How has infrastructure as an asset class evolved over the last ten to fifteen years?

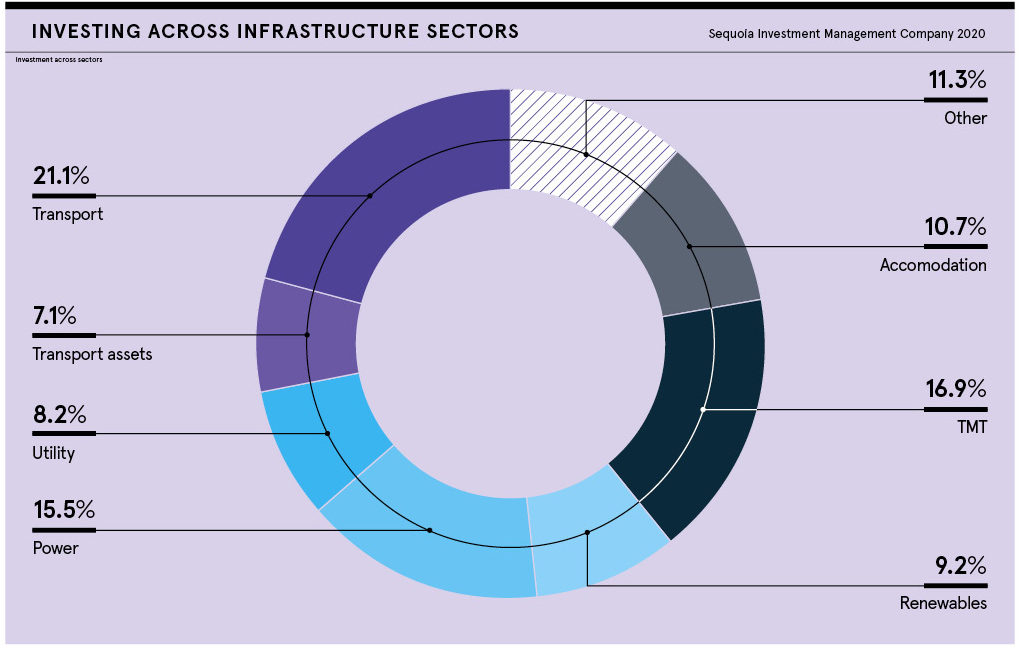

Asset classes like renewable energy have become more mainstream as the cost of capital has come down and the ways in which they get financed have become more sophisticated. With renewables, electricity supply can fluctuate depending on weather conditions, so you need ways to add back-up capacity to the grid, and therefore assets like standby generators, battery storage and peaking plants have also become important. Electric vehicles, meanwhile, create the need for chargepoints. New asset classes have also emerged in the technology, media and telecom (TMT) sector, including mobile-phone towers, datacentres and subsea data cables. We are not just seeing all these new asset classes emerging, but also some other asset classes beginning to fade out. Coal-fired power stations, for example, are being decommissioned at a rate of knots. They become stranded assets, with withdrawals of capital through environmental, social and governance considerations.

Why has infrastructure debt become such an attractive opportunity for investors?

Virtually all infrastructure lending used to be done by banks, but the financial crisis of 2008 led to a retreat. Some banks closed, including big infrastructure lenders with more than $100 billion of infrastructure debt. Other banks just got smaller or focused only on their domestic markets, and regulatory changes made it more expensive for them to lend long-dated debt and subordinated debt. Yet clearly the need for capital didn’t go away, and it’s growing further as governments seek to advance their TMT infrastructure and meet ambitious goals around net-zero carbon. To fill the void, institutional lenders’ debt funds have stepped in, along with insurance companies and pension funds. It presents great opportunities for investors, not just in the asset class growth, but pricing too. More demand for capital than supply means very robust returns on infrastructure debt.

How have infrastructure investments fared during the coronavirus crisis?

Overall, they’ve performed really well. Part of the investment thesis for infrastructure is the stability of the assets. They’re essential assets, sometimes regulated, with huge barriers to entry, so they tend to be non-cyclical and defensive. Some parts of our portfolio have actually outperformed this year, including the TMT sector which has benefited from more people working at home. We expect this to continue with the rollout of 5G and as the world becomes increasingly connected. Clearly there have been a few pockets that have had a difficult year, such as aviation, but for the most part we’ve found a lot of the affected assets bounced back really quickly. Almost entirely across the board, we have seen great resilience in the infrastructure sector. Relatively speaking, it’s been an oasis of calm and a safe haven through the chaos seen in many other sectors.

What approach does Sequoia take in this area and, geographically, where do you see the best investment opportunities?

Our high-yield Sequoia Economic Infrastructure Income Fund is one of only two listed infrastructure debt funds on the LSE. We are also the Investment Adviser on Sequoia Infrastructure Debt Fund, a private euro investment-grade/crossoverfund investing in core Europe. We take a global approach to the market, and we have found the withdrawal of banking capacity and capability has created huge opportunities, especially in those newer infrastructure asset classes in TMT, grid stabilisation and renewable energy. We invest in numerous developed markets, but our jurisdiction of choice is the United States. It’s a very large jurisdiction that’s naturally diversified and it’s where we see the widest range of investments and generally the best valuations. There’s a shortage of capital, but a massive forward demand for US infrastructure spend, arising not just through new asset classes, but also maintaining core infrastructure. The American Society of Civil Engineers estimates the United States will require $4.5 trillion to upgrade its existing national infrastructure by 2030 and only around $2.5 trillion of this has been identified. That large shortfall is a significant opportunity for investors.

For more information please visit seqimco.com

Promoted by Sequoia