Who needs sunlight to grow plants? Located 33 metres below Clapham in south-west London is a hydroponic farm using LEDs instead of sunlight. The environment is entirely controlled. No wind, no frost. The light colour can be varied for each crop. The result is a facility growing watercress, radishes and coriander using 70 per cent less water than traditional open-field farming.

Who needs sunlight to grow plants? Located 33 metres below Clapham in south-west London is a hydroponic farm using LEDs instead of sunlight. The environment is entirely controlled. No wind, no frost. The light colour can be varied for each crop. The result is a facility growing watercress, radishes and coriander using 70 per cent less water than traditional open-field farming.

Underground and vertical farming is just the latest revolution in the world of food. It is an industry in which every principle is being challenged. Every model rewritten. A tsunami of innovation is changing the food industry from the first seed to the first mouthful.

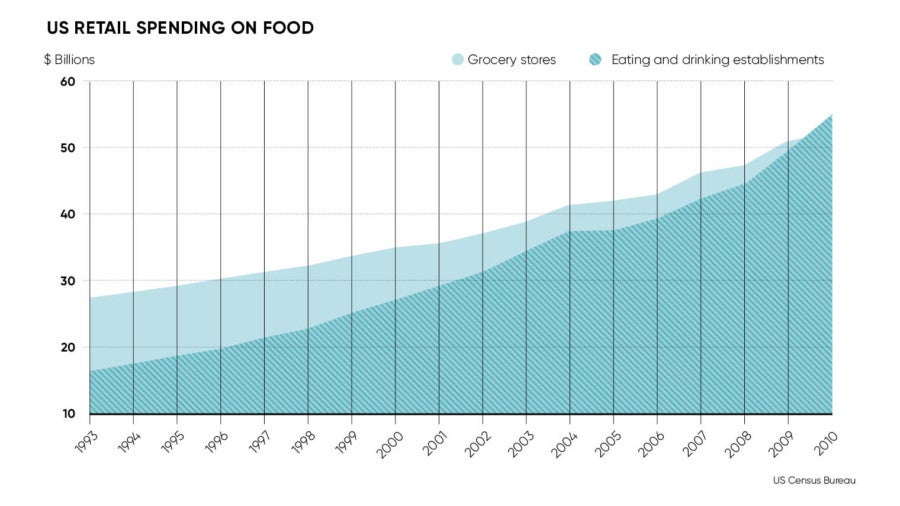

The amount spent at grocery stores was eclipsed by spending on restaurants, takeaway and delivered meal solutions. “There is a seismic shift occurring in the market,” says Mark Collin, group director of ventures at ThoughtWorks, a software consultancy helping old and new brands capture opportunities with technology. “Prepared meals are overtaking home cooking, as we used to know it. Traditional retailers need to understand this and react or they are going to get eaten.”

Hungry challengers, from smaller food kit insurgents such as HelloFresh to retail behemoths like Amazon, are all vying to claim their title as victor of the stomach wars. Amazon has gobbled up a plateful of the industry with its acquisition of Whole Foods.

Shifts in behaviour and technology are shaking up the entire food value chain, starting from how food is produced right up to how it’s found and purchased. On the production side, advances in agtech and decreased costs of production are making vertical farming viable in the not too distant future. On the customer end, changes in preferences are demanding wider sourcing, improved freshness and more prepared, grab-and-go options.

Technology must be woven through the fabric of their organisation, enabling them to meet the changing needs of consumers quickly

EATING THE BUSINESS MODEL ALIVE

The grocery store itself is permanently changing. Grocery stores have a lot to lose, with a large percentage of their profit margin coming from advertising subsidies paid by brands. “Supermarkets used to generate 4 to 8 per cent of revenue from charging for gondola ends and shelf promotions,” says Dan McMahon, head of retail Asia-Pacific at ThoughtWorks. “Now brands are marketing on Facebook, Instagram and striking deals with Google. It’s hard to make money when you are deprived of the traditional sources of income.”

It’s not just brands spending their money elsewhere; it’s customers too. People want to eat great food, buy things at a great price and they don’t want to spend a ton of time buying them. Those desires haven’t changed too much over time. What has changed is the range of businesses rushing to meet these needs. Amazon is getting very good at supplying household goods on the cheap. Easily accessible takeout from platforms such as Deliveroo and Just Eat is chipping away at the “what’s for dinner” market. Convenience stores are taking a bite out of food on the go. These changes demand grocers transform their offering and operations to stay relevant and boost revenue.

