With Brexit and heightened political uncertainty in the United States and Europe, and disruption continuing to unnerve businesses and  driving market volatility, managing risk with a sufficiently diverse portfolio is more important than ever.

driving market volatility, managing risk with a sufficiently diverse portfolio is more important than ever.

From year to year, it is difficult to predict which asset classes will be the best performers. Most investment specialists agree about the benefits of spreading your money across different investments. This diversification can reduce volatility, smooth out highs and lows in returns and help avoid unnecessary risk.

One of the major aims of diversification is to construct a portfolio of investments that don’t all behave in exactly the same way. So while one part of your investment portfolio could be falling in value, the others may be flat or rising to balance it out.

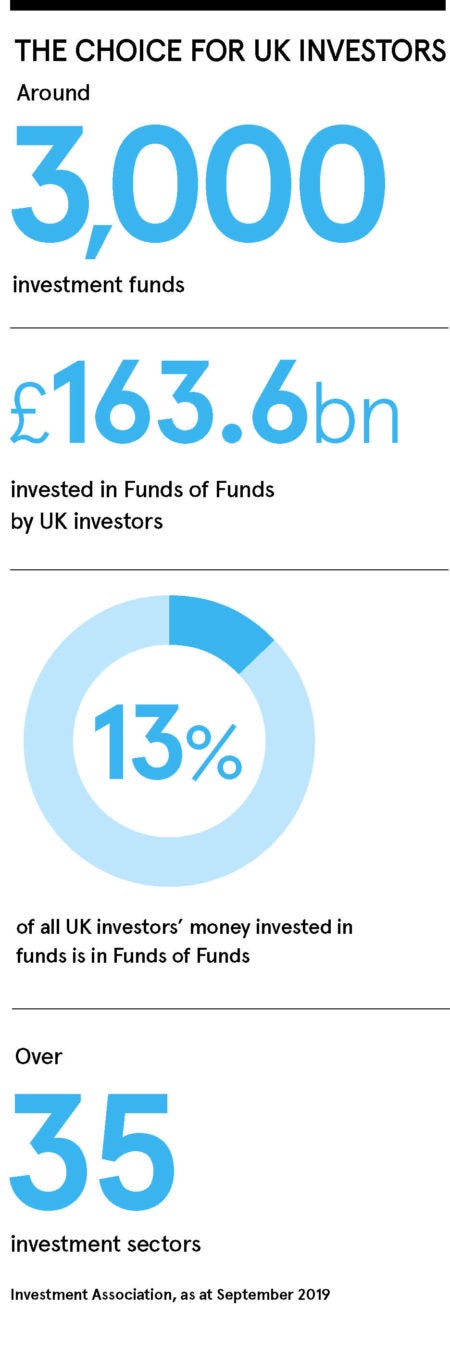

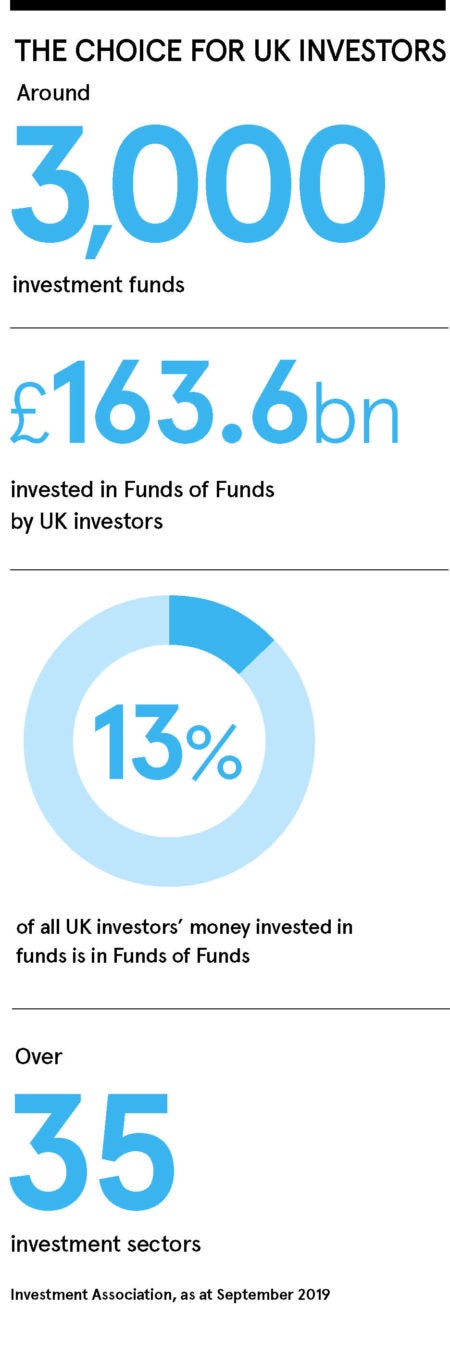

Multi-manager funds are one way of getting this diversification by providing exposure to more geographies and sectors through a variety of investments within one single fund.

“The greater the risks in the market, the more you need diversification,” says Sheldon MacDonald, deputy chief investment officer of multi-manager investment firm Architas. Specialist knowledge is essential for effective diversification, he argues.

“With stocks, for instance, we make decisions based on geographies, but we leave the specific sectors to underlying managers. These underlying managers run the funds that we invest in and have specialist, detailed knowledge of their sector or region,” says Mr MacDonald.

The greater the risks in the market, the more you need diversification

With bonds, again Architas focuses on the level of risk, selecting key government bond managers and investment-grade bond managers to work with.

“Clients like the fact that we can offer the level of risk that suits them,” he says. “We do this by using a different mix of underlying assets within each fund.

“Fund selection is a key part of this process. We’re just looking for the best of the best from the hundreds of funds available.”

Architas’ approach has required an investment of time and human resources. “We’ve been building one of the largest multi-manager focused teams in the industry,” says Mr MacDonald. “This is essential because meeting managers, understanding their individual philosophies and processes, and then working out how to blend them together is time consuming.”

As investors’ needs and wishes evolve, so does the way in which multi-manager investments serve them. Pensions freedom, for instance, means that decumulation – ensuring investors, no longer required to buy annuities, have the right asset allocations to give them sufficient income to sustain them through retirement – is increasingly important.

For more information please visit architas.com