Having lagged behind other functions in digital transformation, finance and accounting teams felt the pressure of inefficient, manual processes more than most when coronavirus forced the world into remote-working mode. Before the pandemic, only 9 per cent of companies had transformed their finance function with automation, according to research from FSN. Many distributed teams have, therefore, had to deal with paper-based documents and office-bound tasks that are simply no longer feasible.

Chief financial officers (CFOs) and their teams are under enormous strain. On the one hand, the need to adapt to pandemic disruption has increased reliance on accurate, up-to-date financial data. On the other, it has also diverted budgets which might have been used for finance improvements to customer-facing systems, perpetuating a decades-long imbalance that has impeded back-office investment. Paper-based documentation slows performance and ramps up risk, since files must now be copied or scanned and sent as attachments.

“This may be feasible in a small company, but it adds dangerous layers of complexity in medium or large-scale finance and accounting operations. Before COVID-19, manual accounting was not sustainable, now it is untenable,” says Marc Huffman, chief executive of BlackLine, whose cloud-based solutions transform finance and accounting by automating, centralising and streamlining key processes. “The impact could have been softened had companies already digitalised processes, but few have fully addressed the finance automation gap.”

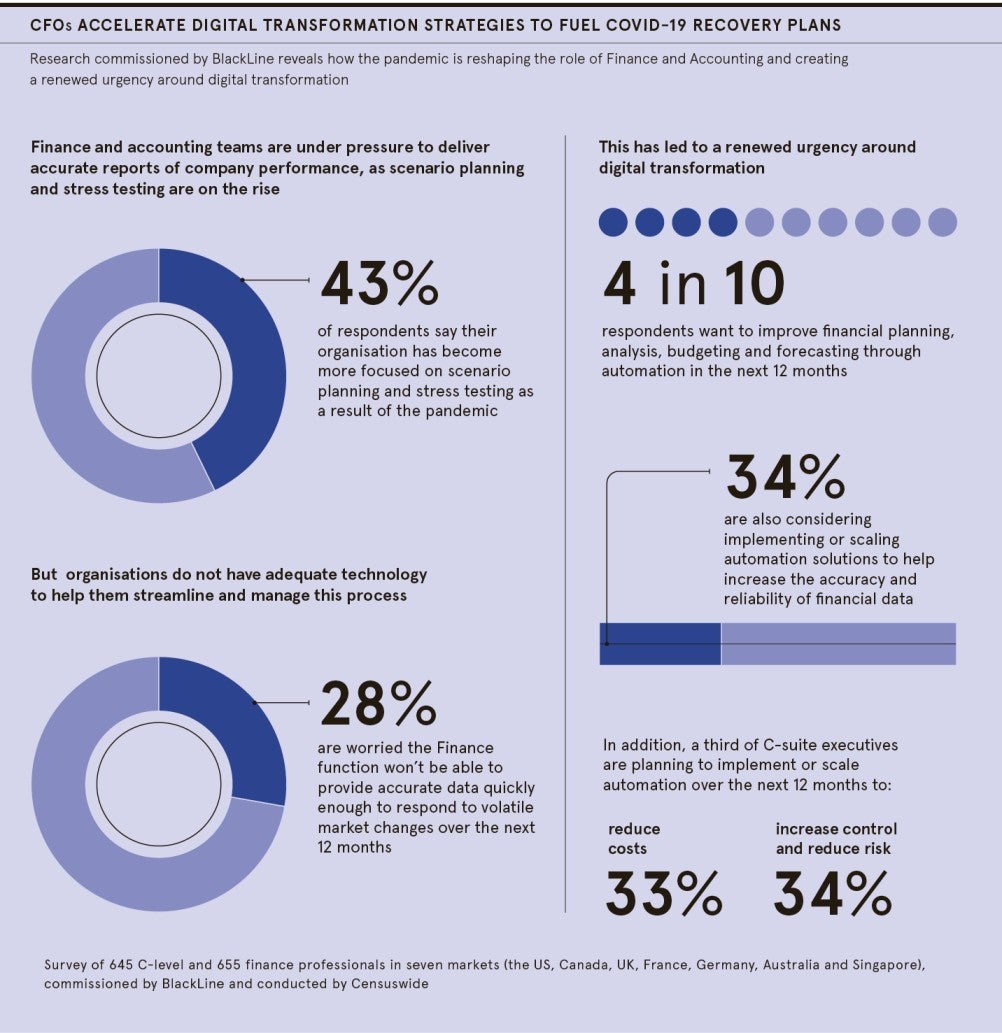

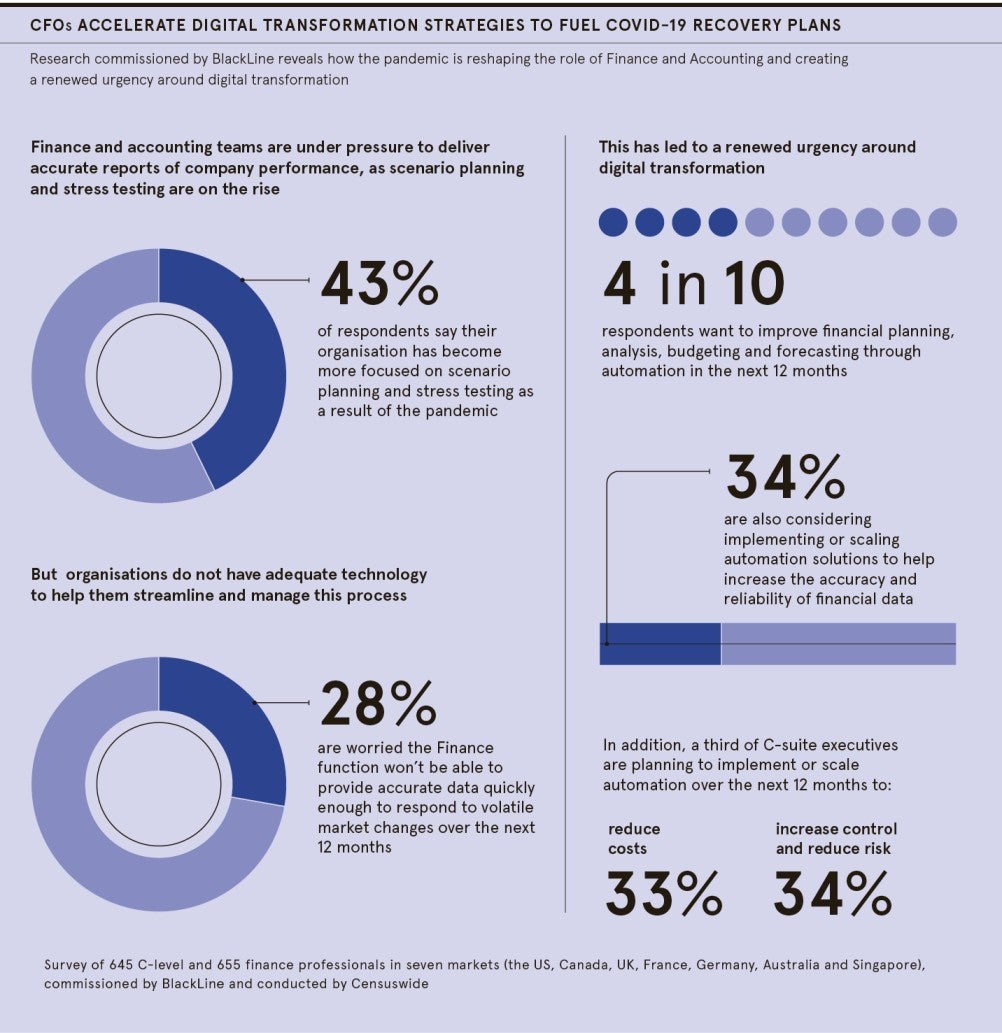

In a recent survey by BlackLine, just 29 per cent of C-suite executives and finance and accounting professionals felt confident in the accuracy of their financial analysis and forecasting data. This is despite a third of respondents believing the pandemic has increased pressure on them to provide an accurate picture of company performance.

