Much has been promised for the future use of blockchain, although many people still regard the sector as something of a Wild West. But as it develops and matures, the industry is finding ways to answer its critics.

Events such as the listing of Coinbase, America’s largest cryptocurrency exchange, on Wall Street’s Nasdaq stock exchange are signalling growing mainstream acceptance of crypto.

Digital currencies such as stablecoins – which aim to minimise price volatility by pegging the stablecoin to an underlying basket of assets – are offering steadier ways to trade cryptocurrencies, bringing a measure of security and stability to the industry. But it is the new ways crypto assets can be deployed that are likely to be the real game-changer.

So now there’s a new way to make money from your crypto assets, which bridges the inefficient world of of traditional finance services (known in crypto as “TradFi”) and the fast emerging universe of crypto. It is starting to bring crypto into the mainstream, turning it from the incomprehensible preserve of tech-savvy twenty-somethings into a standard financial product

that can be used by anyone.

This allows you to cash in on your crypto assets without cashing out, providing a passive income that can not only be significantly higher than that provided by other, more traditional institutions, but can also increase your crypto holdings.

How you utilise this new service is up to you; it can be thought of as simply providing a good return on assets, as an income-generating investment, or as a lender that allows you to pay the school fees or buy a home. Critically, it offers the chance to leverage your crypto rather than selling up as digital assets grow in popularity and price.

There are a number of centralised finance (CeFi) players in the digital assets space that bridge the gap between wild-west crypto and TradFi. Nexo, founded in 2018, is one such. It’s a digital finance equivalent of traditional retail banking services that lets you manage your crypto and fiat assets, whoever you are and wherever you are in the world. You can borrow, earn and exchange between assets, as well as transfer funds to your traditional bank accounts, all from within the Nexo platform and mobile application, as well as spend your crypto-backed loan easily to, say, buy a coffee with the Nexo Card.

