The move to sustainable investing is underway. Now is the time to take action.

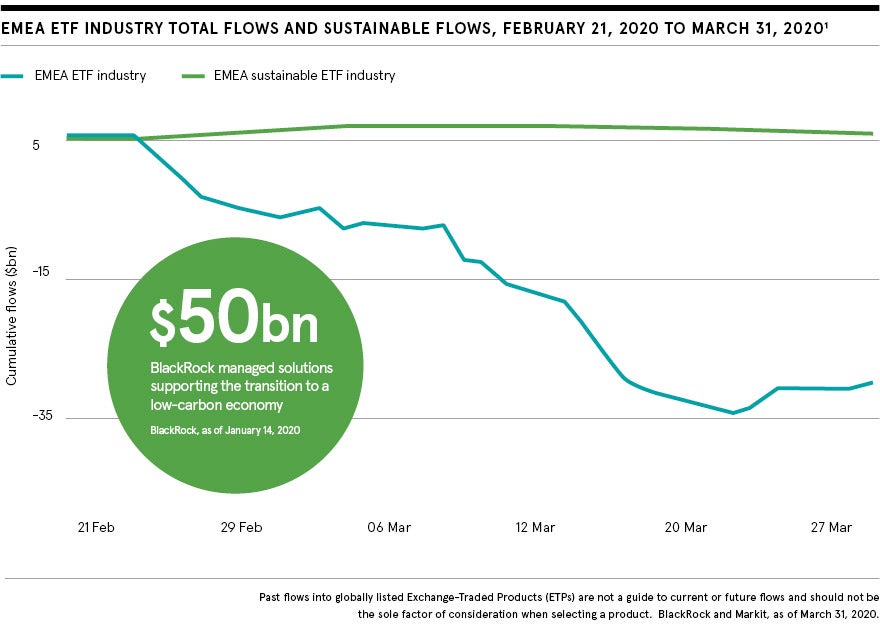

It may seem that investors have lots of other things to think about right now, not least the impact of the coronavirus pandemic on the global economy. But in the midst of unprecedented market uncertainty, investors allocated more capital to sustainable investments than ever before.¹

A unique moment

Part of the movement towards sustainable investing comes from large funds and is being driven by investors ranging from financial advisers to the Continent’s largest sovereign wealth managers. Investors are increasingly recognising that investing with a view to environmental, social and governance (ESG) issues can improve risk-adjusted investment returns.

The pressure from institutional investors to transition to sustainable investing has been building slowly but inexorably, with conversations taking place over the past few years. However, there is another source of pressure, one that is perhaps moving with more urgency: personal investors.

Whether they are investing on behalf of their own savings or have their savings in a collective scheme, such as pension funds, we believe personal investors are also making a once-in-a-lifetime and permanent shift towards sustainability. They are now talking more about concepts such as “financial footprint” and the impact their investments will have on society and the planet.

Certainly, it’s the first time in my career I’ve seen this level of awareness from end-investors. In turn, these investors are putting pressure on pension schemes and other collective funds to change the way they operate to benefit society.

Investors are increasingly positioning their investments to align with their values and performance data is reinforcing how sustainable investing has the potential to outperform traditional, non-sustainable strategies.² These two trends make this a unique moment in sustainable investing and these forces together are set to catalyse the growth of the industry.

Bringing clarity to ESG investing

A decade or so ago, turning conviction around sustainable investing into action could be a challenge. The financial industry loves jargon and acronyms, and sustainable investing was particularly affected. It seemed that a PhD in climate science would be a handy qualification when looking for a sustainable fund.

As sustainability has become more of a mainstream investment choice, BlackRock and other firms have worked hard to demystify the space. We’re very passionate about simplifying sustainable investing; it doesn’t have to be complex.

It’s easy to think that sustainable investing is all about the heart and aligning investments with personal values, but investors today are more data-driven than ever. They demand consistency and standardisation, which is why data and modern investment technology are driving the demand for our sustainable investment products.