The pandemic is bringing to the forefront what we’ve seen for years: manual accounting processes are unsustainable

Findings suggest that while businesses now recognise the critical role financial data has to play in informing business strategy and continuity, poor visibility and a lack of access to real-time data is hindering the ability to respond to volatile market changes. Four in ten respondents said the finance team is increasingly being called on by the board to provide insights that help with scenario planning, yet 28 per cent were worried they are not able to provide data quickly enough for the company to respond to market changes.

The lack of visibility – 27 per cent of C-suite executives said they have none at all into financial scenario planning or stress testing – means business leaders are often making decisions based on an incomplete picture of their organisation’s financial health. It is also undermining trust in the data used for key financial processes and planning, with only 56 per cent of C-level executives confident in the accuracy of their company’s financial data. Accuracy is hindered by a reliance on clunky spreadsheets and outdated processes that leave finance and accounting team members in the dark until month-end.

“Manual tasks, inefficient processes and a lack of data insights are holding back finance functions and preventing them from competing effectively in a tumultuous market that has been upended by COVID disruption,” says Huffman. “In the end, the pandemic is bringing to the forefront what we’ve seen for years. The questions and scenarios might change, but the answer is the same: manual accounting processes are unsustainable.

“Companies often struggle to advance digital transformation in the finance function as they fail to link process change with the most advantageous outcomes of automation. To achieve the full value, they need to be prepared to challenge and reimagine hardened accounting processes. It’s crucial to engage every level of the organisation to embrace digitalisation rather than fight it. COVID-19 has highlighted the importance of an efficient, automated finance function; companies must now address this or risk

falling behind.”

A third of BlackLine’s survey respondents said developments caused by the pandemic have made people at their company value real-time access to financial data more. The opportunity is there for finance organisations to leverage the renewed urgency COVID has created around digital transformation to accelerate their automation aspirations.

BlackLine’s cloud-based solutions enable companies to move to modern accounting by unifying their data and processes, automating repetitive work and driving higher accountability through visibility. They allow large enterprises and mid-sized companies across all industries to do their accounting work better, faster and with more control, shifting resources from just getting the job done to telling a complete story, and enabling them to focus on strategic decision-making and the work that matters most.

In particular, BlackLine helps companies manage the financial close by automating accounting processes, such as reconciliations or journal entries, reducing detail-heavy, routine tasks that distract from higher-value work. It recently introduced a new solution to speed up accounts receivable cash application by using artificial intelligence to automatically match customer payments to invoices and provide real-time visibility over cash flow.

“By reducing errors and inaccuracies in the finance function, our automation ultimately frees up time for more complex and valuable tasks, including analysis and forecasting,” says Huffman. “An end-to-end automated accounting environment also leads to better control, ensuring key processes are secure, standardised and repeatable, and is much better suited to working virtually. It protects files and documentation by storing them centrally and eliminates the need to share data via email or other unsecured processes.

“Most importantly, embedding automation within day-to-day activities facilitates real-time financial intelligence, enabling CFOs and their teams to elevate their role by providing unprecedented value and consultancy to the broader business. Rather than solely managing data, digital transformation enables finance departments to activate it and uncover valuable insights that could ultimately determine the success of their business, transforming finance and accounting into a highly valued strategic business partner. The organisations that use financial data to their advantage will ultimately be better positioned as we move from crisis mode and into post-pandemic recovery.”

For more information please visit www.blackline.com/covid-F&A-survey

Sponsored by

Having lagged behind other functions in digital transformation, finance and accounting teams felt the pressure of inefficient, manual processes more than most when coronavirus forced the world into remote-working mode. Before the pandemic, only 9 per cent of companies had transformed their finance function with automation, according to research from FSN. Many distributed teams have, therefore, had to deal with paper-based documents and office-bound tasks that are simply no longer feasible.

Chief financial officers (CFOs) and their teams are under enormous strain. On the one hand, the need to adapt to pandemic disruption has increased reliance on accurate, up-to-date financial data. On the other, it has also diverted budgets which might have been used for finance improvements to customer-facing systems, perpetuating a decades-long imbalance that has impeded back-office investment. Paper-based documentation slows performance and ramps up risk, since files must now be copied or scanned and sent as attachments.