SPONSORED BY Luxembourg for Finance

Environmental sustainability has shot up the agendas of governments, businesses and consumers as the visual effects of climate change have grown. Droughts and heatwaves have become more frequent, while wildfires have burnt at unprecedented levels and some areas are experiencing extreme weather events never seen before. The understanding that climate change is an existential issue is now widespread, as is the realisation that everybody is responsible for the solution.

The business regulatory framework in Europe continues to push the sustainability agenda very strongly, mirrored in varying degrees around the world. Even in the United States, rapid progress is being made at corporate, municipal and state levels. Recently, federal agencies such as the Commodity Futures Trading Commission have issued reports on climate-related market risks and the Business Roundtable, an influential lobby group made up of chief executives of major companies, has made clear that corporate America is keen to promote environmental stewardship.

Achieving the ambitious goals of the Paris Agreement, signed by global leaders at the 2015 United Nations Climate Change Conference, will require people to change their consumption habits and behaviours, and organisations to shift to more sustainable ways of operating. This means investing heavily in new production, manufacturing and distribution processes, which will of course require substantial financial resources.

“Everybody must contribute,” says Nicolas Mackel, chief executive of Luxembourg for Finance, the agency for the development of Luxembourg’s financial centre, representing it globally and connecting investors to the range of financial services provided in the country. “If you think the COVID-19 pandemic has disrupted people’s lives, wait until we face a serious climate crisis because it will be significantly more disruptive.

“Some commentators say to achieve the Paris objectives we need hundreds of billions of euros, just in Europe, to help finance the transition required in the economy. We need to retrofit our buildings, live differently and invest in new technologies. That is where the financial industry is not only needed, but must play a very important and positive role as part of the solution.”

Organisations in the financial services sector are increasingly taking the view that they not only have a moral and societal obligation to contribute to the transition to sustainable finance, but it is also imperative to the success of their business. Most now see sustainable finance as a core part of their future, not least because the investment risks presented by climate change will result in a significant reallocation of capital around the world.

The opinion in some circles of the financial services industry that environmental, social and governance (ESG) investment criteria are merely a nice to have and come at the expense of performance has now been debunked by numerous studies. Research from data provider Morningstar earlier this year found six out of ten sustainable funds delivered higher returns than equivalent conventional funds over the past decade. On average, more than three quarters of ESG funds available ten years ago still exist, compared with fewer than half of traditional funds.

