The broker channel may be alive and well, but the insurance community is not exactly known to be a pacesetter when it comes to innovation. As a traditional industry driven first and foremost by trust and advice, concerns that those core attributes of a successful customer relationship may be damaged through digital developments have long defined the sector’s perspective of technology.

Historically, insurance transactions have been achieved through face-to-face meetings, dating back to the coffee houses of 17th-century London. An attitude has therefore prevailed among sections of the insurance ecosystem that while leveraging technology may increase efficiency or enable new customer engagement, it also threatens relationships built over many years.

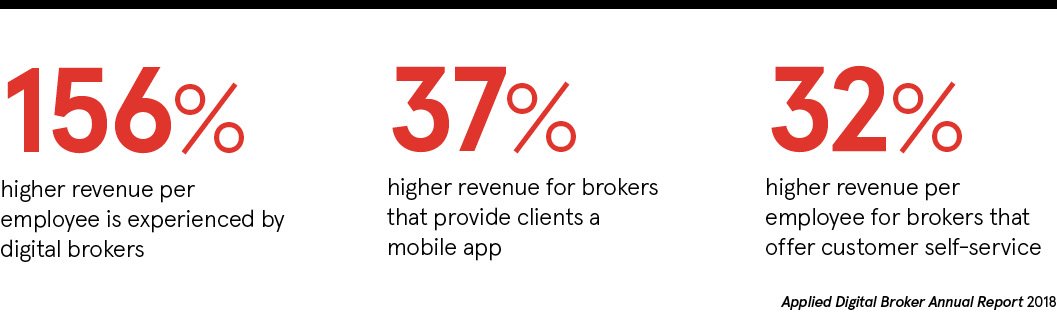

As a result, adoption of technology among insurers and brokers has been slower than in other industries. The reality, however, is that technology in fact enables brokers to provide better advice, be a more trusted adviser and form a closer relationship with customers by enabling the insured to communicate in the ways they wish.

While the broker channel continues to be the primary insurance distribution channel, the industry is being redefined by customers whose expectations are rapidly evolving, driven by the digital interactions they are enjoying other industries such as financial services and retail. While technology is yet radically to change how insurance products are created, it is transforming how brokers operate and providing them with more time to focus on their core attributes of selling and servicing.

“It is transforming how consumers think about their insurance broker and what their broker can provide them,” says Jeff Purdy, senior vice president of international operations at Applied Systems. “It’s also transforming how they choose their broker. Those expectations are coming from outside, not inside the insurance industry.

We see more and more brokers adopting digital technology to best position themselves for growth both today and in the future

“Technology enables the broker to get closer to their insured. When we look at our own customer base, our digital broker offering is our fastest growing offering. It allows brokers to automate operations within their own office for greater efficiencies and to seamlessly connect with insurers to deliver the best product at the best price to the consumer.”

The pace of technology adoption in the insurance industry is now increasing dramatically as brokers recognise the need to meet these consumer expectations. The whole life cycle of an insurance transaction is typically over a 12-month period, so it’s not a single transaction, and for brokers to be able to drive greater connections with insurers and consumers they need to establish a single view of

the truth.

Traditionally, brokers have managed their business across a diverse set of manual documents, systems and insurer portals, which results in often manual, redundant work and does not provide a single view of their customers. Brokers now need a single, open application that provides a complete view of their business across all products, employees and office locations.

Joe Sultana, managing director for broker solutions at Applied Systems, says: “A broker’s business is about giving advice and looking after their customers. It’s not about being experts in technology, so they need to make sure they partner with the right provider who understands the unique needs of the insurance industry and the software expertise that can push the industry forward with modern, open and scalable technology.

“With technology core to the business and its operations, brokers can have strong growth and efficiency, attract talent to the business and drive better customer satisfaction, helping build even more trust. Technology helps improve the great service and advice brokers provide, rather than replace it. The pace of change will continue far into the future, so brokers need to think of technology not separately from business strategy, but as one single strategy.”

Applied Systems is a leading global software company that enables brokers to connect their business digitally, seamlessly connecting customers, broker staff and insurers. By enabling real-time connectivity between broker management platforms, multiple insurers and multiple products, Applied’s technology enables brokers to offer the most suitable cover at the best price.

Applied Systems is a leading global software company that enables brokers to connect their business digitally, seamlessly connecting customers, broker staff and insurers. By enabling real-time connectivity between broker management platforms, multiple insurers and multiple products, Applied’s technology enables brokers to offer the most suitable cover at the best price.

The company’s technology also enables consumers to interact with brokers in a similar way as they do with direct sellers of insurance, providing anytime-anywhere customer service and thus allowing brokers to compete on a user-experience level against direct sellers or alternative distribution providers. With a recent investment from Google’s parent company Alphabet, Applied is looking to leverage world-leading expertise in innovation, including artificial intelligence, to further enhance the brokers’ ability to drive smarter and closer connections.

To cope with the necessary culture change required for a digital transformation, Applied Systems also has a professional services division that helps brokers implement digital technology, train their staff and provide tools for their insured to interact digitally with their broker. Serving only the insurance sector, its expertise is valuable.

“We’re extremely proud of our deep domain expertise within the insurance ecosystem,” says Mr Purdy. “A horizontal software provider can only go so far and then it becomes very hard because the domain expertise required to enter a market like broker management is so deep. Brokers providing trusted advice require a set of skills that don’t diminish overtime, they increase. But in a world that is far more complex than it was just a few years ago, they need a partner with deep expertise as much as their own customers do.”

By failing to respond to the changing expectations of their customers, brokers risk falling behind. New startups are entering the sector that are entirely digital with the mission to disrupt traditional broker management. Meanwhile, other brokers are now adopting digital technologies in their masses. Brokers that refuse to transform or implement new innovation will lose market share or be forced into other action.

“You see lots of M&A activity in this space because ultimately brokers that are not willing to embrace digital transformation are exiting,” says Mr Purdy. “We see more and more brokers adopting digital technology to best position themselves for growth both today and in the future. The broker channel is strong and healthy, as shown by the organic growth of the industry and in equity being put into the channel, like our investment from Google, and we are excited to continue to support broker momentum in this digital age.”

For more information please visit appliedsystems.co.uk