The financial services sector faces a critical juncture. With quarantines, social distancing and stay-at-home orders all in place, digital tools are among the only means by which consumers can communicate with institutions around the globe. The coronavirus pandemic has therefore put trust in remote digital onboarding centre stage.

It’s not just banking. Government benefits, health services, online education, dating companies and gaming are just some of the sectors witnessing a huge surge in demand for digital know-your-customer services. This is expanding the use of digital authentication. The outbreak is also proving fertile ground for fraudsters exploiting the global rise in onboarding.

“Trust is paramount. You need to trust a system that’s going to take physical identity documents and live images of real people and turn them into digital identities. Anyone who tells you they can fully automate this process without some degree of fraud risk is not telling the truth,” explains Joe Bloemendaal, head of strategy at Mitek Systems, a global leader in digital identity verification.

We all need a system we can trust to authenticate the massive shift to online services

“Even in 2020, as economies digitise fast, most forms of ID globally are stuck in the analogue world. There is no comprehensive, interoperable digital identity that exists anywhere. Fraudsters are hot on our heels creating fake IDs and we estimate that about 20 per cent of the techniques they deploy each year are new. You cannot account for all types of ingenious fraud in an automated system.”

The science behind digital authentication has become more complex, vigorous and automated than at any point in history. Machine-learning algorithms can digest multiple security features in a passport or driving licence and know whether it’s fake. This is then combined with the ubiquity of smartphones to verify the consumer using a selfie and liveness detection, which recognises whether a person is real.

“Right now, computers may be better at facial recognition, but an experienced agent is still better at spotting fraud in some forms of paper ID. Therefore, we still need human experts to assist in digital onboarding. Having been around for over 36 years, we have a huge amount of experience in this area. We’ve always had experts and they know what the latest fraudulent activity looks like,” says Bloemendaal.

“It’s true that fully automated systems can be faster and sufficient for many requirements. Artificial intelligence-powered technology can recognise a valid ID as genuine and match the ID photo with a selfie using biometric facial comparison. But while algorithms are powerful, they are not perfect. There will be exceptions that the technology has not yet been trained to recognise. This is where agent-assisted solutions come into their own.”

Trust matters most in the digital world and onboarding process. Customers value signals that their online identities aren’t just automatically being processed, but carefully considered. This is known as positive friction and a small amount of it is seen as a good thing.

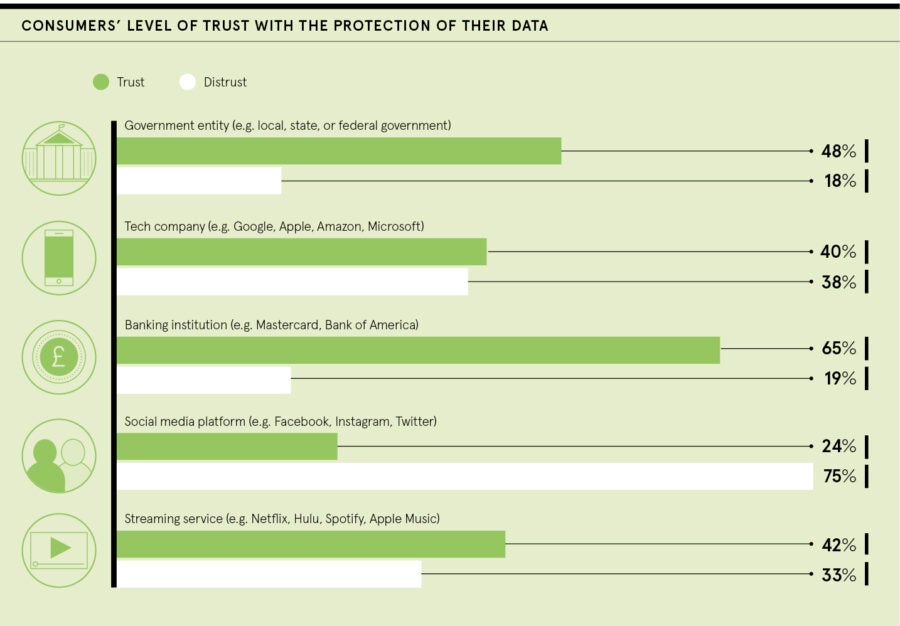

In a survey by Experian, 66 per cent of people polled said they like security protocols when they interact online because it makes them feel protected. In another poll, 86 per cent of consumers say they value security over convenience in digital channels.

“Digital onboarding is analogous to flying an Airbus A380. Most functions of the flight are now automated and digitalised. But no passenger actually wants to fly with a computer in charge. The pilot gives them assurance and takes control at crucial times. This is no different to digital onboarding,” says Bloemendaal.

“This is how we view the process. You still need humans to reach necessary levels of assurance. And taking a little extra time to digitally onboard someone is a good balance between positive friction, user friendliness and building trust. Automation, machine-learning algorithms, even artificial intelligence are all there to empower humans and vice versa. It’s not human or machine, it’s about using the best of both.”

This also allows machines to learn from experts. Machines don’t teach themselves. Capturing the latest fraudulent ID and feeding these into powerful analytical systems so computers can spot fake documents is how the machine’s abilities are continually improved.

“We’ve had a lot of inquiries with the COVID-19 outbreak. We all need a system we can trust to authenticate the massive shift to online services. Verifying people digitally has never been more vital, especially in an age when phishing and synthetic identities are surging,” says Bloemendaal.

“These are crucial times for the biometric industry. It is essential to get digital onboarding right in the rush to authenticate and verify many more people. Their lives depend on it, whether it involves new interactions with banks or governments.”

An example of where human and machine are working together is the fight against synthetic identity fraud. This occurs when criminals combine real and false information into new, bogus IDs to commit financial crime. Big in North America, it is now spreading across Europe. There are no audit trails and this type of fraud allows criminals to build up a credit score, create new bank accounts and then exploit the financial system.

“A very robust check of an ID document using the right identity verification solution can help in the fight against this crime. Combining this with a mobile phone selfie, a liveness test and an expert eye, which then counter checks all elements of a person’s identity, provides a robust system,” says Bloemendaal.

The future certainly looks bright for biometrics. Using the best of human and machine, digital authentication and verification are now merging and also reaching new audiences. “These are exciting times. Mitek Systems is at the forefront. You will soon see biometrics used to verify much larger bank payments and authenticating an older generation into the digital world,” Bloemendaal concludes.

Mitek Systems is a Nasdaq-listed company, which has worked with 7,000 organisations around the world, servicing more than 80 million users.

For more information please visit miteksystems.com