How far in advance should you plan the sale of a technology business?

We predominantly advise software-as-a-service (SaaS) businesses in education technology, financial technology and artificial intelligence. We work with these clients better over one or two years before sale. That time will pay back because, to get the best price for your company, you need to make it look as attractive as possible. For example, by highlighting issues with a SaaS company, we helped it increase sale value from £2 million to £15 million over two years. We don’t charge for the extra time involved because we are remunerated on a percentage of the sale value.

What are the challenges facing technology companies who want to sell?

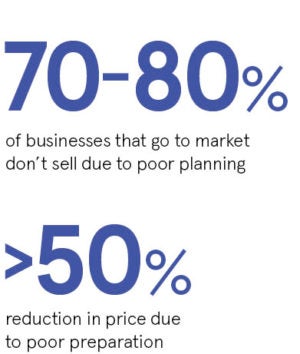

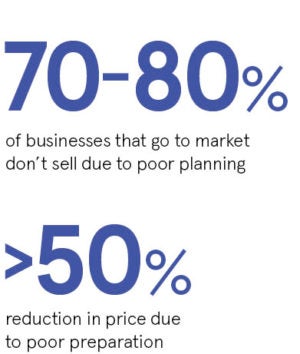

Some advisers simply want to get the deal done with a one-size-fits-all process. They do not develop a deep understanding of the client’s company and their primary and related market sectors. Research shows that this kind of poor planning means only about 20 to 30 per cent of businesses that go to market sell. Furthermore, poor preparation can reduce the price you make by up to 50 per cent, in my experience.

What are your top three tips for tech companies preparing for sale?

Prepare yourself, your company and your timing. Step one is about getting the owners mentally ready for an exit. Step two is to gauge how quickly they want to do it. Next, they must commit to the due-diligence process and a thorough assessment of the company, which will identify any issues. To prepare for this they need to clean their house. For example, tidying up any contracts that are poorly worded or have ambiguities adds value. Leaving it for the purchaser to tidy up will reduce how much they are willing to pay.

What are the typical reasons for a reduction in expected value?

A typical scenario is where a small startup allows themselves to be muscled into unfavourable contract terms by larger clients. It might be good for them to get the contract in the short term, but not the long term. For example, a business had a distribution agreement with no contract in place to protect their intellectual property; the other company started effectively reselling the IP to others. Another problem we have seen is putting software code into an escrow agreement. This is a common deal between technology firms and public sector organisations, which makes sure the code continues to be serviced rather than abandoned or orphaned. It can be a ticking time bomb if a change of control triggers the release of the code. So, where possible, that agreement might need renegotiating. Another potential landmine is in the general data protection regulation (GDPR). This has become a real headache for many technology companies. Any potential GDPR compliance or other data security issues can be a problem. A further issue might be if the ownership is complicated. For example, some enterprise management incentives can lead the seller to incur an unforeseen tax burden. In this case, we advise consulting a tax adviser to see if they can simplify or flatten the structure.

What advice do you give on how to time a sale?

Every client has different motivations for selling and we do our best to help them meet their goals. But a good time to sell is when the business is established, growing and as profitable as possible. If these characteristics aren’t there, but are achievable, we help clients plan to prove they are achievable. This can take time and they need to allow a year or more. Alternatively, if clients just want to sell quickly, we help them adjust their valuation to a more realistic level, where necessary. Be aware of your buyer’s needs. Private equity buyers are looking to accelerate on growth and profit. Strategic acquirers could have other motivations, such as adopting your technology into their company. Either way, they will want to know what your growth plan is, how you justify your forecast and what are the owners’ personal aspirations. We spend time making sure these issues are nailed because the more watertight the business plan, the stronger your projections look. We also try to differentiate by coaching individuals and building a team that can generate those results. An adviser can help your management stay focused on running the business, keep building on current success and keep growing through the acquisition. The perfect time is when you are ready to sell, your company is doing well and your market is thriving. Try and sell just before the peak, so there’s still value for the acquirer.

An adviser can help your management stay focused on running the business, keep building on current success and keep growing through the acquisition

Technology companies can be difficult to value due to the speed of growth and hype bubbles in the sector. How do owners value their companies realistically?

There is a science behind it. You can use discounted cash-flow calculations, but the most reliable way is to look at a scatter graph of comparable purchases. Private equity firms are rules driven, but strategic acquirers can be more entrepreneurial, so you can see why they sometimes pay higher multiples.

Please explain your remuneration structure?

Mid-market companies, with an enterprise value of £50 million or more, are well represented by the advice market. But the smaller ones less so, so we aim to champion the goals of smaller businesses. We charge a modest retainer, which we refund on sale, and a percentage of the sale value. We have seen advisers put companies through a process knowing that it won’t sell, just to get the fees. We have seen them push lower offers, even though they know it could make more, and cut corners. We have also seen advisers who don’t do their homework, miss critical points and do not focus on the client’s needs. They are robbing owners of the value that they have created. In contrast, our remuneration structure means our interests are aligned fully with those of the client and we’re working together to achieve their full deal potential.

For more information please visit www.lighthouse-advisory.co.uk

An adviser can help your management stay focused on running the business, keep building on current success and keep growing through the acquisition