We’re very passionate about simplifying sustainable investing; it doesn’t have to be complex

The creation of exchange-traded index funds (ETFs) based around ESG indices, in particular, has made sustainable investing as transparent as any other form of investing. Anyone can go to our website and see the holding data of a particular ETF and the companies, industries and geographies it is exposed to. Because of the very transparent nature of ETFs, it’s possible to give very clear insight into the carbon impact of investment choices, for instance.

Sustainable investing is a journey

Each investor, whether a large pension fund or a small saver, has their distinct motivations for sustainable investing. Sometimes investors talk about being on a sustainable investing “journey”, where their investment choices change as their thoughts about ESG evolve over time.

Because each investor has their own level of comfort, we believe it is vital that when they decide to start investing sustainably there is a wide range of options.

If you simply want to avoid some controversial industries, like tobacco or the most polluting fossil fuels such as oil sands, you can choose an ETF that invests in the whole market, but screens these companies out. This can achieve a lot in terms of meeting sustainability goals, yet remains close to traditional index benchmarks for equity or fixed-income in terms of returns. It’s our experience that this kind of investment can fulfil the needs of quite a large segment of the market.

If you want to be more holistic, more committed to sustainable investing, there are other ETFs that tilt the investment portfolio more strongly towards sustainable themes, with more extensive screening and investment priority given to companies with high ESG ratings.

We also offer ETFs that provide exposure to specific themes, such as clean energy, or to companies that demonstrate high levels of diversity, inclusion and investment in their talent development. These investment products offer investors the choice not only to be environmentally focused, but also to pursue social or governance themes.

Some investors want to see a long performance record before investing in a new product, which has been a barrier for some who have considered sustainable investing. That’s understandable and it is an issue only time can solve. Still, some investors may feel comforted by the way sustainable investments, both equity and fixed income, have outperformed in the recent market turmoil because they tend to overweight high-quality, defensive companies and are underinvested in some hard-hit sectors such as energy.²

Making sustainable investing efficient

ETFs have lowered the cost of investment for all. By bringing the inherent efficiencies of indexing to sustainable investing, we help further deliver on our promise to make this type of investment accessible and cost effective.

If you look across the sustainable ETFs we are offering globally, the total expense ratio – the management fees and other expenses that make up the full costs of the fund – weighted by asset class is 0.31 per cent. This is lower than the average weighted figure across our entire business of 0.35 per cent.³

Get comfortable, get engaged, get invested

This is our three-step suggestion for investors moving into sustainable investing. Getting comfortable is about understanding sustainable investing, which is what this supplement is all about. Getting engaged is a vital second step because few investors act completely alone; this is the stage where conversations may take place with advisers, for instance.

We’re committed to making the third stage, getting invested, easier than ever. In our 2020 Letter to Clients, we told our clients of our commitment to make sustainability our new standard for investing because of our conviction that sustainable portfolios can provide better risk-adjusted returns.

Doubling our range of sustainable ETFs was just one element of this pledge, which also included backing industry initiatives such as Climate Action 100+ that engages with companies on climate disclosure. We also made specific pledges on reducing investment in thermal coal, which we believe is becoming less and less economically viable.

It would be easy to think that COVID-19 would dent interest in long-term thinking on issues such as sustainability, and indeed BlackRock chairman and chief executive Larry Fink was asked about this a few weeks ago at our virtual Global Summit. He responded that the COVID crisis in fact reinforced the need to build sustainable economies and invest for the long term.

Even as the pandemic took its toll, he pointed out that extreme weather events such as droughts and heatwaves are continuing, saying: “Every day we’re reminded of how the world is evolving and changing.”

He also noted: “What is very clear is that investors are becoming more impatient. More and more investors believe sustainability does represent investment risk.”

¹ EMEA ETF industry total flows and sustainable flows, February 21, 2020 to March 31, 2020

² BlackRock with Q1 2020 data from Bloomberg and Morningstar, as of May 7, 2020; more than 90 per cent of sustainable indices outperformed their parent benchmark during this period of the heightened market uncertainty and drawdown

³ BlackRock, as of March 31, 2020

For more information please visit iShares.com/uk. Capital at risk.