The breadth of reverse engineering required to innovate, protect and monetise intellectual property (IP) in the semiconductor industry has exploded as the internet of things has rapidly expanded the chip market. There are an estimated 50 billion connected devices globally, according to Ericsson. Chips are no longer the preserve of mobile phones, but can also be found in cars, appliances, medical equipment and more.

This has made it extremely difficult for semiconductor and electronics companies to understand whether their IP is being used without their knowledge. Reverse engineering, the practice of deconstructing a device to understand what it is doing and how it was built, has had to advance in line with multiple use-cases, particularly in areas such as advanced processors, memory, radio connectivity, power management and image sensors.

To understand IP with a chip, it can be reverse engineered in a number of ways, for example starting with process or structural analysis, which is becoming increasingly complex as manufacturers seek to fit more functionality into smaller chips. The latest iPhone includes Apple’s most advanced chip yet, using 5 nanometer process technology.

Next could be understanding the circuit design, through examining both the physical, or schematic, design as well as the actual functionality and performance of the chip internals during operation. Systems reverse engineering is another approach, showing how multiple chips interact during operation depending on hardware, firmware and software.

“Semiconductors are becoming ubiquitous,” says Gavin Carter, chief executive of TechInsights, the leading information platform providing advanced technology analysis and IP services to the world’s largest technology companies. “The speed of innovation isn’t slowing down and the complexity of reverse engineering has to keep pace with that. It’s very difficult to get a broad view of what’s going on in the industry and to monitor competitors that may or may not even be in the same application space but use the same technology.

“In a fair marketplace, semiconductor intellectual property can be both created and monetised. The creation part is the ongoing innovation of semiconductors and monetisation is then having the chip ultimately appear in a product, the manufacturer driving revenue directly from that, or the owner of the IP licensing its use in a chip. There is a lot of IP wrapped around the semiconductor. Our platform provides a central repository of our analysis, images, schematics and costing data so it can be easily leveraged to protect and monetise IP or for competitive intelligence purposes.”

TechInsights has led reverse engineering in the semiconductor industry for more than 30 years, supporting a fair marketplace where IP can be innovated and monetised. By revealing the innovation others cannot inside the broadest range of advanced technology products, the company enables business leaders to make the best technology investment decisions and prove patent value with fact-based information.

