The financial advice industry has transformed over the last six or seven years. Historically, largely commission incentivised, issues relating to transparency for clients resulted in the need for regulation. The Retail Distribution Review (RDR) sought to remove commission entirely from investment and pensions advice and, since coming into force in January 2013, has meant advisers must be paid directly by clients for the service they provide.

Though RDR has created a more transparent environment, it has also challenged advisers’ traditional business model and led to unintended consequences. To protect their income, many advisers chose to concentrate their efforts on servicing higher-net-worth clients rather than people of wider economic wealth, creating an affordable advice gap.

A study from OpenMoney and YouGov found the number of people in the UK willing to pay for advice, but think it is too expensive, now stands at 5.8 million people, while a further 14 million people don’t know how to get financial advice or think it’s not even an option for them.

The challenge in the UK is that people don’t like talking about money and behavioural economics suggest they find it difficult to think too far into the future. Auto-enrolment has been effective in engaging more people in their pensions, but contribution levels remain low and many don’t understand that their savings are unlikely to be enough for their retirement. This is particularly concerning when the UK’s ageing population is taken into account.

“A lot of people just don’t get this, so it does often require someone to help them understand what they can do,” says Nick Eatock, chief executive of Intelliflo, whose web-based business management software, Intelligent Office, helps financial businesses improve efficiency and increase profits.

“The earlier you do something about it, the easier it is. Unfortunately, as advisers tend to be focused more towards the top end of the wealth spectrum, their clients tend to be a bit older. The people who probably need financial advice the most are those at the beginning of their career who can make a huge difference by just increasing their pensions contributions by a small amount.”

Emergence of robo-advice, digital platforms that offer advice based on algorithms, caused fear among advisers that they could be replaced. They’ve since come to realise, however, that robots can’t do the entirety of their job and technology can actually assist them by removing a lot of the grunt work of providing advice. The significant efforts that go into keeping up with regulatory demands can now largely be handled by software, allowing advisers to reduce costs and focus time on servicing more clients.

With the use of workflows and tasks, Intelligent Office helps advisers deal with inefficiencies at the backend, while simplifying regulatory reporting. As such, it is the most widely used business management software by UK financial advisers.

Through its Personal Finance Portal, Intelligent Office also alleviates strain on the frontend of an adviser’s business by allowing their clients to provide information on their situation and requirements.

