Digital transformation is a wave that companies can’t ignore if they want to remain relevant and compete in the modern world.

However, discretionary spending on digitisation projects has typically focused on the front end of companies, particularly those that have been in recovery since the 2008 financial crisis. This has included technology deployments to improve customer engagement channels and optimisation for mobile, putting a digital face on the business.

On the back end, meanwhile, there have been significant efforts to identify, reduce and outsource unproductive costs through labour arbitrage and the application of technologies that automate and optimise certain tasks and processes.

But throughout this shift, the office of finance has been left behind, with only the spending needed to meet regulatory requirements. The result is a squeezed middle for the finance function.

“Chief financial officers (CFOs) have continued to be the guardian of the past rather than orchestrating the future,” says Jeremy Suddards, chief executive at Aptitude Software. “They have been last in the queue when it comes to digitising their environment. While many have tried hard to incorporate some digitisation as part of their regulatory or compliance budgets, it’s only now, with maturity achieved at both the front end and back end, that companies are realising their finance function is holding the business back.”

The majority of the finance office’s time is spent on backward-looking reporting and mundane, manual tasks to maintain the status quo, rather than driving the business forward.

Our number-one priority is creating financial certainty for our clients

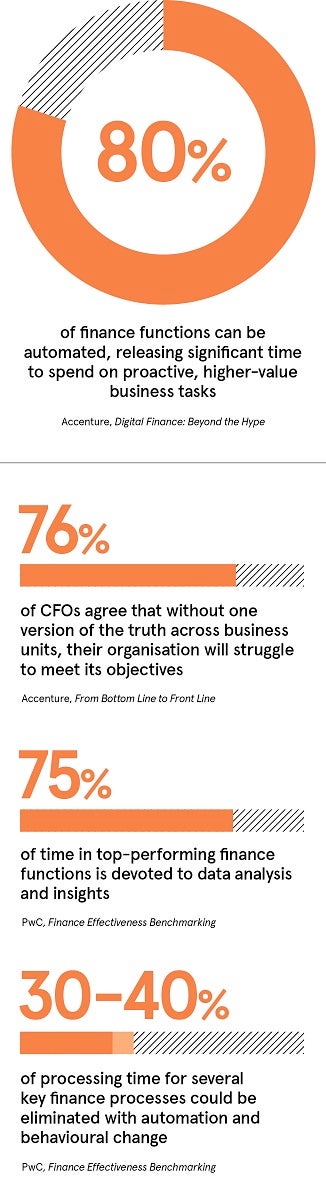

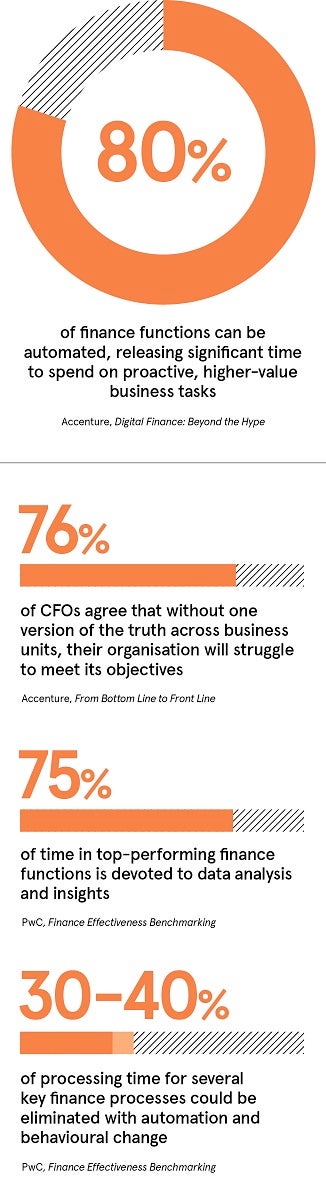

“It doesn’t matter how fast your front end or back end is working, if it takes a quarter to close a quarter, how will you ever get the time to look at the future?” says Mr Suddards. Research by Accenture, in Digital Finance: Beyond the Hype, estimates 80 per cent of finance functions can be automated, releasing significant time to spend on proactive, higher-value business tasks.

