The financial services industry is navigating an unprecedented set of challenges: a sea-change in consumer expectations, an extended period of regulatory upheaval, onerous new capital and liquidity requirements, and – crucially – the rise of challenger banks and other new disruptive market entrants.

Already underpinning familiar offerings such as Netflix and Amazon, cloud technology has the potential to transform some of these challenges into opportunities for the industry, promising greater agility and innovation to enable financial institutions to remain competitive.

“Cloud providers have evolved considerably in recent years,” says Derek Lum, UK head of cloud advisory at Capco. “Their proposition meets the very specific requirements of financial institutions, prioritising security and regulatory compliance. In turn, those institutions increasingly view the cloud as an enabler of change, offering scalability, innovation and greater ease of operations.”

Cloud technology offers institutions the power to gather, store, analyse and leverage data from millions of customers more effectively and cheaply than traditional in-house or on-premise systems.

As Rob Deakin, partner and UK head of digital at Capco, notes: “Infrastructure has historically been a necessary evil for banks, but thanks to cloud that is no longer the case. Why compete with Google’s thousands-strong infrastructure engineering team when you can instead deploy their offering at a low cost and refocus your time and energy on real banking activities, product innovation and the customer experience?”

The cloud will be central to fostering the data-driven, innovative and above all customer-focused environment that large financial services organisations recognise as key to their future competitiveness, says Mr Lum.

“With cloud technology, banks can react quickly to changing dynamics while also remaining profitable,” he explains. “If a bank wishes to target a particular demographic, they can build solutions, experiment and then scale much faster than on-premise systems would allow. That is a huge and vital differentiator in today’s world.”

With challenger banks rapidly amassing market share, there is a renewed sense of urgency among established incumbents to transition to a more customer-centric, cloud-based digital business model

Mr Lum stresses the importance of collaboration: “A critical distinction is that on-premise infrastructure is a walled garden, hindering innovation and collaboration. Moving outside those walls via the cloud opens up a more expansive ecosystem where collaboration is the norm.”

An offering such as Starling’s app store-style Marketplace is proof that partnerships and co-operation need not be a zero-sum game for the banking sector; rather they are very much the future. This is not simply down to an influx of new market entrants, however, but also due to legislation.

The UK last year saw the introduction of open banking, to be followed later this year by the implementation across European Union member states of the Second Payment Services Directive (PSD2). Both are designed to foster innovation and accelerate competition by opening up the client data held by banks to other providers.

Sharing this data with third parties has sparked concern in some quarters. However, it offers incumbent banks the opportunity to tap new revenue streams through connections with large technology providers and smaller fintech partners, capitalising on their new perspectives and brand power to launch new services, improve customer experience and, crucially, enter new markets.

As Jonathan Fenwick, UK head of digital engineering at Capco, says: “These platform businesses that seamlessly connect services to people, in the process making their lives easier, are ultimately the big winners. We see a number of financial organisations looking to build new services as platform models, and a cloud-based approach is key in enabling them to do this efficiently and effectively.

“The cloud is utterly transformational in that it federates empowerment rather than centralising it, as has traditionally been the case. It inspires an entrepreneurial spirit and is the reason why challengers can react to market developments so quickly.”

Capco’s own track record supporting established banks as they embrace digital solutions includes the launch of Mettle, the Royal Bank of Scotland’s innovative small business bank. Mettle is designed around digital principles of speed, access and ease of use; for example, allowing customers to open a business current account more easily and quickly, forecast their business performance or create invoices from their mobile phone.

The growing ubiquity of the cloud, says Mr Deakin, will push technology much higher up the business value chain. On-premise technology is seen as the domain of specialist IT departments. Cloud technology by contrast offers a user-led and user-friendly experience, where impact and value are much more tangible and therefore more easily appreciated.

