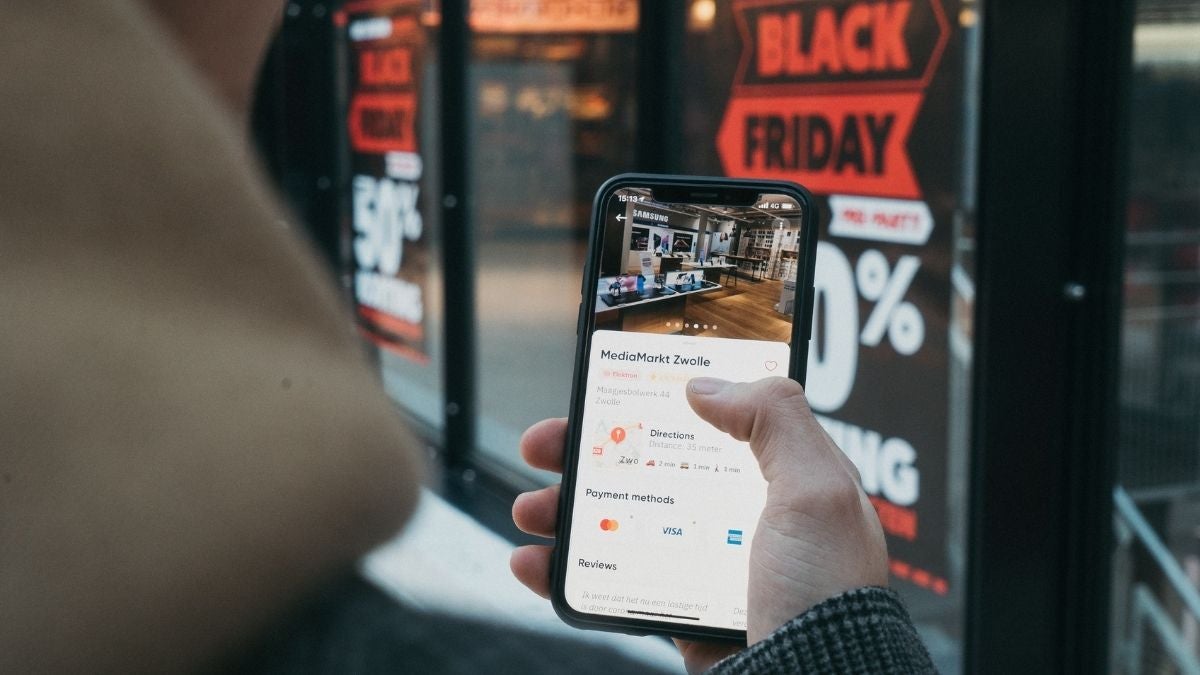

Black Friday is one of the most important dates in the retail calendar. Since being widely adopted in the UK in 2014 after being brought over by US retailers such as Amazon and Walmart (through Asda, which it then owned), the event has grown from one day of discounting to weeks - and for some companies a month - of discounts.

However, this year’s Black Friday comes amid a challenging period for the retail sector. There have been supply chain challenges and labour shortages, as well as huge shifts in shoppers’ behaviour caused by the pandemic. Against this backdrop, can this year’s discounting extravaganza live up to expectation?

Zulf Khan, associate professor of supply chain management at Coventry University’s business school, claims that lead times on international deliveries, which were once measured in weeks, have tripled. Ocean freight charges have also increased fivefold for some international deliveries.

And these issues are persisting. Research by business supply management software company Coupa reveals that supply chain disruptions are the biggest concern for UK retailers, with 64% listing it as their biggest challenge.

Technology retailers, meanwhile, have warned they may have insufficient stock to meet demand due to delays in the supply chain. The online retail association the IMRG told the BBC that Asia is a “pinch point” causing delays to stock arriving.

Although Khan acknowledges that retailers are not going to refuse a sale over the Black Friday period because of supply chain problems, “if stocks become depleted many will have to look for alternative, and potentially more expensive, suppliers otherwise they will have less to sell to Christmas shoppers.”

