As economic confidence continues to return, companies around the UK are looking to replace equipment and to invest in new technology, having put the process on hold over the last six to seven years.

The correct financing solution can have a significant impact on an organisation’s success, providing the liquidity needed to grow, adapt, make acquisitions or simply help to manage day-to-day business requirements. More businesses are now aware that there is a range of financing solutions available to them and as a result many forward-thinking companies are looking at alternative forms of funding.

Two particular examples that are attracting growing interest are asset financing and invoice financing, both of which are flexible, cost-effective opportunities for businesses to realise working capital and which enable borrowing for investment.

QUICK GUIDE

Asset financing

In its simplest form, asset finance is a loan that is used to purchase tangible assets. These assets can be anything from vehicles, agricultural equipment, plant and machinery, IT to boats and planes.

Asset finance provides a resource over and above your normal banking facility, and as such is a useful additional source of funding that provides significant cash flow and tax benefits for businesses looking to purchase a new piece of equipment, a vehicle or other fixed assets.

Invoice financing

This is an umbrella term covering a number of products, such as factoring, invoice discounting and asset based lending. The latter, not to be confused with asset finance, enables businesses to borrow against the value of their trade receivables and inventory, such as raw materials, finished goods or both, as well as other balance sheet assets to finance the working capital they need.

GROWING AWARENESS

It might be a well-established form of financing, but in recent years asset finance has grown significantly as more and more companies have become aware of the benefits offered by this flexible, cost-effective, risk-managed form of financing.

Figures released by the Finance & Leasing Association show that in 2014 new asset finance business grew by 13 per cent to £25.4 billion, the strongest rate of growth in at least seven years, while plant and machinery finance grew by 48 per cent in December 2014 compared with the same period the previous year.

Asset finance has grown because of its simplicity and flexibility as a funding method for equipment as diverse as office furniture to biomass boilers

“Asset finance, along with other forms of finance, such as peer-to-peer and invoice finance, have all grown in popularity as businesses have looked to find alternative methods of funding to the traditional bank loan, and also to provide solutions to specific funding requirements. Asset finance in particular has grown because of its simplicity and flexibility as a funding method for equipment as diverse as office furniture to biomass boilers,” says Neil Lloyd, head of sales development at leading asset finance provider Lombard.

“The simplicity and flexibility of asset finance mean that it’s suitable for all types of business, from buying their first vehicle, to PLCs investing in new IT architecture. The reason for this, other than possible tax benefits and the ability to budget more easily, is that on most occasions the asset is our security, which makes asset finance very accessible as a form of funding. Commonly funded assets include vehicles, plant and machinery, and IT.”

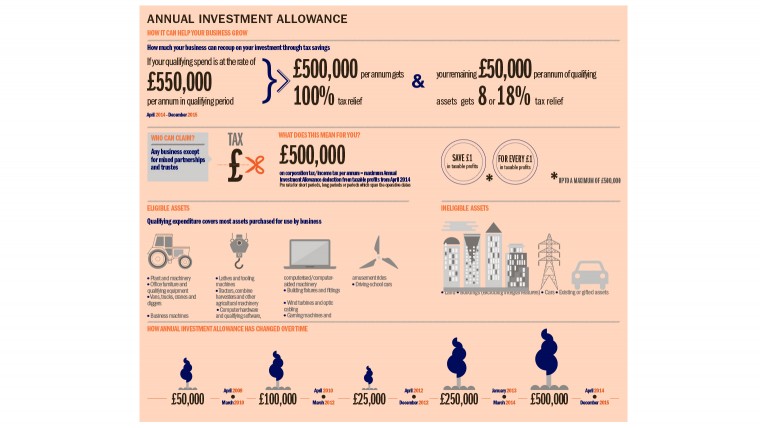

The benefits afforded to manufacturing companies in particular by asset financing have been enhanced by an increase in the annual investment allowance (AIA). Many companies are still unaware of this form of capital tax relief that offers a 100 per cent allowance on qualifying capital expenditure in the year of purchase. The AIA limit increased temporarily from £250,000 to £500,000 a year with effect from April 1, 2014 for companies and from April 6, 2014 for sole traders and partnerships, having already been increased from its original level of £25,000.

However, the time-limited increase is due to end on December 31, 2015 and at present there is no indication whether this will continue or revert to a lower allowance. This date might seem some time off, but given that the amount of tax that can be offset is calculated for each accounting year and that acquiring new equipment is rarely a speedy process, companies need to plan ahead and consult their accountants or financial advisers to get guidance on how they can best benefit from the increased allowance.

