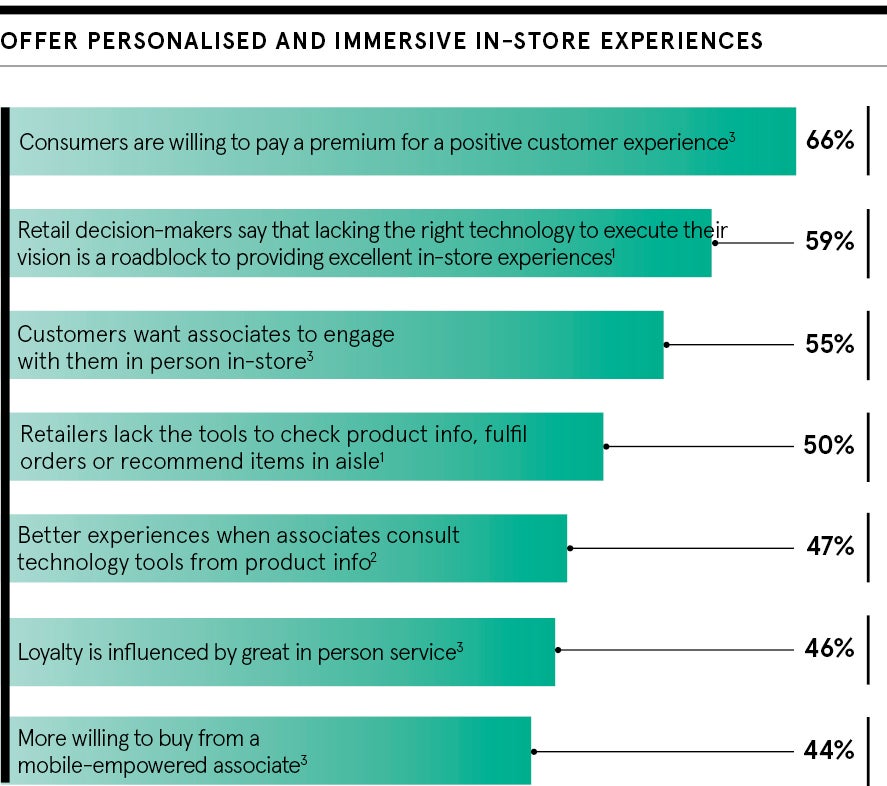

If shopping is not fun, why should we do it? Why not stay home and buy online? In recent years, with the huge rise of internet-only mega corporations, successful retailers have been quick to realise that physical shopping has to be more than a chore; it must be a form of entertainment, competing with not just the retail industry, but the leisure industries too.