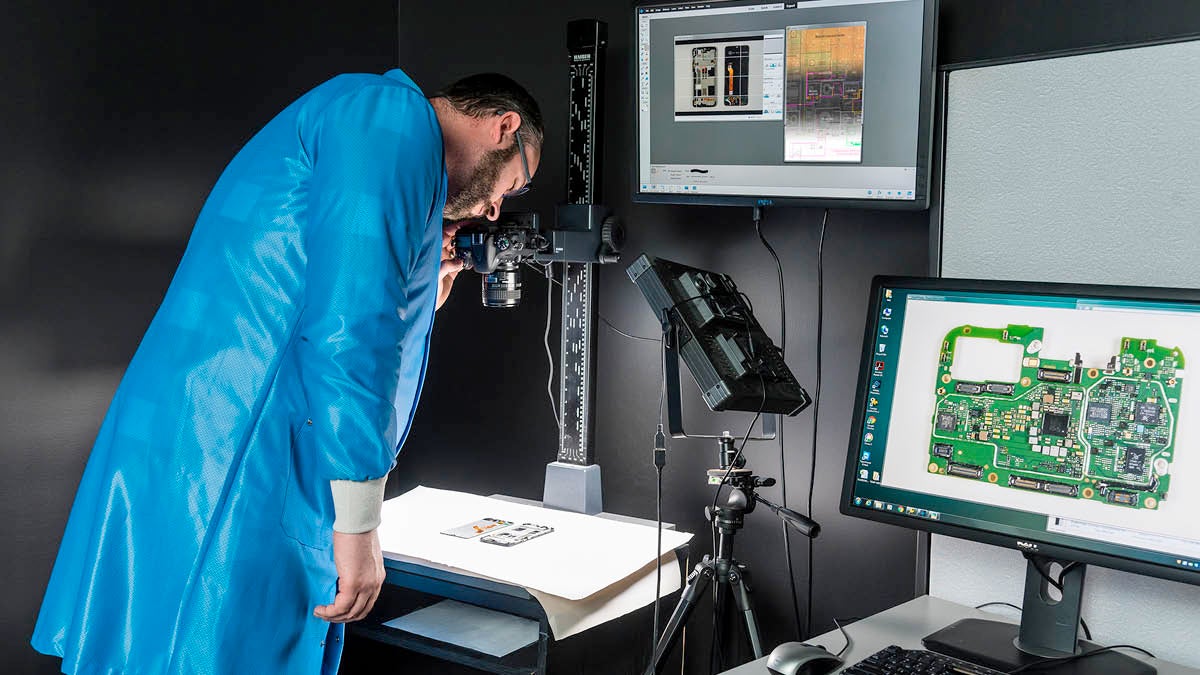

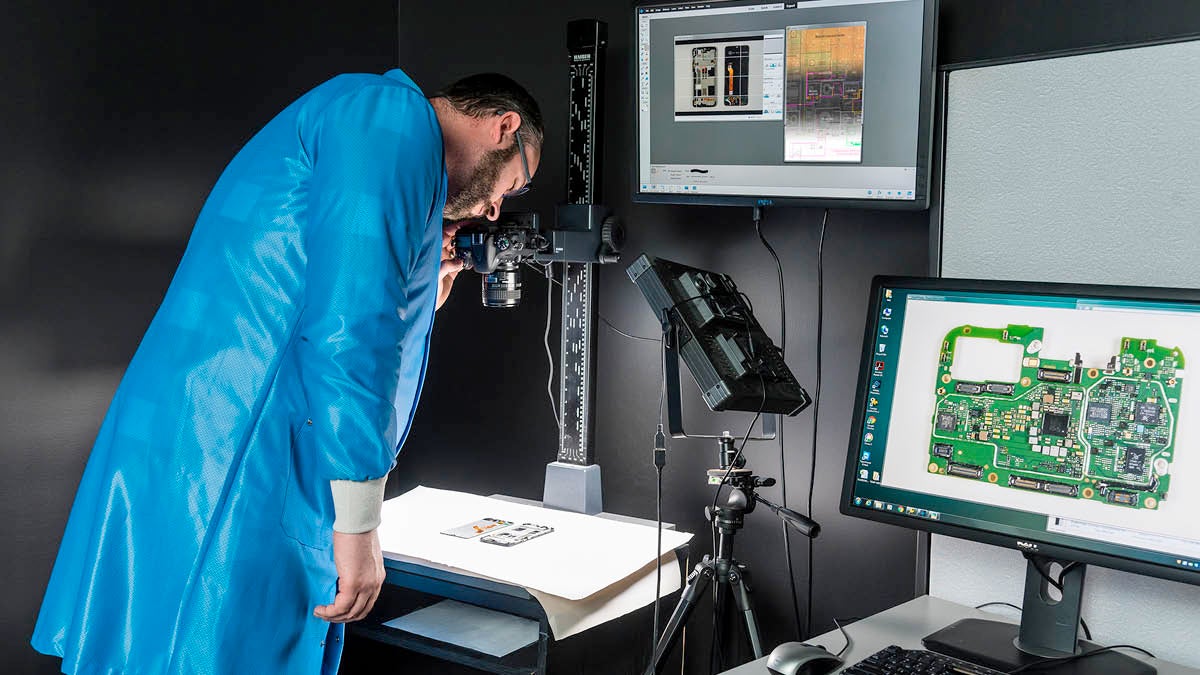

With TechInsights’ broad but also deep look into how semiconductors are built, organisations can gain a cost-effective view into whether or not their IP is being used in the market. When they find it is being used, they require documentation that can support straightforward licensing negotiations all of the way up to litigation. This is where the forensics come in and the sophisticated analytical techniques used by TechInsights allow IP owners to document exactly what they need, whether it’s the manufacturing process, the functionality in a chip or the circuit design.

With more than 200 engineers highly skilled specifically in reverse engineering, TechInsights is able to analyse and reveal innovation in products in ways other companies simply can’t match. The company’s embedded knowledge is bolstered by its learnings from patenting some of its own technology, including its delayering process when reverse engineering a chip. This expertise is supported by significant capital equipment including multi-million-dollar equipment that is normally used in manufacturing semiconductors, but has been reconfigured to support reverse engineering.

“Those three elements combined, along with our incredible passion to reverse engineer the latest innovation, clearly differentiate our services,” says Carter. “The top ten semiconductor companies globally all leverage the TechInsights platform. They’ve engineered a chip, they may also have some of the capabilities required to reverse engineer it, however they work with us because of our broad coverage across a wide range of devices, speed and depth of analysis, and the neutrality we bring. That third-party neutrality is incredibly valuable in a licensing negotiation or a dispute. Ultimately, we document facts and that’s very well respected in the industry.”

TechInsights has evolved its strategy to create even more value for IP owners by building a broader content platform for the semiconductor industry. This includes increasing the use of artificial intelligence and machine-learning for a range of applications, from shortening the time taken to analyse circuits, to the current short-term goal of bringing in relevant third-party content.

Ultimately, we document facts and that’s very well respected in the industry

Through the platform, TechInsights gives companies a complete view of the IP landscape and allows them to benchmark products against competitors. Meanwhile, with Moore’s law, the doubling of complexity on a computer chip every two years, the need for sophisticated reverse engineering is only going to increase even further in the future.

“It might not be as linear as we’ve seen over the last 50 years, but the complexity will continue to get more challenging to reverse engineer,” says Jason Abt, chief technology officer at TechInsights. “We’re going to see fewer organisations able to do that reverse engineering on their own, even a small part of it, and relying more heavily on TechInsights to provide it.

“It’s also going to be more difficult to monitor what’s going on in the industry. It’s not at all unusual to see an inventive concept originally intended for, say, a mobile phone suddenly appearing in a tyre pressure monitor in a car.

“That cross-pollination of technology against different applications is going to continue to grow, making it even harder for individual organisations to monitor exactly what’s going on in the industry and the potential use of their intellectual property. The use of the kind of content that TechInsights brings to bear will become increasingly important to not only maintain a competitive advantage but to protect their IP.”

For more information please visit techinsights.com

Promoted by TechInsights

The breadth of reverse engineering required to innovate, protect and monetise intellectual property (IP) in the semiconductor industry has exploded as the internet of things has rapidly expanded the chip market. There are an estimated 50 billion connected devices globally, according to Ericsson. Chips are no longer the preserve of mobile phones, but can also be found in cars, appliances, medical equipment and more.

This has made it extremely difficult for semiconductor and electronics companies to understand whether their IP is being used without their knowledge. Reverse engineering, the practice of deconstructing a device to understand what it is doing and how it was built, has had to advance in line with multiple use-cases, particularly in areas such as advanced processors, memory, radio connectivity, power management and image sensors.

To understand IP with a chip, it can be reverse engineered in a number of ways, for example starting with process or structural analysis, which is becoming increasingly complex as manufacturers seek to fit more functionality into smaller chips. The latest iPhone includes Apple’s most advanced chip yet, using 5 nanometer process technology.