As awareness of the benefits of asset finance grows in all sectors, it’s important for a provider to have a proper understanding of the company that it’s working with, whatever its business might be. As well as its 150-year heritage, Lombard finds that clients, especially those who are new to asset finance, appreciate the detailed knowledge of its team of more than 300 relationship managers based across the UK.

Lombard has dedicated teams working in technology, agriculture, commercial transport and green energy, and also has manufacturing specialists, who understand the particular requirements of funding in these areas. For example, the green energy team are able help customers looking for an effective way of funding renewable energy and are knowledgeable about the government initiatives available and how to apply for programmes such as the Renewable Heat Incentive scheme.

“Our relationship teams are well educated across a range of business skills and are accredited each year by Chartered Banker, the only professional banking institute in the UK, meaning our customers can have confidence in what our relationship managers say. It is also very much in line with our ethos of taking time to understand our customers’ needs, both current and future, in order to better serve these needs,” says Mr Lloyd.

With asset finance firmly on the radar of more and more companies, what advice would Lombard give to a business thinking of joining this trend? “First, make your accountants your first port of call,” Mr Lloyd says. “They should be able to advise you on which asset finance product is best suited for your needs and put you in touch with an asset finance provider. Then get your funder involved at an early stage of the buying cycle. Doing this will ensure they work with you and the supplier of your asset to put in place a funding solution that is right for you.”

ASSET FINANCING PROVIDES A FLEXIBLE SOLUTION

Devon-based Hymid Multi-Shot Limited, one of a handful of specialist manufacturers of two-shot plastic injection moulding in the UK, was looking to fund increased capacity. It turned to Lombard for asset finance that offered the financial flexibility which enabled the business to acquire the new equipment it need straightaway and to make the investment without impacting on its cash flow.

“We have worked with Lombard for many years and asset finance is an established and proven product for us,” says Tom McMurtrie, managing director of Hymid Multi-Shot. “It provides a flexible solution that enables us not only to invest in the latest technology, but also to free up cash so that we can raise the technical capabilities of our staff. The combination of efficient systems and well-trained staff means we can pursue our overall growth strategy, and ultimately plan for the long term to ensure Hymid continues to achieve and perform in a competitive market.”

INVOICE FINANCING SUPPORTS ASSET FINANCE

Once a company has secured the capital expenditure spend on new assets with asset finance, how can it finance the growth in revenues these assets will bring? Particularly when the increased sales made on the back of these assets take some time to turn into cash and this gap needs to be bridged by some kind of finance. Growing businesses quite often won’t have the internal capital to do this nor to purchase raw material and finance the conversion cycle of these assets into cash.

The answer could be asset based lending which allows companies to accelerate payments against outstanding invoices and also to finance the inventories they need to hold.

Advocates of alternative forms of financing include former trade and investment minister and former director-general of the CBI Lord Digby Jones. “I’m very, very keen on getting more companies to stop looking to their bank for an overdraft,” he says. “Look to your bank for using your invoices and using your debtors. Go to a company that will lend you money on your invoices and manage your invoices… then you can look at a different way of financing.”

“Manufacturing companies in particular can experience extreme seasonal fluctuation in orders and payment, but they still have to run plant, upgrade technology and invest in new materials and inventory all year round,” says Mirka Skrzypczak, head of product and client proposition at RBS Invoice Finance, one of the largest invoice finance and asset based lending companies in the UK. This form of finance helps bring stability to this cycle through access to working capital.

“Invoice finance improves the cash conversion cycle of a business and provides access to cash quicker than debtors pay which in turn allows having bargaining powers with suppliers,” she says.

Christopher Hawes, RBS director of UK Corporate Asset Based Lending, adds: “The availability of working capital is an issue faced by most, if not all, businesses. Asset based lending is a cost-effective alternative for companies to increase working capital without having to slow business growth or raise equity.”

BOOSTING INTERNATIONAL EXPANSION

James Briggs, a producer of manufacturing products including paints, lubricants, cleaning fluids and polishes for the automotive, industrial and hygiene sectors, recently secured a £9-million working capital facility with RBS Invoice Finance.

The business, which has a turnover of £50 million and 200 staff, was backed by private equity investor Endless LLP in a management buy-out in 2013 and has been focussed on further expansion.

“The funding from RBS Invoice Finance will allow the business to pursue opportunities in new territories and new sectors which provide a hugely exciting future for the business,” says Ian Plumb of Endless.

To find out more about how Lombard can help you finance eligible assets call 0800 502402

Security may be required. Product fees may apply