Patience seems to be an increasingly precious commodity in today’s investment world. Globalisation means a constantly changing environment, with fund managers now expected to beat the market not just year to year, but on a day-to-day basis. This puts them under increasing pressure to justify their existence and any misjudgments made in haste can be amplified over time.

The short-term fixation is most clearly evidenced in average holding periods. Back in the 1960s, a stock listed on the New York Stock Exchange would be held by its owner for an average of eight years before being sold. Now, according to Business Insider, that average stands at just five days. With stocks being traded at such velocity, the concept of buy and hold appears old-fashioned by comparison. Moreover, the race to beat the market or outperform competitors is arguably reaching the point where the long-term interests of investors are secondary.

Short-term thinking presents problems

While much of this trend can be attributed to high-frequency trading and the more widespread use of exchange-traded funds, high portfolio turnover is unlikely to deliver better returns for long-term investors, especially those investing for retirement.

By their very nature, pensions should be focused on the longer term, with returns based on a time horizon of ten, twenty or thirty-plus years. But with the rest of the market adopting a short-term methodology, the concept of time arbitrage – delivering outperformance by investing on a longer horizon than the rest – is proving increasingly difficult. More worryingly, short-termism doesn’t immunise investors against downturns, market shocks and negative trends.

Long-term investors need risk management now more than ever

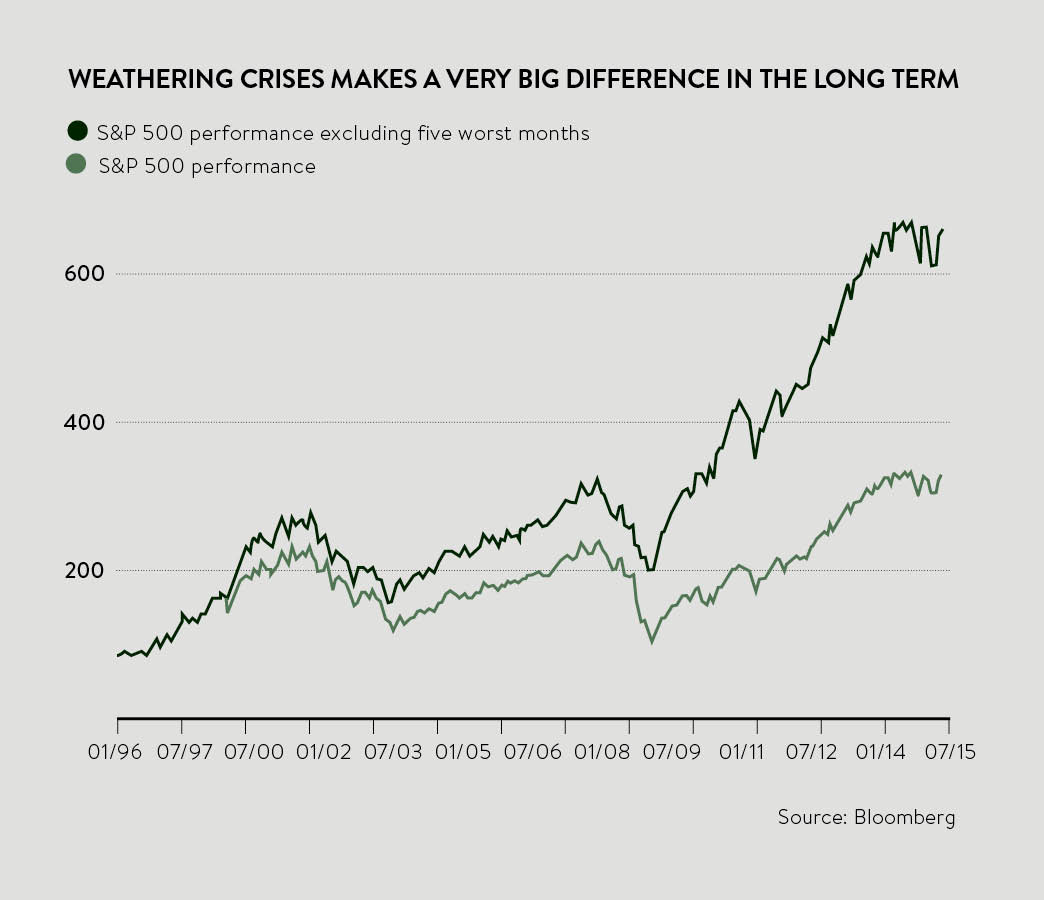

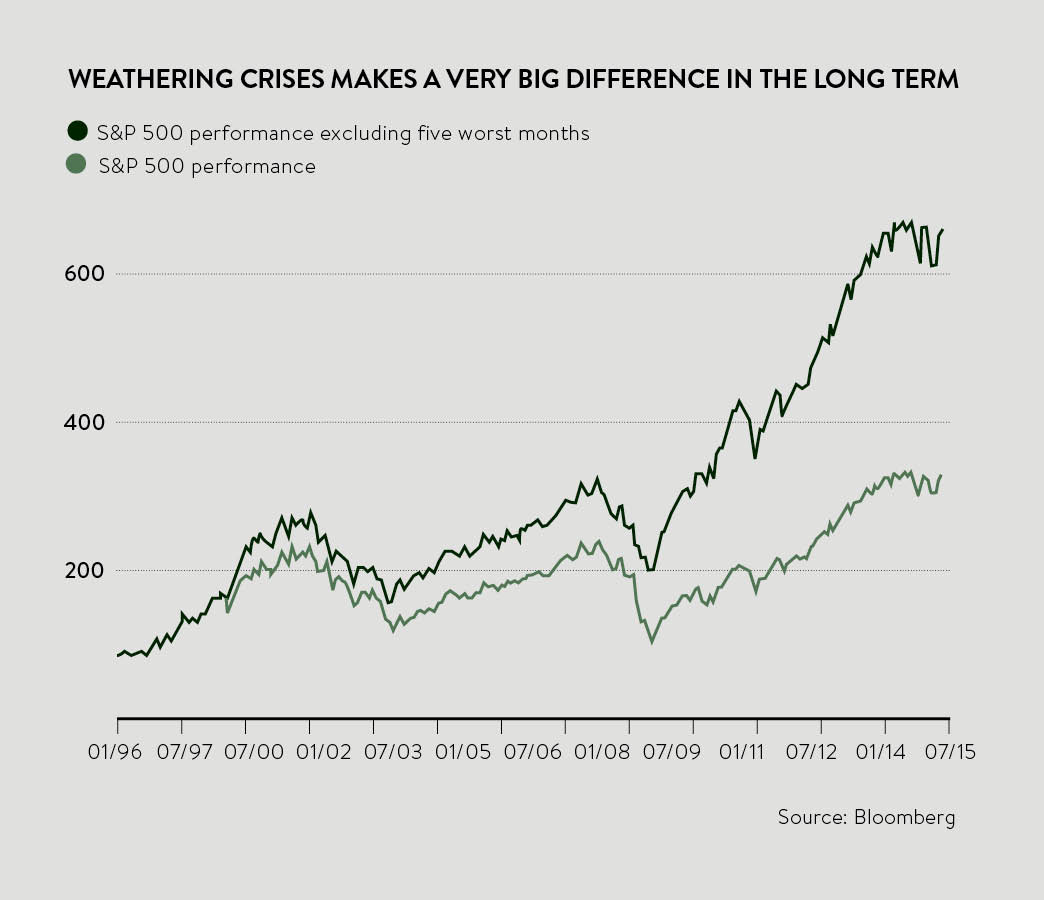

Empirical evidence suggests that knowing when to take risk off the table is a valuable insight that can have a dramatic impact on long-term returns. The chart shows the returns of the S&P 500 over the past 20 years and what happens if you exclude the worst five months. Only skilful active management based on a clear understanding of risk can help investors benefit from multiple small “up” days, while reducing the potential for the most destructive “down” days.