According to Forrester’s The Vision Report of the Insights-Driven Business Playbook, forward-looking and insight-driven organisations are growing up to eight times faster than their peers, creating a golden opportunity for CFOs. Digitising the finance function will give them more strategic foresight by using financial data as an asset to impact revenue, profit and other core key performance indicators positively.

The digitisation of front-end applications has led to massively increased volumes and types of data transactions. However, finance data is only an organisation’s greatest asset if it can be consolidated, accessed and analysed to provide business insight. A key stumbling block is that data is typically dispersed across multiple systems and often duplicated across countries and regions. These systems tend to be patched together into a general ledger (GL) consisting of spreadsheets and pivot tables.

The manual nature of this process inhibits finance organisations, especially those with vast and complex business structures, from achieving a single version of the truth and datasets that are accurate at any given time.

Most companies retrospectively sift through information from the last month or quarter ahead of a board meeting, before moving on to the next. Those that have expanded through mergers and acquisitions face greater challenges, including a “spaghetti” of patched systems and legacy architecture. This makes it even more difficult for CFOs to achieve visibility of real-time business performance, let alone a future outlook.

By attaining that single version of the truth and applying analytics, CFOs can suddenly become the key strategic adviser businesses need them to be, based on trusted data that instils financial confidence.

They can identify which products are most profitable or whether cash is stuck in certain areas of the balance sheet because they can’t release revenue obligations. They can understand how quickly the business can bring a product to market in different regions based on historical data and current market conditions, as opposed to relying on gut feeling and subjective insights gathered from colleagues.

“CFOs are frustrated because often they know the data is there to empower business decision-making, but they don’t know how to get that data out of their systems in an easy and timely way,” says Mr Suddards. “They still have to do the reporting and governance, and be a guardian of the data, but they also have to move themselves into this proactive place of being a strategic adviser to senior management and the board.”

Successful CFOs have worked out how to drive efficiency and optimisation in the traditional part of their role, which doesn’t go away, and are now looking at how to gain operational intelligence by leveraging their finance, operational and customer data. That means being able to access data and intelligence when and where it is needed, and not just investing compliance budget to tick boxes, but delivering smart compliance to consolidate, automate and drive productivity in the business.

“This provides the agility needed to respond quickly to evolving market conditions,” Mr Suddards adds. “CFOs can really start to generate value from data and turn it into meaningful, deep business insights that drive action. It comes down to simplifying systems and choosing partners that have a clear focus around surfacing the data.”

Aptitude Software provides finance management software that equips CFOs to run their global businesses, forecast decision outcomes and comply with complex regulations. Aptitude solutions help CFOs to achieve smart compliance, with very specific calculation engines that address the relevant regulations, while getting the most business value and return on investment beyond compliance.

Aptitude’s accounting hub has been used by some of the world’s largest companies for more than 15 years. Its rich subledger simplifies the most complex of finance architectures, creating a single view of finance, a highly granular data foundation for analytics and a launch pad for digital finance. It becomes the “fat ledger” of the organisation, removing the requirement for multiple GLs, taking pressure of the GLs that exist as well as enabling cloud GL migration. It empowers finance teams by removing their manual, backwards-looking tasks so they can do more value-add tasks.

“We focus solely on giving the office of the CFO the ability to really scale and manage their data,” says Mr Suddards. “Our number-one priority is creating financial certainty for our clients. That isn’t something you do just once. It’s on an ongoing basis where at any one point you know the data on which you make decisions is sound and drives competitive advantage.

“It allows businesses to make clear and calculated investment decisions and is key to the CFO’s ability to provide the controlled agility and future readiness that boards need to keep up in the fast-moving digital landscape.”

For more information please visit aptitudesoftware.com