How has the nature of money changed amid advances in technology and changes in consumer attitudes?

How has the nature of money changed amid advances in technology and changes in consumer attitudes?

Consumers, particularly newer generations of corporate travellers, want ease of use, a seamless experience and control of their spending. Cash doesn’t give you this and bank transfers are just clunky and difficult to manage in real time. So consumers are turning to mobile wallets and contactless payments. Meanwhile, the new leaders on the supplier side of the payments industry, the likes of Uber and Amazon, have been successful because they’ve made payments invisible and seamless. It’s just so easy to buy through them and that’s why consumers love them. The only way you can do this is to make sure you have really granular control, visibility and accountability of each payment. If people don’t trust Amazon, they’re not going to use it. Companies like Amazon have created a one-to-one match between all the data from the product you want to buy and then from your profile and payment method.

Have these changes been reflected in the corporate payments space?

Corporates have been well behind the consumer space in terms of making payments seamless and easy. It’s almost like if you work in a corporate, you’ve had to get used to the fact that payments are difficult. However, millennials don’t see the reason for this because of what they’ve been accustomed to in their consumer life. When they go to work for a corporate and there are all sorts of processes around spending money, getting authorisation, reconciling and expensing, they just don’t get it. So the corporates are having to respond. Often the cost of buying a cup of coffee for somebody and then expensing it is not worth it. It costs £5 for the coffees and £30 to expense them in a corporate enterprise resource planning system. Mobile payments, which millennials already use through the likes of Apple Pay and Google Pay, streamline that process. The challenge for corporates is facilitating this within their existing banking network.

How are you helping corporates consumerise their payment systems?

Conferma Pay originated as a way for corporates to control their spend, especially in the world of T&E (travel and expenses). The way travel is paid for in corporates is antiquated. It’s very difficult to get a handle on where your spend is and the data flow in travel is very poor. Our business started because we realised if we created a unique payments vehicle for every single transaction, we’d have a one-to-one match between the payment vehicle and what you pay for. It’s what later became known as a tokenisation, but we call them virtual card numbers, whereby we’re able to create a unique number for every single thing you want to buy. We’ve essentially learnt how to bring what Amazon and Uber are doing to the T&E world. You can pay for your flights and hotels and all your ancillary spend while you’re out on business travel and seamlessly integrate it into your corporate payment and expense platform.

Consumers, particularly newer generations of corporate travellers, want ease of use, a seamless experience and control of their spending

How are you different to other fintechs?