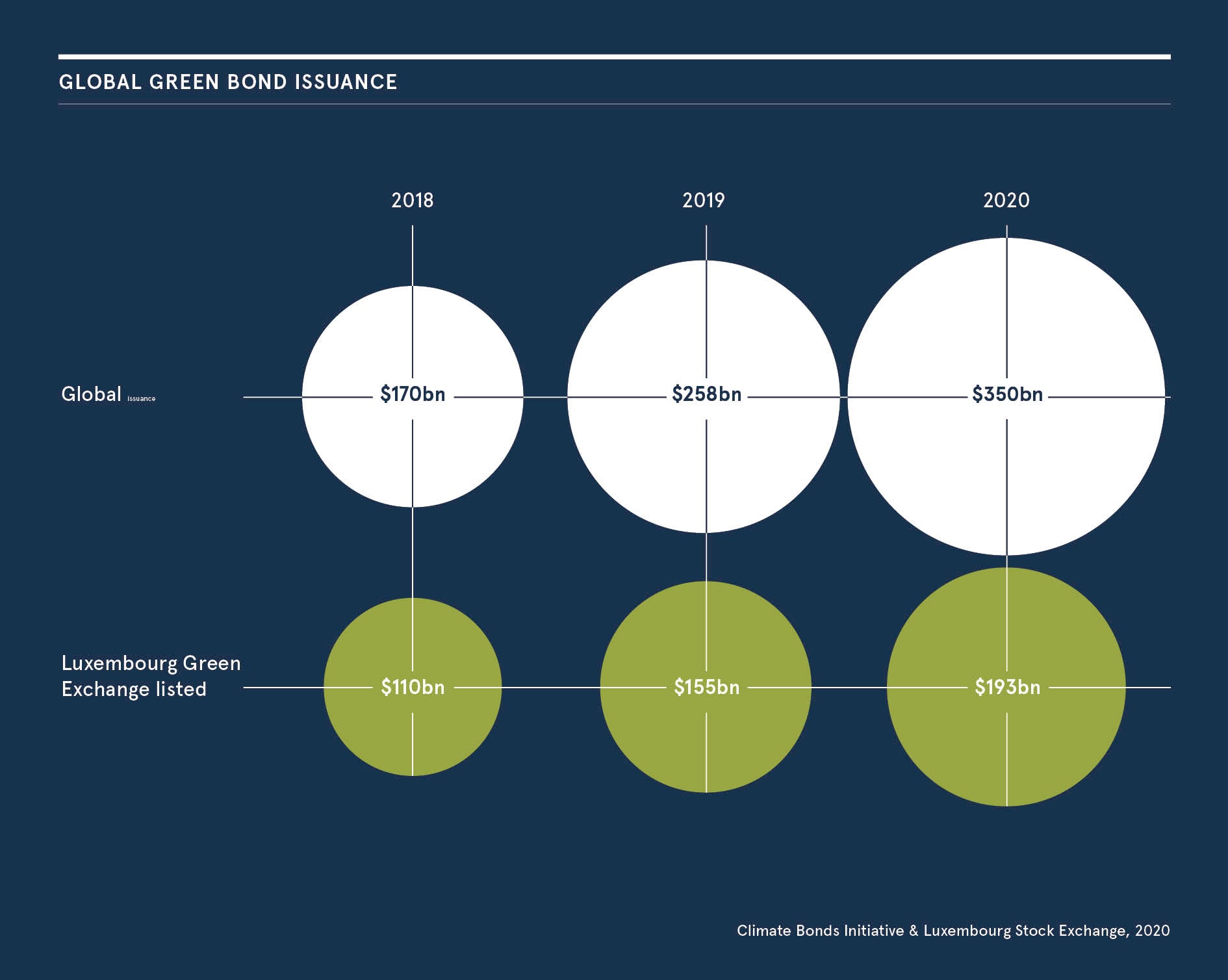

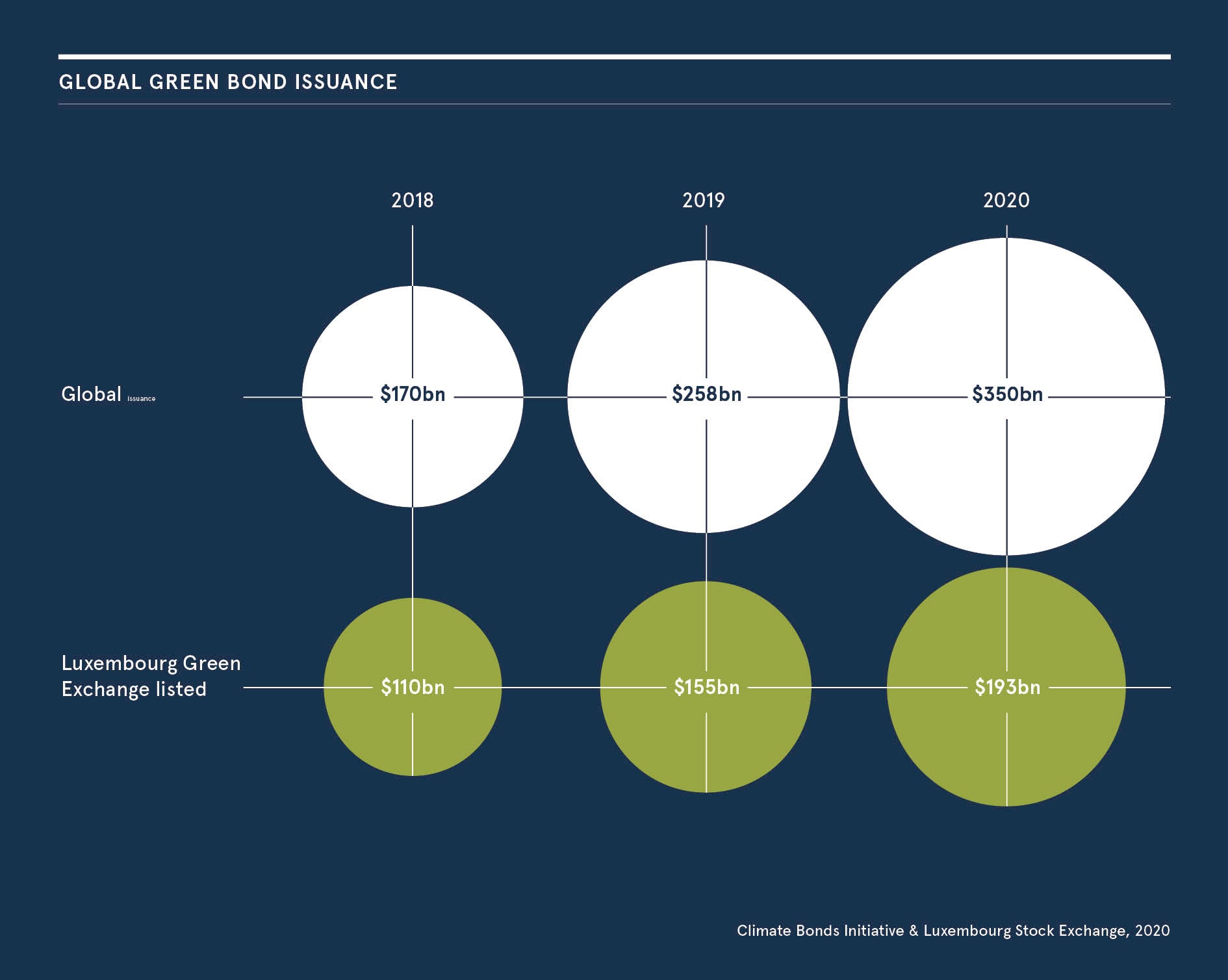

“Financial services companies have really started to take sustainable finance seriously, but we are only at the very beginning,” says Mackel. “In capital markets, there are now around $250 to $300 billion in green debt issues per year, though green bonds still only make up 2 or 3 per cent of the total volume. That needs to increase substantially. The other area of impact we’ve seen is in investment funds, led by BlackRock.”

As the world’s largest asset manager, with around $7 trillion under management, BlackRock is an incredibly important voice in the investment world. Earlier this year, its chief executive Larry Fink wrote to shareholders and business leaders to say his firm will now judge companies on their ESG commitment.

“That is very important because when Larry Fink says something, company decision-makers listen,” says Mackel. “They now know if they want to attract investors like BlackRock, they must be serious about sustainability. We need more Larry Finks and we’re seeing it happen. I don’t think there is any asset manager today that doesn’t mean serious business when they talk about their ESG strategy and sustainable investments.”

Financial centres are crucial to push the sustainable finance agenda and build bridges globally. As clusters of expertise that connect projects with investors, their role as investment hubs will be fundamental in making the transition to a more sustainable economy a reality. Luxembourg, in particular, has led the way in this area, home to the first green bond listing in 2007 and the first dedicated green stock exchange in 2016.

