Ever since it was recognised a decade or so ago that the majority of a company’s value is attributable to its intangible assets (IA), there have been calls for intellectual property (IP) to become fully integrated into corporate strategy and for intangibles to be managed as business assets. However, confusion and practical challenges remain for IP to become fully embedded into corporate decision-making and strategy.

IP specialists have wished for the business and financial communities to better grasp the significance and value of IAs. But Josue Ortiz, director at ClearViewIP, believes the onus should be on IP professionals to bridge the gap.

“It needs to work both ways,” he says. “Of course, people from an IP background would want the C-suite to better understand its benefits, but IP practitioners need to articulate the contribution to the business of the IP assets they create and manage. At the end of the day, this requires IP operations to be measured and reported on a similar basis to other parts of the organisation, that is with key performance indicators, including specific return-on-investment (RoI) and budgetary targets.”

Only a robust understanding of the interlocks between the intangible assets of a company and its products and services, enables companies to optimise and leverage their IP portfolio for commercial advantage

While much of the IP industry has resisted making the first move in this direction, ClearViewIP has strived to do just that since its inception in 2007.

With an initial vision to provide business-driven advice on IP matters to UK companies, the business has since evolved to provide services across the full breadth of IP rights to a global client base, including Fortune 500 and FTSE 100 multinationals and prominent startups.

“While it is not surprising that startups would gain substantial benefits, it is perhaps unexpected that sophisticated multinationals rarely have a full picture of their intangible assets, so it’s very much a gap that needs filling,” says Mr Ortiz. “Only a robust understanding of the actual interlocks between the IAs of a company and its products and services enables companies to optimise and leverage their IP portfolio for commercial advantage.”