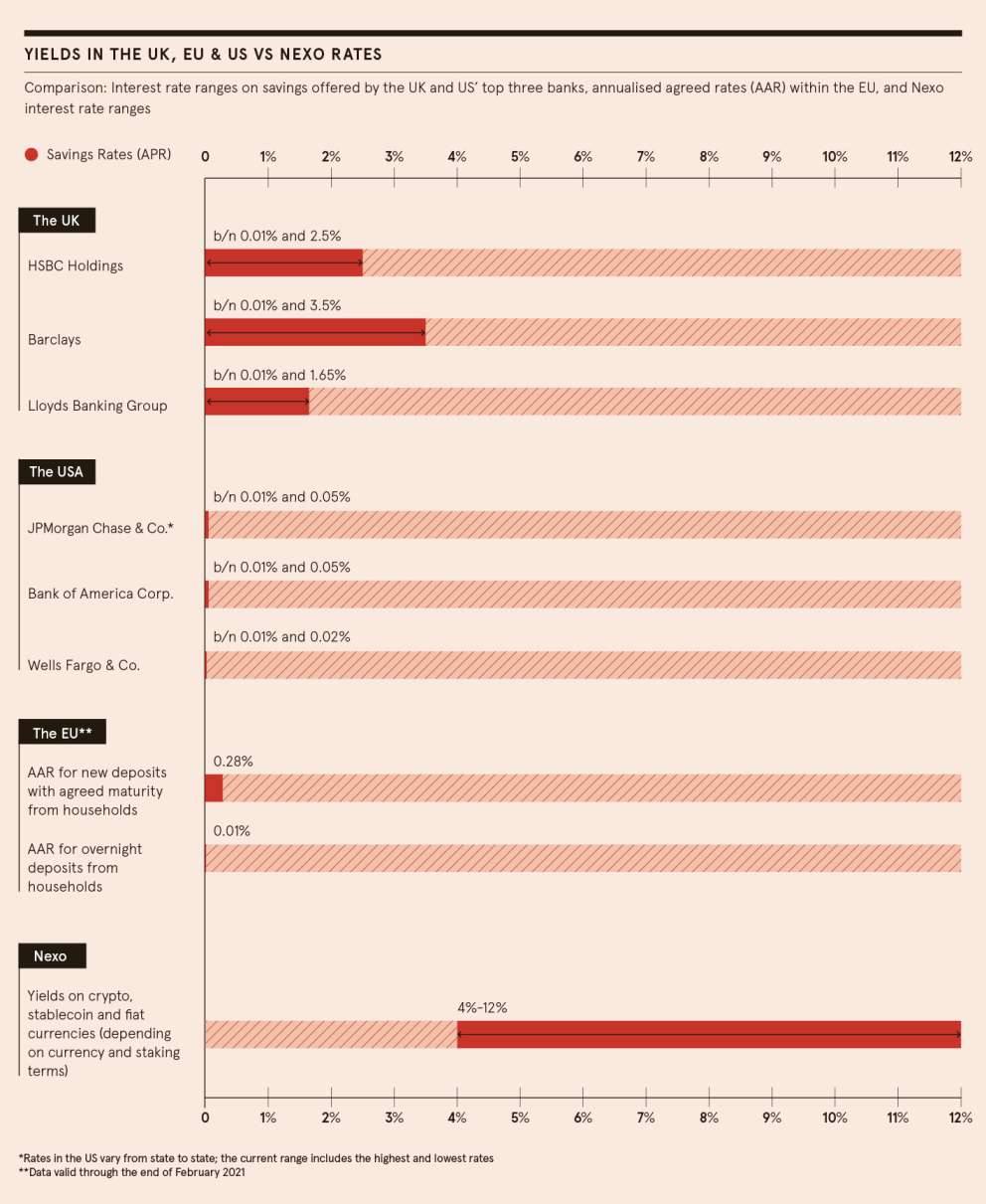

Should you need to take out a loan, the APR is lower than you would get from a traditional bank, and if you are HODLing – holding crypto for the long term – it gives you the chance to earn a much higher interest rate than is possible elsewhere in the financial services industry.

No trader or investor needs to be told about the current low-interest environment; ever since the 2008 financial crash, it’s been difficult to earn a respectable rate on assets and still harder to generate the kind of instant liquidity that can be a key element in

becoming a successful trader.

Whether you are a holder of crypto or fiat, or both, Nexo is a great alternative investment and storage option, earning up to 12 per cent on your crypto and fiat currency holdings. It offers the ability to mix fiat and crypto currencies, and take out an instant, fee-free cash loan against those assets. It’s a quicker and easier process than those on offer from a lumbering, traditional bank.

Yet you can still access the assets at any time, making this one of the most flexible and efficient ways of borrowing money. Perhaps as importantly for traders, this ability to use your crypto

assets as collateral offers you a valuable element of liquidity in your portfolio, without triggering capital gains tax events and without missing out on any potential future growth in crypto.

The company additionally boasts its own cryptocurrency, the NEXO Token that, besides being highly liquid and having grown in value by more than 8,000 per cent since 2018, is the world’s first dividend-paying, assetbacked token. Over the past three years, Nexo has distributed more than $9 million in dividends to token holders.

Nexo’s business model – centred on sustainable yields, top-tier custodial insurance, and over-collateralised loans – lays the groundwork for mass crypto adoption

The company is also seeing more and more crypto-savvy investors choose to buy or receive their interest payouts in its native NEXO Token, which ranks among the top 100 currencies in

terms of market cap out of more than 4,000 cryptos currently in circulation.

In effect, Nexo is acting like a traditional bank, translating the services of the finance industry into the world of crypto and deploying familiar processes such as KYC, or know your customer. It has even launched a card as an extension of its crypto-backed credit line, which can be used in the same way you would use your traditional bank card. No longer do you need to be a digital assets expert to add a little crypto future-proofing to your portfolio; Nexo’s systems mean

there is a way for anyone to dip a toe into the crypto world.

You still need to be prepared to manage your investments and watch the crypto market, which remains volatile, as anyone who has been on the rollercoaster ride that is bitcoin will know. As with any trading, it’s critical not to lose sight of the ultimate investment and always be prepared to back your loans should prices fall. However, CeFi platforms like Nexo make this a lot easier than their decentralised finance (DeFi) equivalents and far more profitable than their TradFi counterparts.

Security is obviously an important part in choosing anywhere you hold your assets. Nexo, which is building for the long term as a business, is choosing a more stable and less volatile business

model, over-collateralising loans at 200 to 500 per cent, enforcing a strict liquidation policy – an automatic liquidation if loan-to-value goes above above a certain percentage, albeit

after three margin call defaults – and offering a consistent and stable return.

The company, which is keen to educate both users and the wider world about crypto, also carries the hallmarks of classic financial institutions: licenses across the world, insurance coverage of $375 million on custodial assets, and rigorous KYC and anti-money laundering

mechanisms.

While it may be the high yields and instant access to cash credits backed by crypto that draw investors to Nexo, it is likely to be the secure set-up and safe environment that keep them working with the company for years to come.

For more information please visit nexo.io

Promoted by Nexo

Much has been promised for the future use of blockchain, although many people still regard the sector as something of a Wild West. But as it develops and matures, the industry is finding ways to answer its critics.

Events such as the listing of Coinbase, America’s largest cryptocurrency exchange, on Wall Street’s Nasdaq stock exchange are signalling growing mainstream acceptance of crypto.

Digital currencies such as stablecoins – which aim to minimise price volatility by pegging the stablecoin to an underlying basket of assets – are offering steadier ways to trade cryptocurrencies, bringing a measure of security and stability to the industry. But it is the new ways crypto assets can be deployed that are likely to be the real game-changer.

So now there’s a new way to make money from your crypto assets, which bridges the inefficient world of of traditional finance services (known in crypto as “TradFi”) and the fast emerging universe of crypto. It is starting to bring crypto into the mainstream, turning it from the incomprehensible preserve of tech-savvy twenty-somethings into a standard financial product

that can be used by anyone.