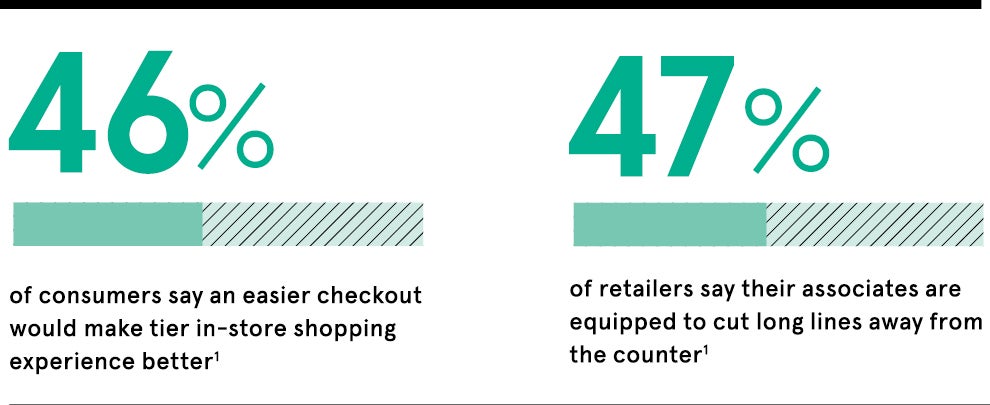

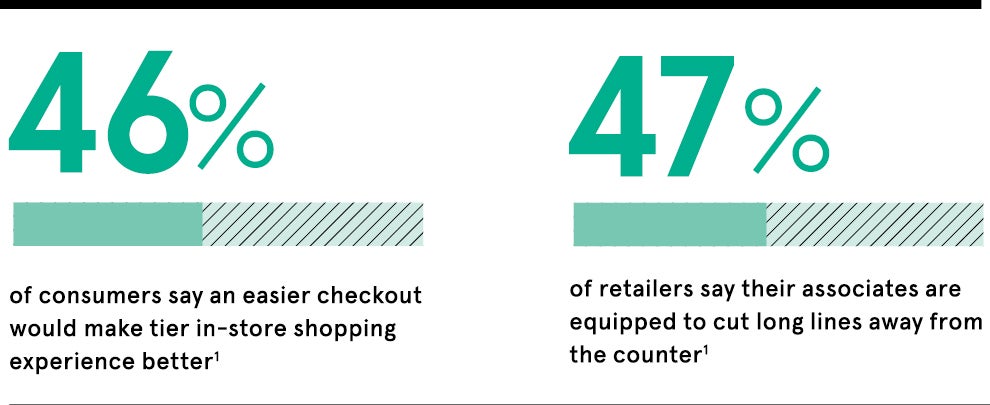

Shops have become more inviting, often a masterclass in beautiful interior design. Customer service professionals have come a long way from the man in the brown overall slouching behind a wooden counter. They are now out on the shop floor, showing deep product knowledge and mostly welcoming smiles. And, for the consumer, the hardest part of the process, parting with our money, has become easier and faster.

Arguably, the leader of this new world of shopping is the Apple Store. With knowledgeable staff, plenty of interaction with exciting products, people who can properly explain them and a payment experience that is a natural extension of a dialogue, a trip to the Apple Store can make your day a little brighter than it was before.

Better still, with no checkout counter, there is no queuing and no wasted space. This means the store design can be more imaginative and shift the balance of space towards showcasing the goods and providing a great customer experience.

But Apple and the other mega players have two critical advantages over a typical smaller retailer: scale and money. Taken together these unlock two things: more and better trained staff, and the technologies and know-how to engineer a seamless payment experience.

So, while many smaller retailers may not have the same resources, imagination and smart thinking are not limited to the larger operators. Yet a technology-enabled service experience is a lot harder for the smaller retailer.

All a retailer needs is a suitable payment terminal, a tablet and some way to fit them all together

Engineering harmony

What’s the hold up? We all know what a great experience can look like. It is easy to blame the retailers, but we in the industry know there is a consistent appetite for improvement. Others believe it is the suppliers, those that create the customer payment journey by providing the hardware and software, the banking and merchant services, and the distribution and implementation that glues it all together. Are they the big brake on innovation? It seems unlikely as they make substantial investments in keeping up with the market and each other.

In fact, the challenge is in harmonising all the different technologies. There are some fantastic providers, but integrating the different layers is not always straightforward. We in the industry create connections between products to ensure they play well with others, but we often work through our own lens when designing the products. When suppliers come together, and develop payment solutions from the perspective of customers, everyone wins.

Keep it simple

Let’s take an example. Until very recently, unless a retailer was very small, they usually needed to roll out inflexible, expensive and static till systems. These days, all that capability is available to download from innovative new software developers. Now, the stock management and customer engagement tools that have helped the big players to keep their edge have been democratised, available to any retailer for a relatively modest monthly fee.

All a retailer needs is a suitable payment terminal, a tablet and some way to fit them all together. Seeing this trend, Ingenico has designed a new type of combination, the Axium system which combines a payment terminal with a built-in Android tablet, an elegant, detachable stand and a printer. Add on a simple cash drawer and you have a single system that enables the server to stand at a traditional cash desk or break free to go straight to the customer. It is small, portable and elegant. More importantly, it does not need an expert to be integrated with anything else, keeping it all very simple and low cost.

But maybe best of all, because it is a standard Android tablet, the server always has access to the web to answer even the trickiest customer questions. This enables a retailers’ staff to stay up to speed on the products and the market, without having to lose days of productivity through training on every scenario, training that is often out of date as soon as it is done and wasted if the employee leaves the business.

Crafting the future

Creating these new customer experiences takes the combined efforts of different partners. In the case of Axium, that means a dynamic reseller, an imaginative acquirer, a creative point-of-sale software developer and, of course, Ingenico providing the payment platform.

The retail world is moving very quickly and sometimes the pace of change challenges traditional business models, but the opportunities are here and they are good for everybody.

Whatever may come, the point of payment is a significant moment for a customer and a retailer; it is the electronic equivalent of shaking hands on the deal. The future holds a lot of possibilities and options, but we think that pivotal point of trust will survive for a long time as it is deep in all our psyches.

It is our job at Ingenico to invest in imagining what is possible, challenging our role and thinking about how we can bring technology together to make retail better for everyone. After all, who doesn’t want to make something

more fun?

To find out about modern, simple and frictionless payment from our ecosystem of partners please visit ingenico.com

1Forrester, Step up the in-person experience, 2016

2Accenture, Operating Seamlessly: Integrating operations to deliver the non-stop customer experience, 2013

3Oracle, Retail without limits, 2016