The Luxembourg Green Exchange is the world’s largest platform focused exclusively on sustainable finance, listing more than 50 per cent of the entire global volume of green bonds. Its success and credibility has earned the exchange the business of the World Bank, the largest issuer of green debt, and the European Commission, as well as many corporate issuers. In the investment funds area, meanwhile, 35 per cent of the assets under management in Europe’s renewable energy funds are in Luxembourg funds.

Financial centres are crucial to push the sustainable finance agenda and build bridges globally. As clusters of expertise that connect projects with investors, their role as investment hubs will be fundamental to making the transition to a more sustainable economy a reality

“That is where we play our role as a financial centre and investment hub, bringing together investments and projects that are then financed with this money,” says Mackel. “Collaboration across financial centres is vital. Luxembourg is an international hub and we’ve facilitated the launch of numerous cross-border investment and projects, as well as encouraging collaborative exchange of best practices across different financial centres, growing sustainable finance globally.

“In the coming years, we will see an exponential increase in the overall uptake of sustainable finance in markets. It has become mainstream. Every part of banking, asset management and capital markets will pursue this objective of contributing to a sustainable economy, hopefully sooner rather than later. Everybody is taking it seriously and it’ll be very top of the agenda well before the end of the decade.”

For more information please visit luxembourgforfinance.com