The AGM is an important governance process companies must go through to ensure transparency as well as provide an opportunity for real-time, two-way communication between shareholders and board directors. As the digital evolution continues to affect all kinds of business communications, there is a clear opportunity for AGMs to

also benefit.

Does this question whether the traditional way of holding an AGM can be a barrier to maximising shareholder engagement? Traditionally, shareholders are notified of the meeting time, venue and business, and can cast their vote up front by giving it to a proxy or attend and vote in person. Only by attending have they had the opportunity to put questions to the board.

“Holding AGMs in one physical location can limit the engagement of that meeting,” says Lisa Graham, head of meetings, at Equiniti. “Business today is more global than ever. Both board members and shareholders may have to travel extensively to attend, perhaps even internationally, leaving a large environmental footprint.”

At the height of proxy season this year, Equiniti confirmed as many as 18 AGMs in one day

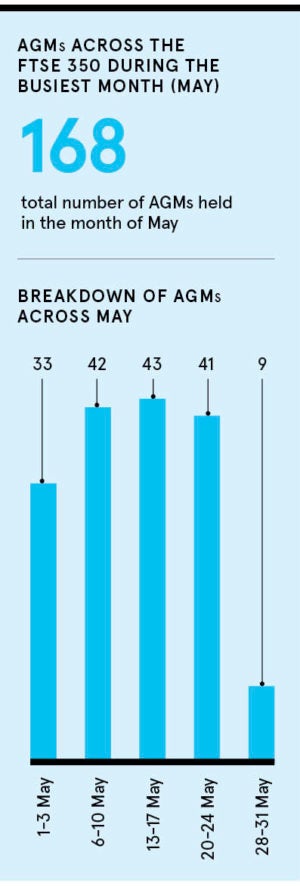

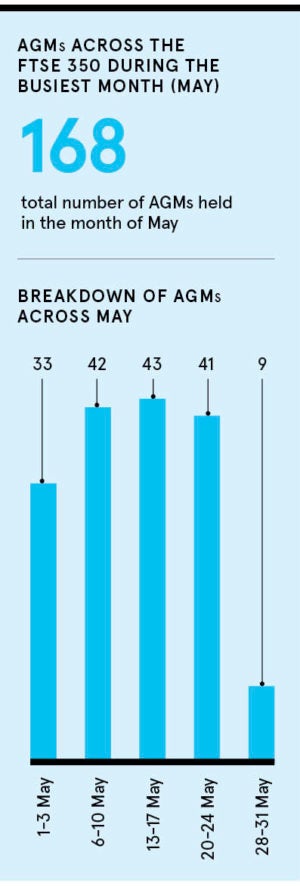

Shareholders can also often face the issue of having multiple AGMs happening at similar or overlapping times. At the height of proxy season this year, Equiniti confirmed as many as 18 AGMs in one day, which means shareholders have to choose one meeting over another. This compromise is particularly prevalent with institutional investors whose multiple investments make it impossible for them to engage and be more involved at multiple AGMs.

Sheryl Cuisia, managing director at Boudicca Proxy Consultants, which was acquired by Equiniti last year, says: “At the height of the AGM season in May this year, there were 43 AGMs in one working week. Hybrid AGMs provide both the corporate and the shareholder, especially an institutional investor, the means to communicate even if the shareholder has multiple investee AGMs happening on the same day or time.”

Sheryl Cuisia, managing director at Boudicca Proxy Consultants, which was acquired by Equiniti last year, says: “At the height of the AGM season in May this year, there were 43 AGMs in one working week. Hybrid AGMs provide both the corporate and the shareholder, especially an institutional investor, the means to communicate even if the shareholder has multiple investee AGMs happening on the same day or time.”

The opportunity for digital evolution enables wider shareholder participation and a broader representation of sentiment from the spectrum of investors. Allowing owners to engage more actively in meetings in which they’re invested is surely an improved outcome for all stakeholders.

The creation of the hybrid AGM combines electronic and physical participation. Companies still have a physical place of meeting, but also enable virtual attendance, allowing investors to listen to the proceedings, ask questions and vote at many more meetings than previously possible.

By introducing the digital meeting, organisations make their AGM far more accessible and seamless to attend. This not only increases participation, but also creates opportunities to leverage the additional engagement to promote more shareholders into being customers; customer acquisition and retention being a key strategy for so

many businesses.

“Looking forward, we are sure to see the use of digital services be adopted more widely across organisations of all sectors, seizing the range of opportunities they provide,” says Ms Graham. “In the coming years, the hybrid AGM will be an important step for companies to really open up participation, not just at the AGM itself, but with shareholders all the year round.”

For more information please visit equiniti.com/uk/services/eq-boardroom/