Tax rules are updated daily around the world, which means getting purchase orders and invoices right the first time is far from straightforward. It presents a serious challenge to businesses of all sizes attempting to transact in different locations, but it also offers an opportunity to develop favoured buying relationships by getting the process consistently right.

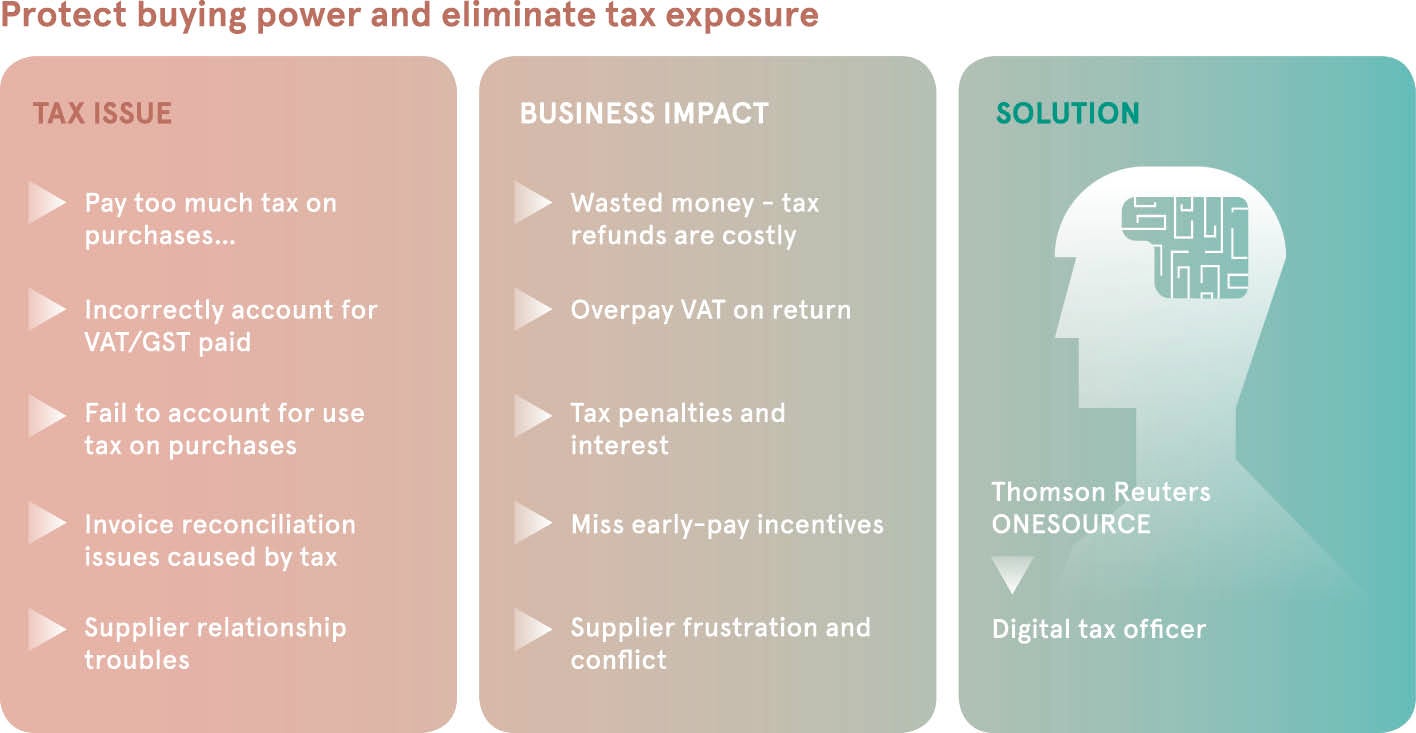

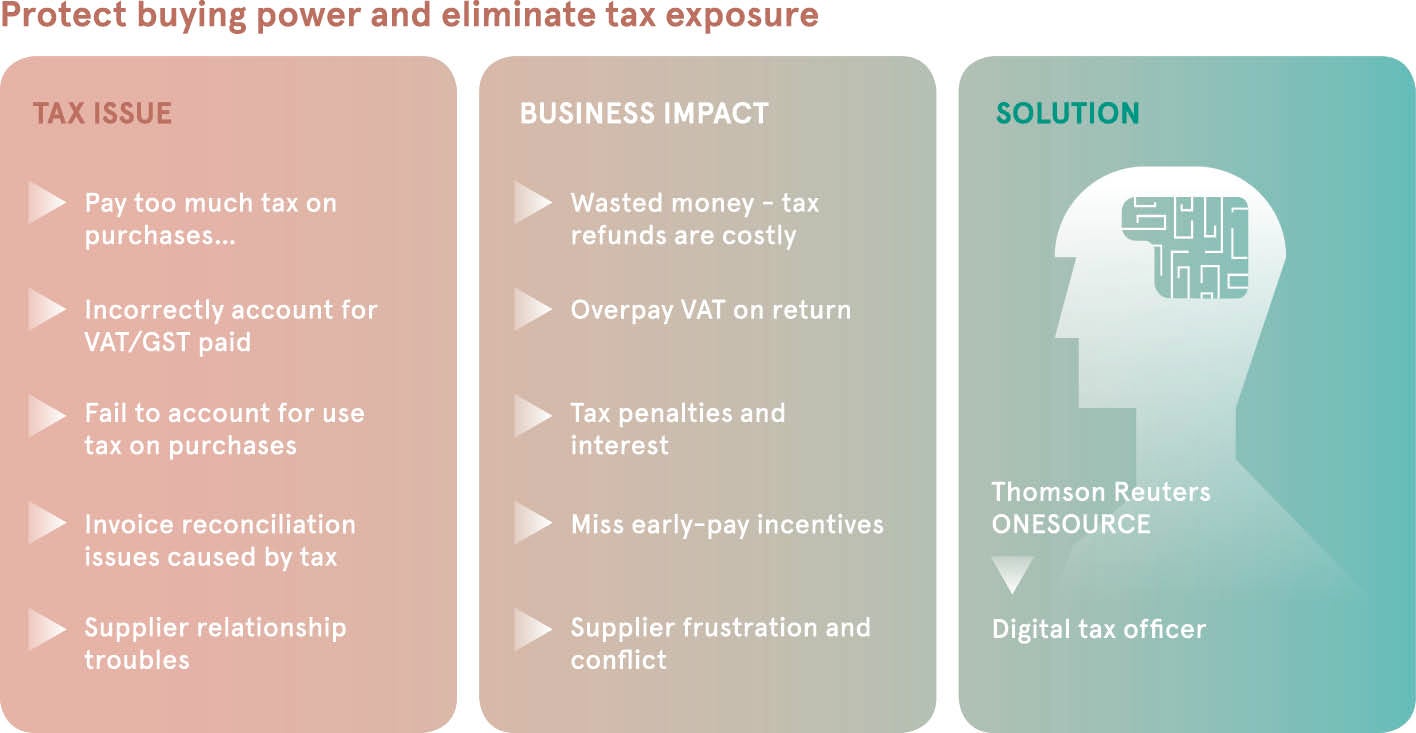

In procurement, many departments aim to address the issue by manually keeping track of changing legislation in different parts of the world and then applying the rules to their purchase orders. But they regularly need to speak with sellers to correct tax on problematic invoices. Finding themselves over or underbilled for tax causes frustration with suppliers, aside from potential financial problems, so there is a strong incentive for buyers to ensure things are right from the start.

The latest systems help by monitoring changes to tax regulations in real time and feeding directly into procurement technology. These services enable users to get closer to optimal invoicing, saving time and money while improving relationships.