Resisting the temptation of short-termism

It sounds obvious that investors looking for a comfortable retirement should be focusing on long-term outcomes instead of short-term gains, but this proves harder to accomplish if your investment manager is preoccupied with beating their benchmark daily. To combat this, it’s worth considering an investment manager who is capable of seeing the investment world differently and has the conviction to take a fundamentally distinctive approach. Above all, it requires a manager who recognises that the real driver of long-term returns is the ability to manage risk successfully.

The good news is that such an investment house exists, one that has been building its reputation over the past 27 years and is now one of the most established investment companies in Europe.

Introducing Carmignac

Didier Saint Georges Managing director and member of the investment committee

Launched in 1989, Carmignac is an independent, employee-owned global asset manager with more than €50 billion in funds under management. Carmignac has pioneered a balanced multi-asset approach aimed at satisfying the long-term needs of investors. It seeks performance based on superior fund selection from within global equity, global fixed income, emerging markets, corporate credit and commodities.

From the beginning, Carmignac’s priority has been to interpret the macro-economic environment. Its portfolio managers believe long-term investment returns can only be achieved by successfully managing risk. This requires a clear understanding of how core issues such as inflation, unemployment, interest rates and economic growth drive the performance of global markets.

Through the performance of its portfolios, Carmignac has also demonstrated it knows when to act in the best interests of investors by taking risk off the table through cost-effective use of derivatives and modern portfolio management techniques.

[embed_related]

Carmignac Patrimoine: a long-term solution for retirement savings

Carmignac’s pioneering risk management approach is brought to the fore with Carmignac Patrimoine, a fund that invests across global equity, fixed income and currency markets. In English, the closest translation of “patrimoine” would be heritage. It’s a name that neatly encapsulates Carmignac’s investment philosophy.

Carmignac Patrimoine is unconstrained by index composition. The intention is to ensure investors can sidestep future market shocks, while continuing to benefit from long-term “top-down” investment themes, and superior “bottom-up” stock and bond selection. This approach allows portfolio managers to construct an aggregated portfolio greater than the sum of its parts.

Carmignac’s pioneering risk management approach is brought to the fore with Carmignac Patrimoine, a fund that invests across global equity, fixed income and currency markets

Carmignac’s unique insights into the macro-economic environment give Carmignac Patrimoine a clear edge. The portfolio managers can manage risk by determining long-term investment themes and making tactical asset allocation decisions, with the objective of ultimately, through the power of compounding, convert them into superior long-term returns.

Not only does Carmignac Patrimoine offer a solution for those investors still at the wealth-accumulation phase of their retirement plans, but it also aims to preserve capital during those periods of major market drawdowns that can be so destructive to long-term investments. As the old adage goes, past performance is not a guarantee of future results and all funds may present a risk of loss of capital. That said, the fund has only experienced three down years in its 27-year history. Essentially, since inception, Carmignac Patrimoine’s investment approach has adapted gradually to respond to changing market conditions. More recently, portfolio performance has been enhanced through expertise in low-volatility and absolute-return strategies.

Investing with an eye on the long term

Thanks to its global approach, flexible investment strategy and active management, Carmignac Patrimoine has established itself as an investment vehicle well suited for pensions and retirement strategies where long-term returns are paramount.

Since 1989, the concept of Patrimoine has helped Carmignac to foster a culture of long-term wealth planning, based on a more rational and sustainable way of achieving robust performance. In an era where short-termism runs the risk of leading to disappointing returns, investors may want to talk to their financial or pensions adviser about Carmignac, whose belief in heritage and long-term outcomes presents a refreshing alternative.

For more information talk to your financial adviser or visit www.carmignac.co.uk

Promotional material prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg, and distributed in the UK by Carmignac Gestion Luxembourg UK Branch (registered in England and Wales, FC031103, authorised by the CSSF). It does not constitute a subscription offer or investment advice. Risks and fees of the French FCP Carmignac Patrimoine are described in the Key Investor Information Document, which must be made available to the subscriber prior to subscription. The prospectus, NAV, KIIDs and annual reports are available in English at the facilities agent BNP PARIBAS SECURITIES SERVICES, 55 Moorgate, London EC2R or www.carmignac.co.uk

Short-term thinking presents problems