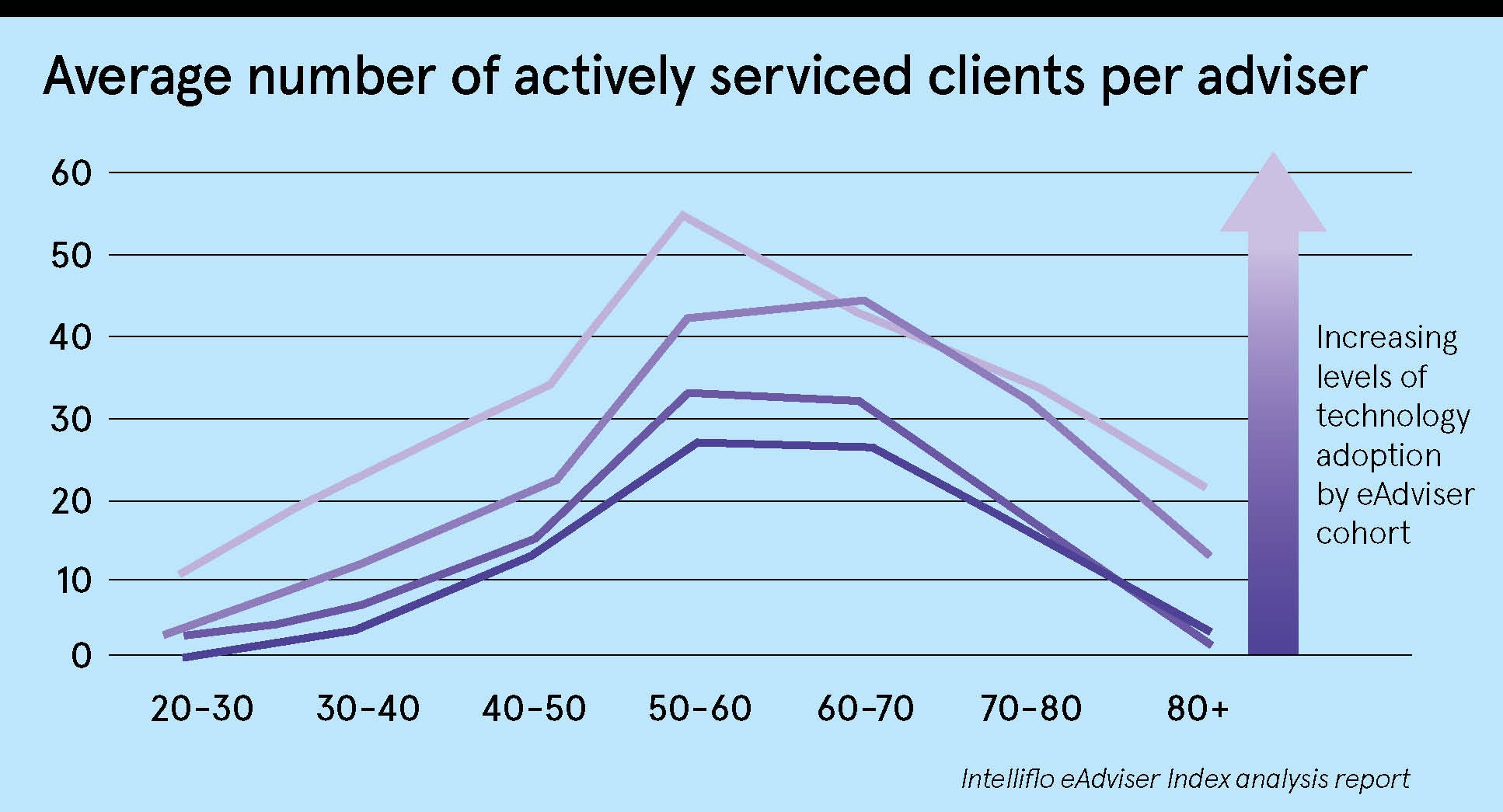

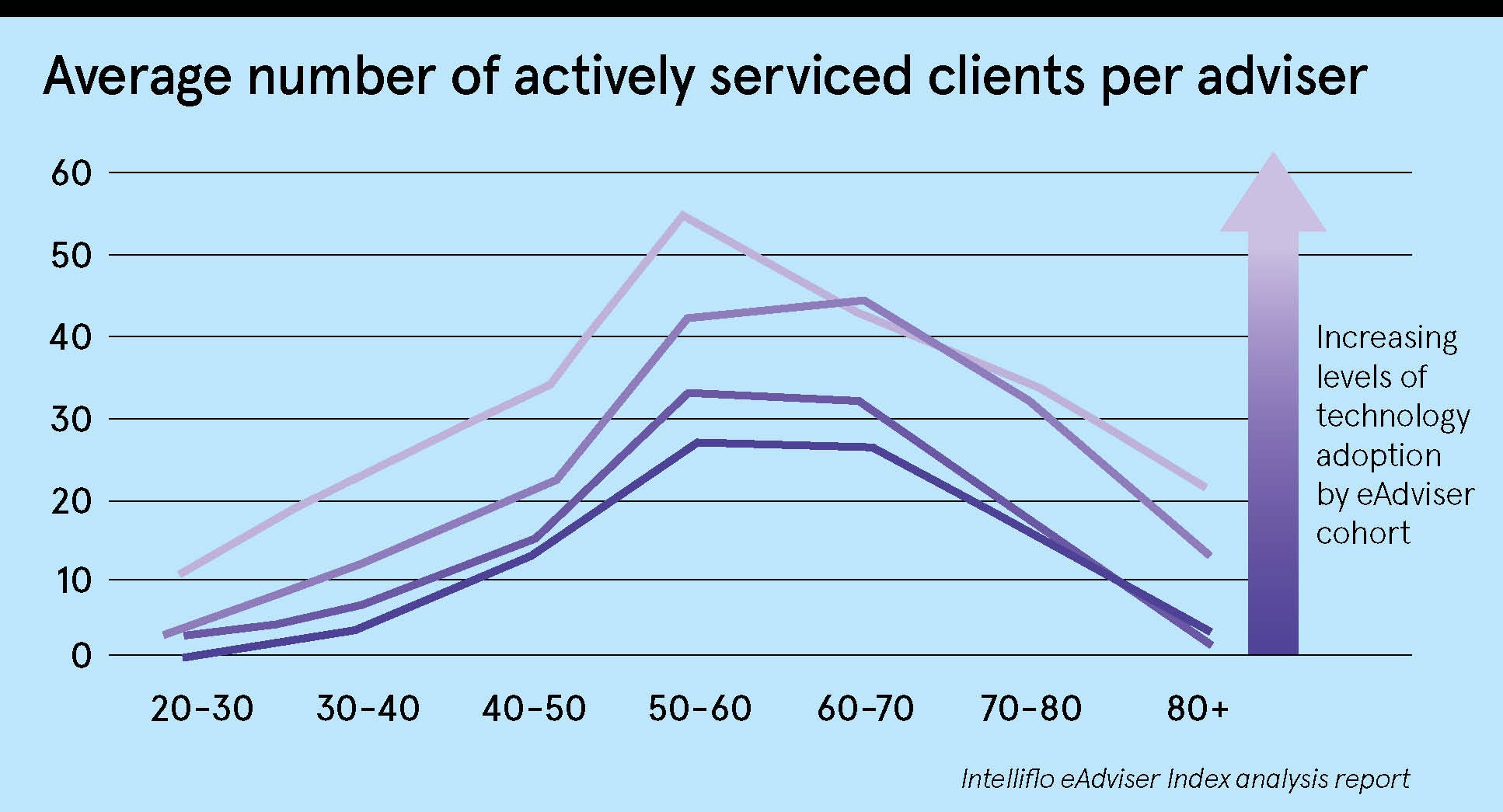

Intelliflo’s eAdviser Index analyses the 2,500 firms that use the software to understand how well they’re doing across five key pillars of efficiency. The findings have demonstrated that firms which have adopted the technology the most have on average doubled their number of clients. Intelliflo’s customer success teams help advisers deploy elements of the technology more effectively, which enables them to improve in terms of their ability to service more clients and grow their revenue.

“We believe passionately in financial advice and our role is to make advisers more efficient and effective across every element of what they do,” says Mr Eatock. “Technology is a big step to closing the affordable advice gap. We also need more people within advisory businesses and more financial education across all age groups, but technology is the key to enabling advisers to service more clients and at a lower cost.”

For more information please visit intelliflo.com/advice-gap-times