So-called D2C brands, such as Warby Parker, Casper and Made.com, have changed the retail landscape, increasing pressure on traditional retailers to be agile and customer centric, and offer a personalised experience. Yet it is not just digitally native brands that own D2C as established high street brands, such as Nike, Sephora, Timberland and Under Armour, are also D2C champions, harnessing the latest technology to offer a one-to-one customer experience.

The growth in digitally native D2C brands has proved pivotal in shifting customer expectations towards a more personalised experience. This new breed of mission-driven brands has made the wider retail space more competitive by focusing on experience over transaction and using advanced technologies such as artificial intelligence (AI) to deliver on that promise. They embody agility and flexibility.

Indeed, most D2C brands are typically private companies whose shareholders have pressing high-growth and revenue expectations, and they are competing against ecommerce giants. Thus, personalisation is an imperative investment; they must stand out and connect consumers with their niche products.

Conversely, many traditional brands are more cumbersome, hamstrung by legacy processes and systems which were built to broadcast mass communications, not to understand the volume and granularity of data that now drives one-to-one communications with customers.

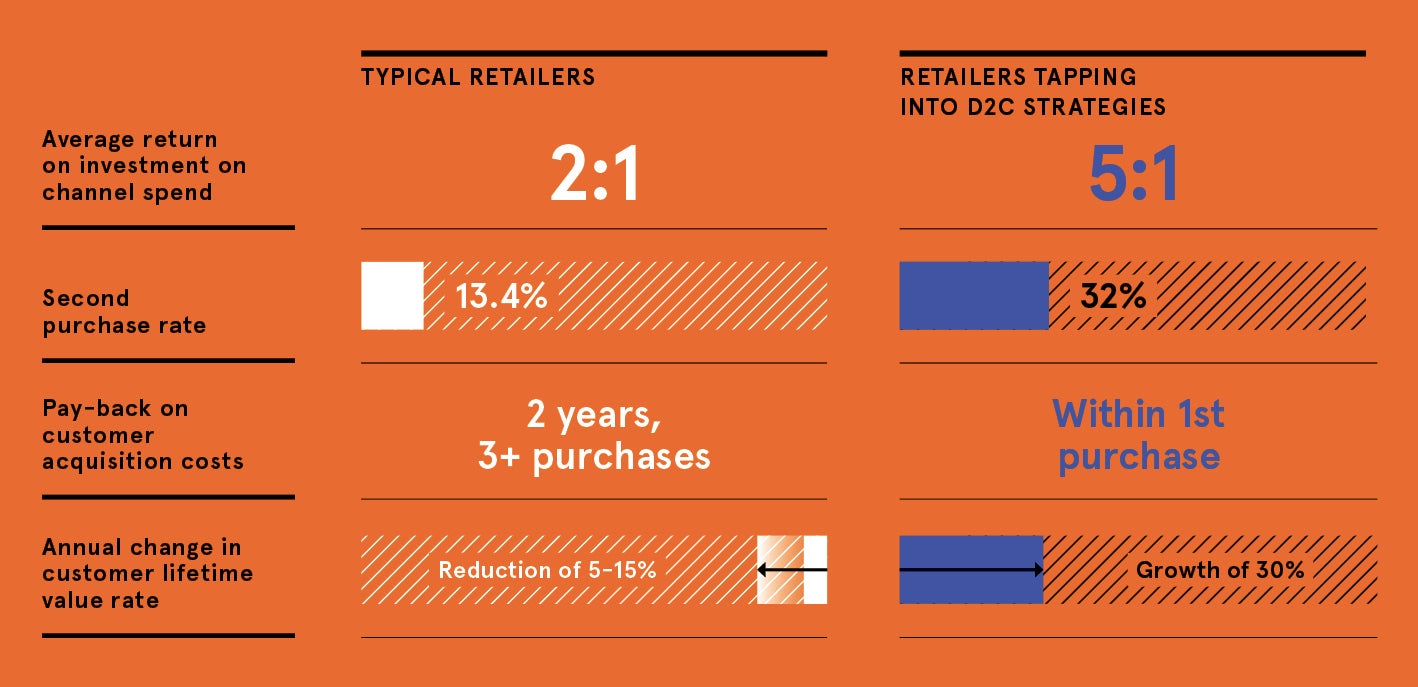

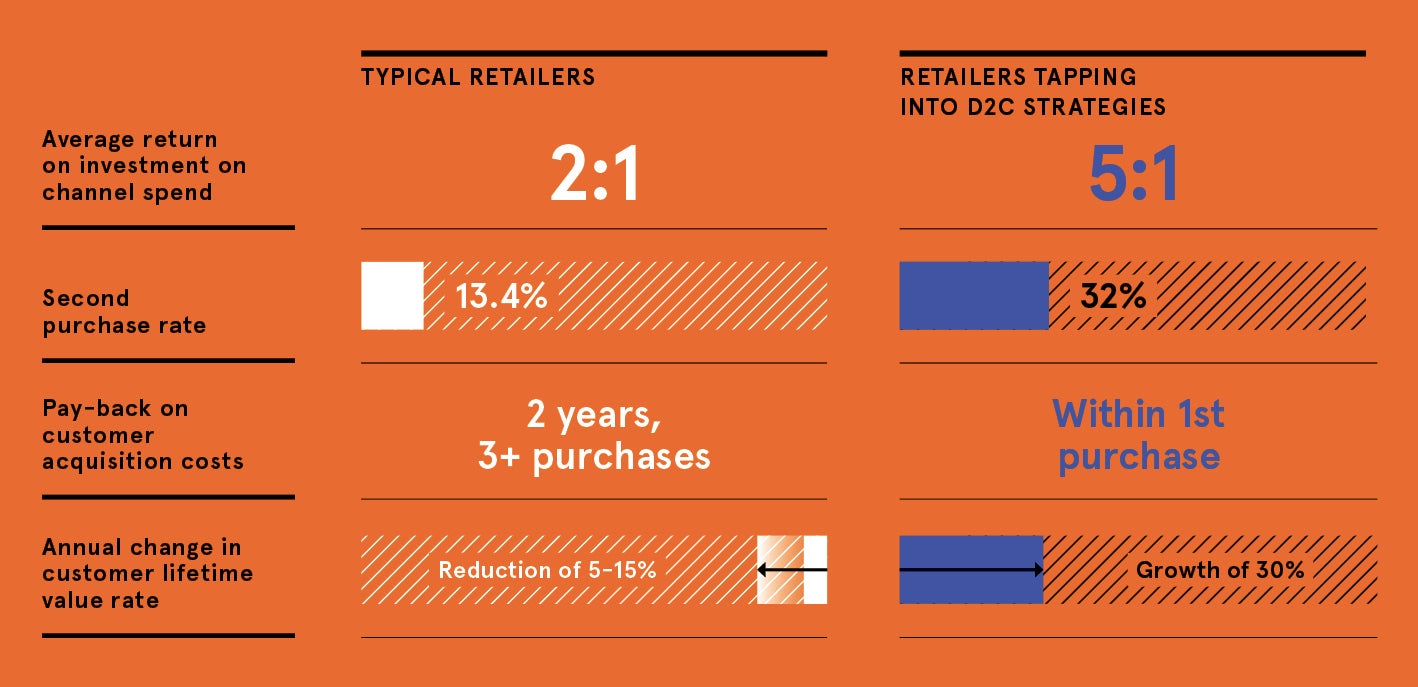

That said, a number of larger established brands have shifted from wholesaler to D2C, both online and by transforming physical stores into concept stores focused on marketing. The rationale is clear. Figures from eMarketer show that the average return on investment on channel spend for typical retailers is 2:1 compared with 5:1 for retailers tapping into D2C strategies.

In addition, Bluecore’s figures show that the second purchase rate for consumers of typical retailers is 13.4 per cent, while for those tapping into D2C strategies it is 32 per cent. The customer lifetime value rate for typical retailers is also declining by 5 to 15 per cent year on year compared with the second group which is seeing growth of 30 per cent year on year. The numbers are telling.

Nike is a prime example of a traditional retailer that has adopted an aggressive D2C strategy. Personalisation underpins its D2C drive and its recent decision to stop selling via Amazon reinforces this, enabling it to take back control of the customer relationship and, critically, own its customer data.

This is what lies at the heart of the ever-increasing number of D2C success stories: their ability to observe (identify and unify product, customer and behaviour data in real time), decide (make quick decisions on who to send what and when, and continuously learn to sharpen personalised experiences), and act (trigger and execute campaigns in minutes) on vast amounts of first-party customer data to drive a unique customer experience.

As Nathan Decker, director of ecommerce at one of Bluecore’s customers, online retailer of outdoor gear and fashion apparel evo, says: “We’re communicating compelling and relevant messages all the time without ongoing effort from our team. Through automation, we are amplifying our effort and harvesting long-term benefit from that effort.”