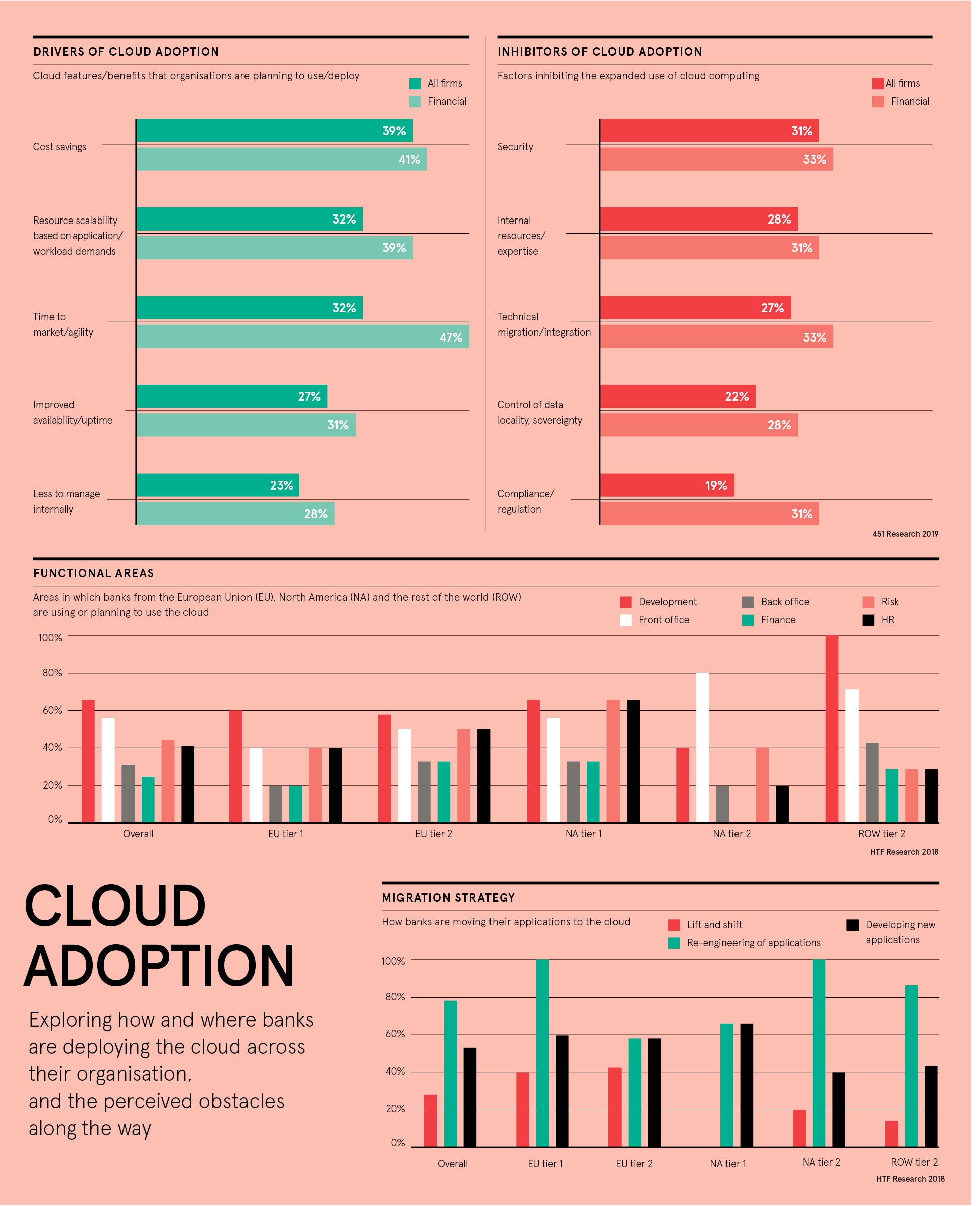

Yet, despite the undeniable benefits it offers, cloud uptake has been slow. As Mr Fenwick points out, a combination of security concerns, lack of in-house knowledge and the burden of systemic regulation has blunted widespread cloud adoption among banks.

“Early iterations of cloud technology did not place compliance at the heart of the solution,” he says “For financial institutions, which operate in a heavily regulated environment and handle sensitive data, compliance is key, and on-premise technology was perceived to offer greater data protection and security.

“Banks have been hesitant to commit to a single cloud vendor and in any case there is no one-size-fits-all approach. Cloud providers are accordingly looking to make it easier for organisations to use multiple cloud services. It is also very likely that regulators will insist on a multi-cloud environment to reduce the concentration risk that comes with placing all your business with one provider.”

Given the complex and monolithic infrastructures that underpin most bank operations, migration to the cloud is often approached with trepidation, as firms fear it will be hard to manage. Attitudes are now shifting, however. With challenger banks rapidly amassing market share, there is a renewed sense of urgency among established incumbents to transition to a more customer-centric, cloud-based digital business model.

Given the complex and monolithic infrastructures that underpin most bank operations, migration to the cloud is often approached with trepidation, as firms fear it will be hard to manage. Attitudes are now shifting, however. With challenger banks rapidly amassing market share, there is a renewed sense of urgency among established incumbents to transition to a more customer-centric, cloud-based digital business model.

To maximise the potential of cloud-based solutions, financial institutions must adopt a cloud-first mindset. “Clients acknowledge there is a skills gap around the cloud, so it’s about retraining employees, bringing in new talent, exploring new ways of working and collaborating with the right partners,” says Mr Fenwick. “We often hear that technology has to understand the business, but the business must also understand how the cloud works to truly harness its benefits.”

The onus is on banks to keep innovating and embracing change. “It may not yet be in their DNA, but the greater cost going forward lies in doing nothing,” he says. “Certainly, migrating to the cloud is not without its challenges and will require a mix of strategy, knowledge and cultural change. In taking that step, however, banks will enhance both their customers’ experiences and their own revenue streams, and redefine their standing in today’s rapidly evolving financial services landscape.”

For further information please visit www.capco.com