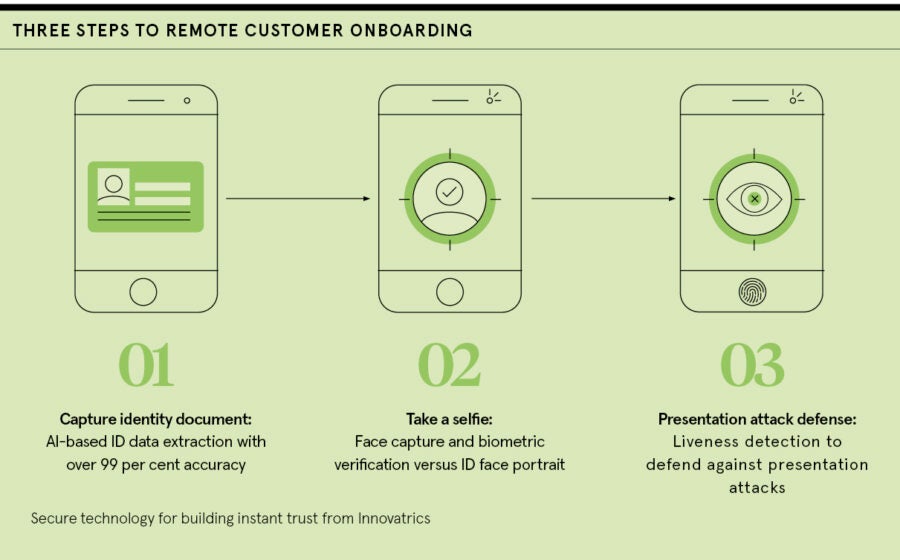

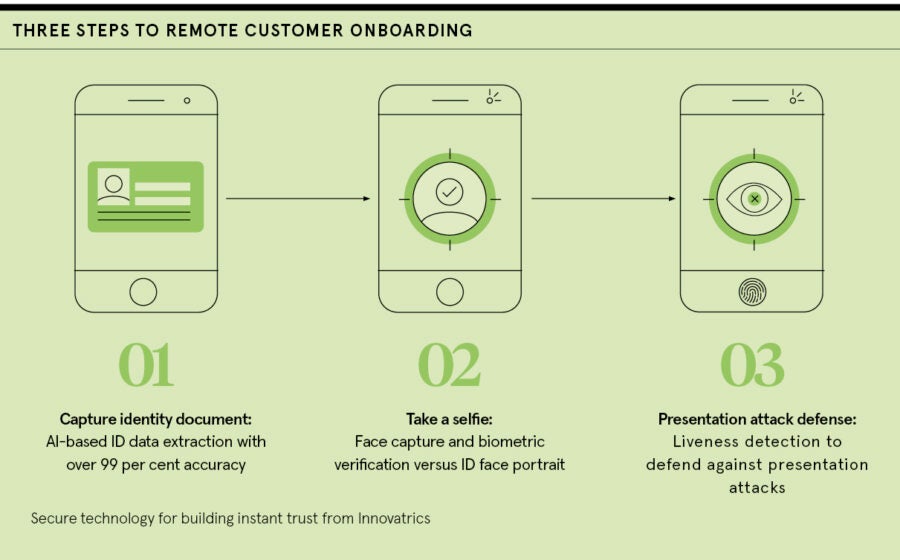

If the coronavirus outbreak has shown us anything it is that we’re moving to a more connected, online world in which we need to prove our identity securely. Biometrics will be in high demand. Take onboarding practices with traditional banks, this involved visiting a local branch to verify who you are with ID documents. Not anymore, so remote access to services via a customer’s device will be critical.

“With most countries across the globe implementing stay-at-home policies, we see banks and telecommunication firms, even governments, moving beyond traditional verification and investing in remote digital onboarding using biometrics, other technology powered by artificial intelligence,” explains Donal Greene, head of enterprise at Innovatrics, a global leader in biometrics, which has enrolled more than a billion people worldwide.

“Those that don’t will lose out to digital-first challenger banks during these testing times. That’s why many global financial institutions and established players are falling behind.

“Right now, financial service providers across the globe are clamouring for safe and secure digital authentication of new and existing customers. The volume of inquiries has increased significantly as they rush to offer more digitalised services online and via mobile apps, especially in response to measures like social distancing.”

Digital-first and challenger finance providers in developing regions from Southeast Asia to Africa have been early adopters, banking the unbanked and bringing microfinance and responsible lending to millions. Their experience demonstrates that onboarding, the process of capturing and verifying a new customer on a digital platform, must be effortless and seamlessly integrated into a bank’s existing infrastructure to maximise efficiency.

“There may be a perception that UK and European banks are ahead with digital initiatives. It’s just not true. We are using our Digital Onboarding Toolkit to enrol millions in developing economies. We’ve been enrolling 30,000 a day in some markets. It takes less than five minutes. You need a service that is quick, easy to use and able to detect fraud rapidly,” says Greene.

“We use proprietary state-of-the-art algorithms trained on millions of datapoints. Our algorithm for face identification is the fastest in the world and among the most accurate. It only takes 13 milliseconds for the algorithm to identify the correct face in a database of 12 million enrolees.”

Biometric identity verification will be one of the most important investments for many companies in the coming decade. Yet the market for digital onboarding is becoming increasingly crowded. There are many providers. It is difficult for banks and other finance providers to assess the right biometric technology partner.

Greene says: “The key is to look in depth at the biometric technology being used. Is it proprietary? Can it be customised and scaled? Has it been benchmarked and certified? Will it be compliant with local data, financial and anti-money laundering regulations? More importantly, is the technology user friendly and intuitive?

“Sixty per cent of our resources are focused on research and development to advance our technology using machine-learning. The key aim is to improve the user experience, increase accuracy and get smarter at reducing fraud. The most important element here is to adapt technology to humans and to efficiently address digital age business needs.

“Innovatrics has been active in this market for 16 years with more than 500 projects in 80 countries. It holds a unique place in the remote onboarding ecosystem. All our technology is proprietary and top ranked in the relevant benchmarks. This means companies don’t need to deal with several vendors and integrate multiple technologies to build a remote onboarding solution.”

So, what does the future hold? Greene says it is an evolution, not a revolution. Biometric technology is getting faster, more accurate, more secure and relevant to a wider range of use-cases. The future is exciting.

For more information please visit www.innovatrics.com