Subscription businesses have driven much of the growth in the D2C sector. In the UK alone, the subscription box market is forecast to grow 72 per cent by 2022, according to Royal Mail. Key to this model is customer retention and there are important lessons to be taken from this.

Most native D2C brands have been disproportionately focused on acquisition, which is increasingly expensive and not sustainable. Facebook alone has increased its average ad price by 14 times between 2011 and 2018. With true personalisation, retention becomes the bigger value driver, as repeat purchases represent long-term, continuous revenue for the business. According to a Bluecore report in May 2018, the value of a second-time buyer is 130 per cent more than a first-time buyer and the value compounds over time.

This is where traditional retailers have an advantage and brands that use data to complement the acquisition of new customers with the servicing of existing subscribers will win. It includes collection and permitted use of valuable customer email addresses to enable highly relevant personalised communications.

But established brands can also learn from their newer counterparts by harnessing modern technology with AI capabilities if they are to capitalise on D2C.

According to a November 2019 report by Forrester and Bluecore, while retail marketers understand the importance of personalisation and omnichannel experiences, only 30 per cent are very effective at omnichannel execution and just 12 per cent feel very confident in their personalisation capabilities.

Yet the technology exists for every retailer to become a D2C champion, equipping marketers with intuitive tools that make data integration easy across multiple systems. This enables them to drive a one-to-one experience while releasing them to focus on strategy.

Digital native brands have embraced the power of AI to drive revenue faster and with less effort. AI enables retailers to offer personalised product recommendations based on the actual user’s tastes, size, preferences and purchase history, not based on aggregate users. This also enables small businesses to automate and scale without facing the prohibitive costs of manual workflows.

Figures from McKinsey in March 2019 show that using AI on customer data to personalise promotions can lead to a 1 to 2 per cent increase in incremental sales for bricks-and-mortar retailers alone.

Modern email platforms with AI capabilities can customise promotions, prices and products for each customer dynamically and in real time using information such as click or browse data.

But vertical specificity in AI is paramount, helping to achieve critical business outcomes, such as driving repeat purchases, guiding product discovery and preserving margins.

Personalisation for retailers is not easy, but look at brands such as Sephora and Perry Ellis International that are embracing D2C commerce and investing in modern technology; they are already seeing breakthrough performances that yield double-digit revenue growth and preserve margins.

D2C is critical to the future success of every retailer, not just digital natives, and the ability to personalise on a one-to-one level at scale will define the retailers that not only survive, but thrive.

For more information please visit www.bluecore.com