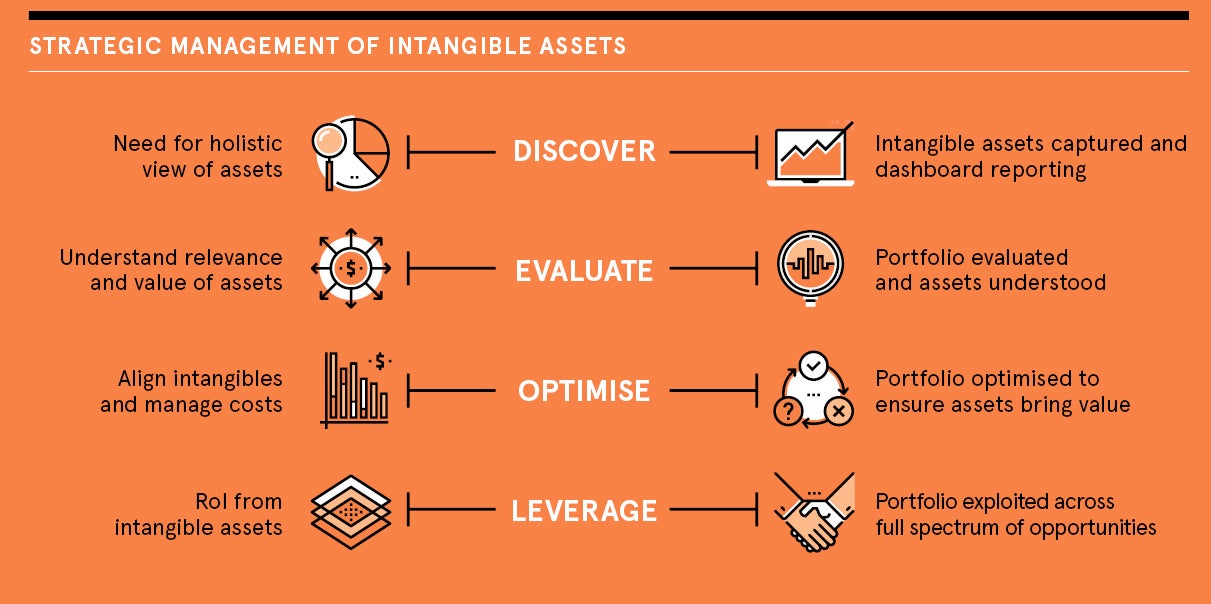

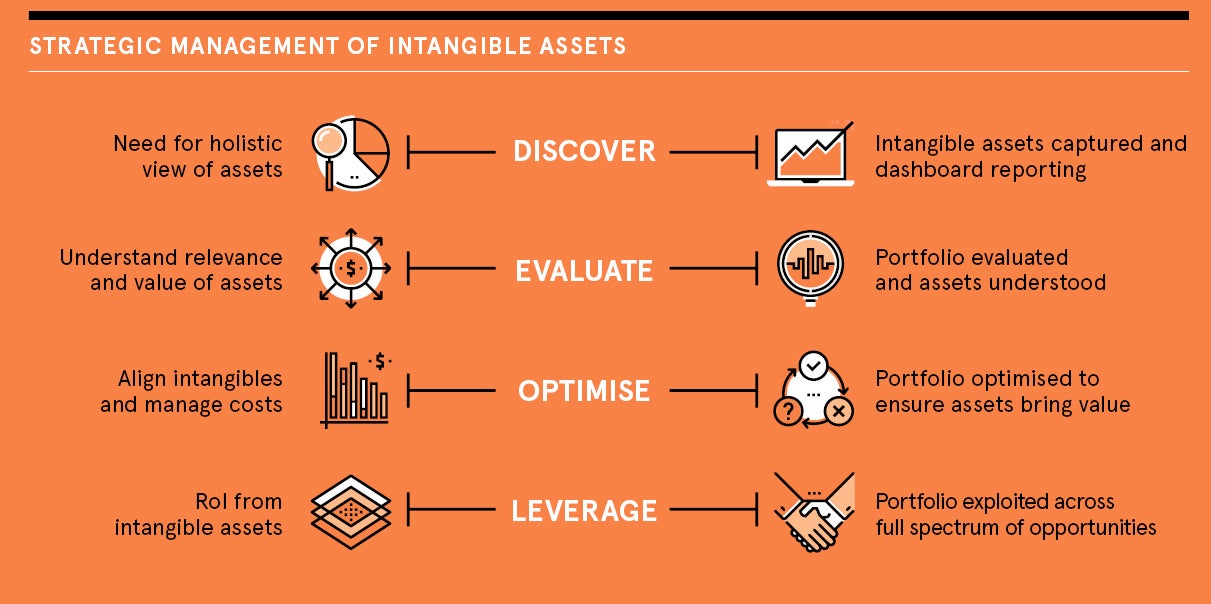

He goes on to describe the process of integrating IP into corporate strategy as a continuum, a cyclical journey from discovering and capturing IP, all the way to value realisation, always in reference to specific business goals that the IP function has to support.

“Deep discovery of intangibles and systematic IP capture underpin the strategic management of IP. These activities enable reporting dashboards through which IP can be managed in line with predefined objectives. IP dashboards are effective in communicating to the C-suite how IP is contributing value to the business. Furthermore, ongoing evaluation of a company’s portfolio enables the possibility for continuous improvement,” and increase value, says Mr Ortiz.

“Assets that are no longer beneficial to the business, for example because of a change in product strategy, could be divested or abandoned. Most companies can achieve substantial cost savings, without detriment to the competitive position provided by their IP portfolio, by implementing commercially driven evaluation processes. In our experience, cost savings of 30 to 40 per cent are not uncommon. Perhaps more importantly, a business-driven evaluation of the IP estate can identify strategic gaps that need to be remedied, either through organic IP creation or acquisitions.”

Referring to practical examples of the benefits of this approach to IP management, he describes two types of client engagements. “We worked for many years with a London-based venture capital-backed company to set up their IP processes and align their evolving IP portfolio to their product and strategic objectives. The company achieved a nine-digit trade sale to one of the largest tech companies in the US. The relevance of their IP was evident, IP due diligence sailed through and company executives believe at least 10 per cent of the value was directly attributable to the approach we had taken to develop their IP,” says Mr Ortiz.

“We have also supported several companies in acquiring IP assets to address gaps in their portfolio. These gaps have a direct link to profitability in that the lack of defensive IP meant having to pay substantial licence fees, incur legal expenses to defend incoming IP lawsuits or an inability to scale up out-licensing opportunities. IP acquisition programmes typically deliver a higher RoI in terms of cost savings or revenue generation versus acquisition costs.”

Direct revenue generation from IP would seem the Holy Grail of viewing intangibles as valuable business assets. However, Mr Ortiz offers a different perspective.

“For many companies, the most significant opportunities to contribute directly to the bottom line have to do with leveraging IP in commercial negotiations that take place on a regular basis in most innovative businesses,” he explains. “This will include partnerships, collaborations and joint-venture discussions, but also supplier relationships. There are also significant opportunities related to legitimate tax incentives related to IP, such as Patent Box.

“What all these opportunities have in common is the need for the IP estate to be well understood, actively managed and for the IP function to have strong relationships with other business functions.”

ClearViewIP’s ability to integrate IP into a traditionally reticent business world stems from the firm’s almost unique positioning as a management consultancy for IP strategy and transactions. This positioning balances the view of the IP function as a cost centre-focused on risk management, while recognising the value creation and value realisation opportunities innovative companies have in their IP.

“That’s a key differentiator,” says Mr Ortiz. “The systematisation of all the stages of the IP journey into a turnkey portfolio of services has culminated in a track record of delivering direct and measurable commercial outcomes. It’s about delivering tangible outcomes from intangible assets.”

So, what does the future hold for IP? Mr Ortiz believes companies will increasingly adopt a commercially driven, strategic approach to the management of IAs.

“While the appreciation of IP’s importance as an asset has increased and the role of intangibles is becoming more talked about, this hasn’t resulted in IP processes being changed that much,” he concludes. “But IP teams are under budgetary pressures and their

value-add is under scrutiny. Those IP departments that can demonstrate their contribution to the bottom line and to strategic corporate objectives will be highly valued.

“Innovation will help in this respect, with semantic and AI techniques helping companies mine their IAs and discover links to products and services. This will lead to IP assets being more frequently understood, leveraged; this will create more reference points that will eventually make IP less difficult to value.”

For more information please visit www.clearviewip.com