SURVIVING VERSUS THRIVING

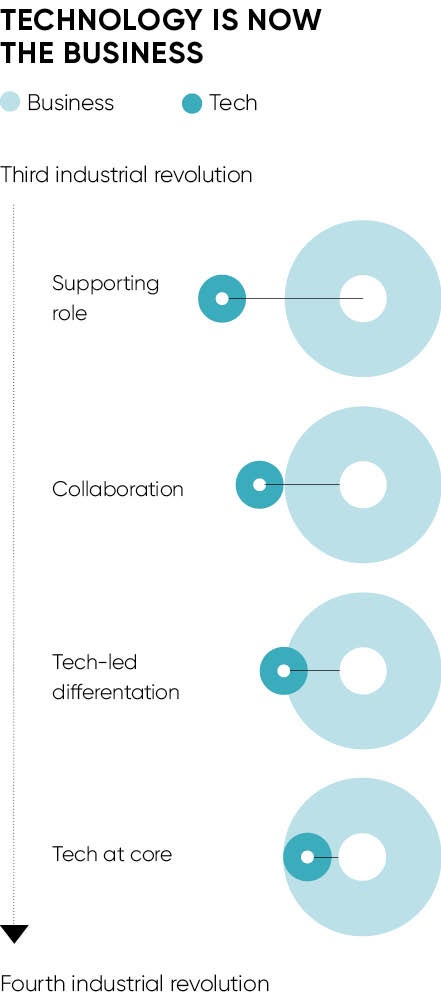

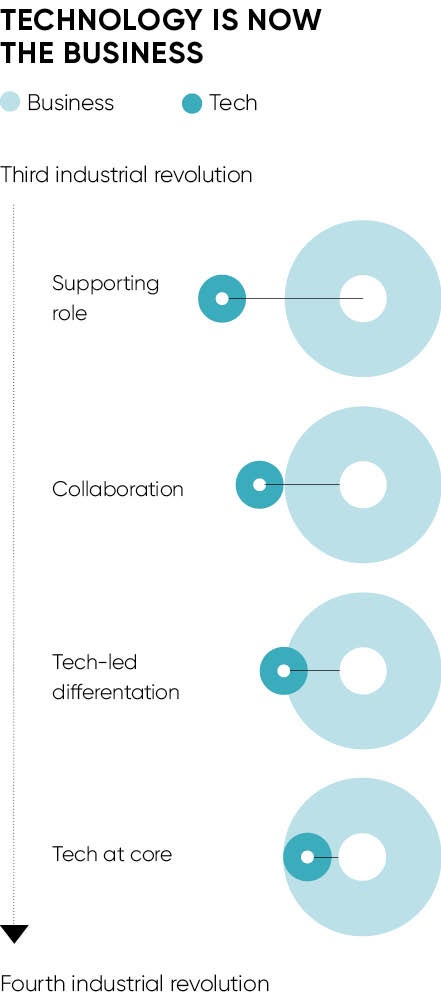

The common thread through all this is technology. Throughout the third industrial revolution, technology played a supporting role for many businesses. Mr Collin observes: “For those businesses that are looking to take on the job of being the food platform for communities into the future, technology must be woven through the fabric of their organisation, enabling them to meet the changing needs of consumers quickly.” For grocers, this means becoming a “borderless store” and developing a masterful command of digital so they can sell beyond the confines of their four walls.

John Lewis is embracing this mission with enthusiasm. It has established a startup incubator called JLabs to explore the retail experiences of the future. Companies get up to £100,000 in equity investment, mentoring from John Lewis and Waitrose executives, and office space in London’s Victoria. The goal is to develop game-changing products. Last year’s best innovations included a robot maker, an Instagram sales service and an app to create 3D models of customers’ rooms to see how potential furniture might fit in. These are the sort of things you’d find in a Google research lab or at MIT.

Also, John Lewis recognises it must change the way it works, so they founded a unit to examine new business models. ThoughtWorks has partnered with John Lewis to bring cutting-edge technology to concepts. “We’ve worked together on Cook Well,” says Mr Collin. “This gives consumers nutritional information and health qualities of recipes. You get a meal kit and the subscription delivers everything to your door each week.”

Companies seeking to adopt a technology at core ethos will need help, ideally from an experienced technology partner able to dream up new business models as well as the ability to implement modern digital retail platforms. “You need a partner who is technology agnostic; someone who can implement algorithms and software that powers customer experience and streamlines operations; a vendor-neutral specialist who can help you develop your platform,” says Mr Collin.

Instead of big, up-front investments and predictions, grocers need a flexible platform that can evolve as quickly as their customers. They need to build their experimentation muscle, quickly testing, validating and scaling winning ideas across the business.

WHO WILL WIN?

The pace of change is only going to accelerate. “The grocer of the future will rely less on stores, owning digital discovery and meeting customers on mobile to ensure revenue growth while foot traffic falls,” says Mr Collin. The core desires of saving time, saving money and eating great food will remain constant over time. The grocer of the future can meet these needs in new ways by owning multiple formats and adding new service offerings supported by digital.

Who’s the winner? Beneficiaries of takeout, as well as offline players such as Lidl and Aldi are modern-day grocery winners, but as customers eat and buy in other ways and through other channels, they too need to rethink their business model.

We’ve seen an explosion of creativity in the finance industry, in transport and smartphones. Now the stomach wars are on.

For more information please visit www.thoughtworks.com

EATING THE BUSINESS MODEL ALIVE

SURVIVING VERSUS THRIVING