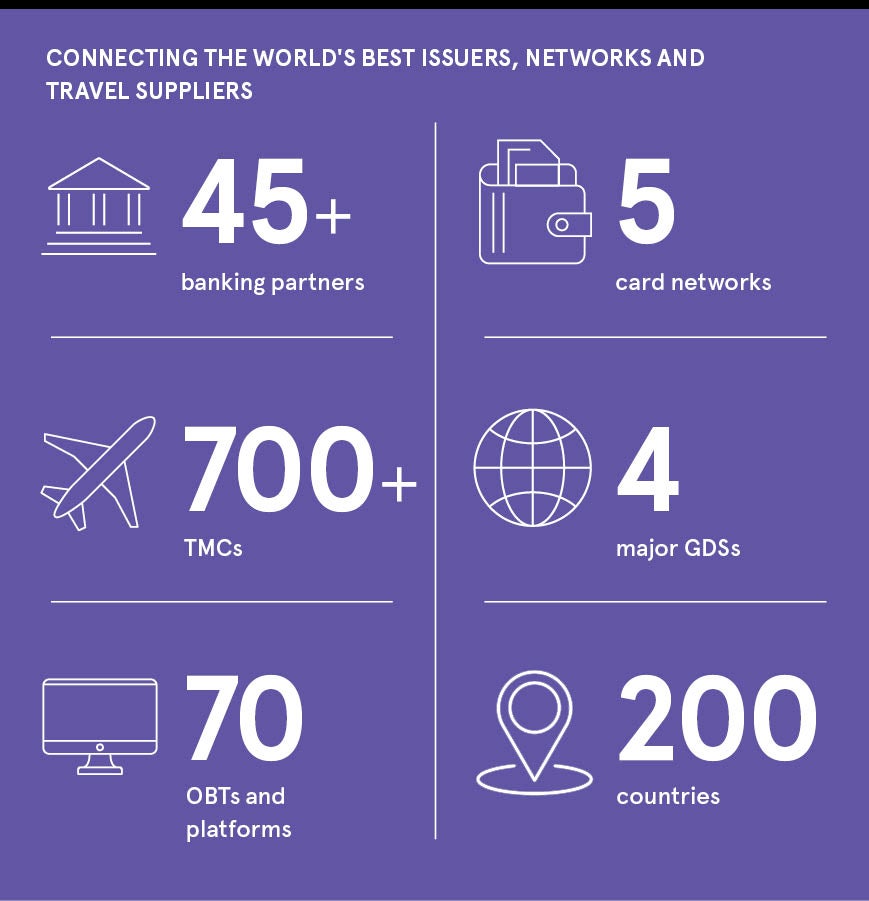

Unlike a lot of fintechs, we don’t really deal direct with the consumer or corporate. We enable the existing established treasury banks around the world to offer this type of fintech payment technology and bundle it into all the other things they do for their corporate customers. Large corporate organisations don’t really want to deal with fintechs unless they can’t get this type of agility and technology from their existing banking relationships. We’ve been able to build up a network of banks wanting to deliver fintech-type technology to corporates that want to buy it from the banks.

In what ways are virtual payments improving the payments experience for corporates and their employees?

In the typical world of corporate payments, employees are issued with a corporate credit card which poses a challenge because it has to be somebody’s liability. If the corporate takes the liability, it’s huge because they have thousands of employees with credit cards. If the liability is delegated to the individuals, they have thousands of liabilities running around on their behalf. The only other alternative has been to not give employees credit cards and have them claim everything back, which is even worse. By incorporating the much more dynamic method of putting a payment vehicle in your employees’ e-wallets and the reconciling is done automatically, the liabilities are removed alongside the huge inefficiencies involved in claiming expenses. We also capture all the data around each token so when one is issued you can follow the transaction from beginning to end. Whereas in the past corporates have been trying to find rich data elsewhere, ultimately the richest source of data lays in their payments.

Does this enable more secure transactions, reducing fraud?

With the backbone of virtual card technology enabling an e-wallet, you’re able dynamically to assign a card spending limit, a time the card can be used and a merchant category code so it can only be used where you want it to be used. Physical corporate cards have to be generalist cards open to different use-cases and different amounts. With a virtual card, because it’s created on the fly for the exact circumstances required, you can control it and put those parameters around it to do with the merchant, time and amount. It’s an extremely controllable device and that’s very valuable in terms of protection and reducing fraud. As a token, you have the security of not having card numbers in the wallets of employees. You just have a token in their wallet. If the token is stolen, there’s nothing the thief can do with it. If it’s lost, it can be replaced instantly.

For more information please visit confermapay.com

How has the nature of money changed amid advances in technology and changes in consumer attitudes?

How has the nature of money changed amid advances in technology and changes in consumer attitudes?

Consumers, particularly newer generations of corporate travellers, want ease of use, a seamless experience and control of their spending. Cash doesn't give you this and bank transfers are just clunky and difficult to manage in real time. So consumers are turning to mobile wallets and contactless payments. Meanwhile, the new leaders on the supplier side of the payments industry, the likes of Uber and Amazon, have been successful because they've made payments invisible and seamless. It’s just so easy to buy through them and that’s why consumers love them. The only way you can do this is to make sure you have really granular control, visibility and accountability of each payment. If people don't trust Amazon, they're not going to use it. Companies like Amazon have created a one-to-one match between all the data from the product you want to buy and then from your profile and payment method.

Have these changes been reflected in the corporate payments space?

Corporates have been well behind the consumer space in terms of making payments seamless and easy. It's almost like if you work in a corporate, you’ve had to get used to the fact that payments are difficult. However, millennials don't see the reason for this because of what they’ve been accustomed to in their consumer life. When they go to work for a corporate and there are all sorts of processes around spending money, getting authorisation, reconciling and expensing, they just don’t get it. So the corporates are having to respond. Often the cost of buying a cup of coffee for somebody and then expensing it is not worth it. It costs £5 for the coffees and £30 to expense them in a corporate enterprise resource planning system. Mobile payments, which millennials already use through the likes of Apple Pay and Google Pay, streamline that process. The challenge for corporates is facilitating this within their existing banking network.