It’s a similar story for small retailers, which regularly struggle to compete with the discounts offered by the largest online stores during Black Friday. A survey of members of the British Independent Retailers Association found that 85% of independent retailers were not planning on participating in Black Friday this year – a higher figure than in 2020, when 35% got involved.

Beyond the usual reasons given for not participating, such as insufficient sales volume to cut prices, the higher costs businesses faced in the supply chain were a major factor.

CEO of BIRA Andrew Goodcare says: “This year has been even worse for independents with 96% experiencing supply chain issues. While stock may be in the shops, ongoing supply and replenishment will be an issue, which is why retailers will need to maximise the income from the stock they have.”

Retailers are trying to be a bit more cautious and flatten the sales curve so that everyone gets what they want to buy and no one is left out in the cold

The answer for many larger stores, which can usually expect a seven-fold increase in sales over Black Friday when compared to a regular trading day, has been to buy stock early. Khan, who recently sat on an all-party parliamentary group on the topic, says the managing director for supply chain logistics at one department store had put increased focus on forecasting, so stock could be ordered well in advance of the discount event.

Despite the challenges, expectations for Black Friday among ecommerce sites remain high. Murray Lambell, the general manager of eBay UK, says the online marketplace has experienced a 14% increase in participation from sellers compared to last year. He adds: “With rising cost pressures, we anticipate consumers will be even more price-conscious and keen to find a bargain, which is why it remains such a big moment in our retail calendar.”

Lambell has noticed a concerted effort from retailers across the industry to get consumers to shop for Christmas earlier, which he claims, “will go a long way to ease stock tensions in the run up to day itself”. Indeed, some 68% of UK retailers have been encouraging people to bring forward their present shopping to help spread demand, according to Coupa’s research.

Online retailer Very began its Black Friday discounts on 5 November, while electrical store Currys has started its sales early too. Elsewhere, fashion site La Redoute is urging customers to “beat the rush” by promoting a month of sales it is branding as Black November.

This is being reflected in consumer spending habits, with the Office for National Statistics recording a 0.8% rise in retail sales figures in October – the first time the sector has seen growth in six months. Early sales incentives and an awareness that products are taking longer to deliver has meant that customers are buying earlier too.

Payment processing provider Worldpay’s vice-president of global retail Maria Prados says: “We’re expecting a greater volume of sales than before. People are very familiar with pre-sales and Christmas shopping has started earlier. It’s almost become a whole month of sales and it could soon get to the point where these discounts continue all the way through to January.”

For businesses that want to ensure this year’s Black Friday will be a success, customer experience will be key. Debbie Ellison, chief digital officer for VMLY&R Commerce advises ecommerce retailers to keep on top of their inventory, so as not to make a sale to a customer that you end up being unable to fulfill.

She says: “Also, promote stock that is proving harder to shift. One of the advantages of ecommerce is that you can make instant recommendations to customers to make sure that they’re satisfied by getting a discounted like-for-like item when another product runs out of stock.”

These types of strategies can ensure that supply chain issues aren’t noticed by the customer, while careful preparation will also be needed to make sure stock can be replenished. Ellison adds: “Retailers are trying to be a bit more cautious and flatten the sales curve so that everyone gets what they want to buy and no one is left out in the cold.”

Black Friday is one of the most important dates in the retail calendar. Since being widely adopted in the UK in 2014 after being brought over by US retailers such as Amazon and Walmart (through Asda, which it then owned), the event has grown from one day of discounting to weeks - and for some companies a month - of discounts.

However, this year's Black Friday comes amid a challenging period for the retail sector. There have been supply chain challenges and labour shortages, as well as huge shifts in shoppers' behaviour caused by the pandemic. Against this backdrop, can this year’s discounting extravaganza live up to expectation?

Zulf Khan, associate professor of supply chain management at Coventry University’s business school, claims that lead times on international deliveries, which were once measured in weeks, have tripled. Ocean freight charges have also increased fivefold for some international deliveries.