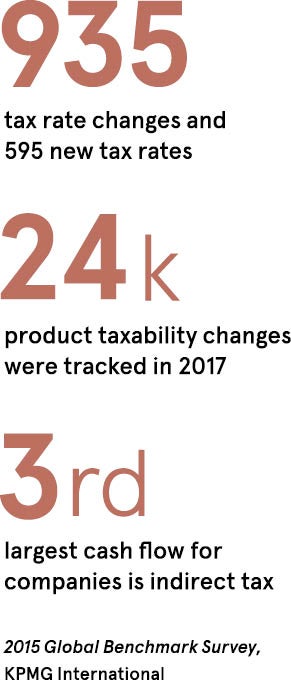

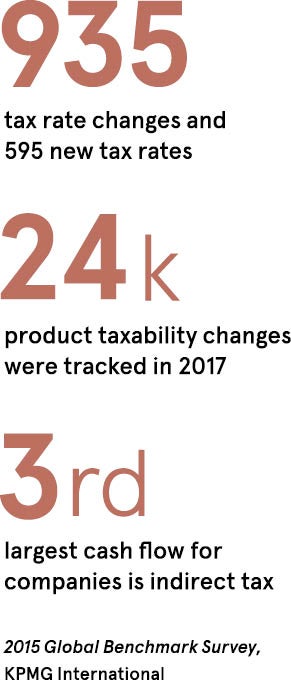

“Governments around the world hold both the buyer and seller responsible for tax, and last year there were over 5,000 tax changes across 15,000 jurisdictions in the US alone. New technology helps businesses avoid the burden of manually checking thousands of shifting regulations,” explains Chris Carlstead, managing director of global indirect tax at Thomson Reuters.

The company’s ONESOURCE system automatically applies current taxes to businesses’ purchase orders and invoices, reflecting buying and selling locations, product or service type, and usage.

“When companies get tax right they remove a big problem between the buyer and seller, and ultimately improve the relationship,” he adds. “They also help the bottom line by minimising time spent on invoice calculations and discrepancies, as well as eliminating ‘VAT leakage’ in which value added tax paid is inaccurately reclaimed.”

Getting tax right begins at the point of order. While it remains essential that suppliers invoice correctly, it is even more important that buyers start the process off well, getting ahead of the game by including the right information.

“For the whole buying process, having accurate tax and usage information on purchase orders means making the right start,” says Mr Carlstead. “By including the right tax calculation on the purchase order, businesses avoid a lot of discrepancies later on and make reconciling much easier.”

The complexity of tax is evident in many national and local examples. In Brazil, regulations present particular difficulties because of the need for real-time tax reporting and payment at the moment of purchase, a revolutionary approach to tax that causes a headache for many firms. In India, a huge change is being made to sales tax, shifting from VAT to goods and services tax, transforming the processes required.

Meanwhile, for the six Middle Eastern countries that make up the Gulf Co-operation Council, VAT is in the process of being gradually phased in from a well-known zero tax baseline. Then there is the ongoing case of ecommerce firm Wayfair, heard in US courts, about if and how online sellers should collect tax for remote purchases.

This complicated environment is prompting a shift in the way buyers approach procurement, especially as the use of ecommerce is opening many firms to broader geographic sales. “You can be a ‘mom and pop’ store selling shoes, and one day you’re in one location somewhere in the world; the next day you’re selling digitally and you’re not only selling all over the world, but you’re also able to purchase your supplies globally,” says Mr Carlstead. “You are then faced with an array of tax rules you have to get right.

“For many companies, the more places they operate, the higher the probability of having errors on invoices, and this is why many are moving to automate the entire process.”

Software business Adobe, which operates globally, is one firm that faced a challenge of tax process inefficiency. The company transformed its tax processes with ONESOURCE, saving more than $1 million annually through process improvement and automation, and through cutting custom enterprise resource planning (ERP) system code by 95 per cent. It slashed tax return times from two weeks to thirty minutes.

The Thomson Reuters ONESOURCE platform is constantly updated with the latest regulation in 190 countries, and last year tracked 24,000 product and service taxability changes. It integrates with procurement systems, such as SAP Ariba, as well as ERP technology. “By having the latest regulation automatically updated, companies can be sure they no longer have to manually keep pace with those complex tax structures, and they can focus instead on efficiency and good business,” says Mr Carlstead.

The Thomson Reuters ONESOURCE platform is constantly updated with the latest regulation in 190 countries, and last year tracked 24,000 product and service taxability changes

Of course for some businesses, the motivating factor will remain fear of a fine or reputational damage for underpaying tax or concerns of ruined client relationships after disputes over too much tax. But many are beginning to focus on the new opportunity instead. Professionals in procurement and their suppliers can get tax right as a core part of developing better supply chain relationships.

“It’s understandable that businesses don’t want to be issued with big fines or to face a reputational hit, but it’s interesting that so many more now recognise that getting tax right is a big strategic opportunity allowing them to have much closer supply chain relationships,” says Mr Carlstead. “Procurement departments are well aware of the common problems with tax on invoices and they see proper purchasing processes as a key answer.”

Automating tax calculation, enabled by real-time information, is enabling businesses to get their payments right the first time and every time. Success here is not only good business, but also a proactive means of solving problems, enhancing relationships between buyers and sellers in multiple countries.

To find out how to automate tax on purchase orders and invoices please visit http://onesourceindirecttax.com