Enhancing employee benefits and involving multiple stakeholders in corporate purchasing and programme design could be key to reducing business risk arising from staff health issues, according to new research.

Members of the employee benefits team at global insurance broker Lockton began work on the project following a survey of business risks arising from mental health issues in the workplace.

This latest piece of research found that the traditional approach to buying employee benefits through human resources (HR) departments alone could be done better through a cross-departmental consensus involving HR, corporate risk, occupational health, finance and legal teams.

Chris Rofe, senior vice president of employee benefits at Lockton, explains: “Risk managers view life differently, so you could mitigate exposure for employer’s liability claims and potentially reduce the number of employee disputes and tribunals. There might also be a knock-on effect to the cost of health and safety liabilities.

“Because all of these services have traditionally been bought in silos, you don’t get any congruence. Bringing a risk manager into the room to look at your greatest asset – the workforce – can give a business a huge advantage.”

The risks arising from employee wellbeing can range from slight to extreme, says Mr Rofe. His comments follow a Lockton report of FTSE 100 companies that looked at which companies offered mental health support to employees, and the implications for the workforce and the business.

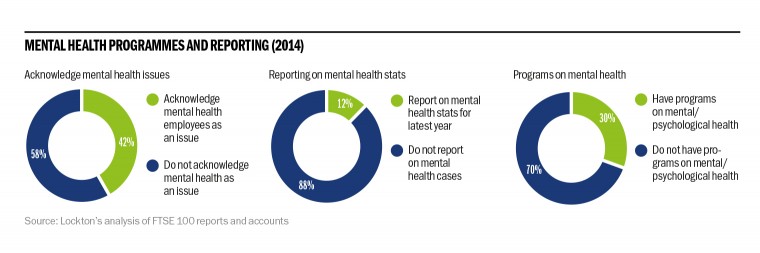

It found that only 42 per cent of FTSE 100 companies recognise mental health as an issue in its own right, while just 30 per cent have programmes that are targeted at the mental health of their workforce.

Mr Rofe says this is an example of where business risk could be significantly reduced, at the same time simultaneously improving the working lives of employees and their families.

“Our industry is awful about comparing ‘return on investment’ or ROI. New initiatives are often justified by all too simple ROI calculations with a focus on short-term savings,” he says. “Understanding the complex interaction of employee health and wellbeing to key business processes and linking target outcomes to quantified business objectives is a far better measure.”

Mr Rofe says that if businesses are truly to reduce the risk in the business, they need to improve their policies and procedures beyond pure corporate social responsibility projects.

“Chief financial officers have to take a leap of faith. You have to mine large and disparate data sets, and get your insights from many, many sources – exit interviews, days lost through absence, customer service scores, and so on,” he says.

“Set that against the possibility to trim insurance costs, improved productivity, improved engagement and ultimately improved profits.”

The Organisation for Economic Co-operation and Development Policy Framework published in March 2015 estimated that 20 per cent of the working population are experiencing some kind of mental health issue at any one time.

The statistics are even more frightening when you consider that half of all workers will suffer a period of poor mental health during their lifetime.

A UK government survey of mental illness in the workplace, conducted in 2013, suggested that industry could be losing up to £100 billion a year because of unresolved mental illness issues in the workforce.

Insurer Legal & General recently announced that it had started work with the charity Business in the Community to consider what the company can do to assess the mental wellbeing of its workforce.

Chief executive Dr Nigel Wilson has been well publicised in encouraging other business leaders to seize the initiative. “What gets measured gets managed,” he says.

So why has mental illness not received more attention from senior executives? Mr Rofe believes it could be due to the fact that the healthcare industry has historically focused on other ailments.

There is so much that employers can do around emotional support, signposting of services and guidance on what is appropriate

“The key drivers of claim costs and inflation on private medical insurance premiums are normally muscular-skeletal, cancer, cardiac and mental illness. Over the years, cancer has received the greatest focus due to significant advancements in treatment and resultant cost implications,” he says.

“Muscular-skeletal has had a lot of work going on for better signposting and better prevention, and cardiac has also benefitted from a lot of focus in the press linked with obesity and lifestyle issues.

“Mental illness is a tough one to tackle. Line managers are fearful of getting involved in mental illness cases. They may lack adequate training on how best to support their employees; they may not know what questions to ask or how to deal with the answers. There is a fear of causing offence or doing the wrong thing.”

Incredibly, this remains the case, despite the Chartered Institute for Personnel Development reporting in 2015 that around 40 per cent of organisations have witnessed an increase in reported mental health problems over the past year.

The findings are “shocking”, says Mr Rofe. “There is so much that employers can do around emotional support, signposting of services and guidance on what is appropriate,” he says.

“With little risk and cost, employers can do so much more to support the emotional resilience of their people, whether it’s to reduce the chance of their employees making the wrong business decisions, preventing long-term sickness or more serious incidents.”

There are some positives, however. The Lockton survey did find that four FTSE 100 companies have made leaps forward in assisting employees with mental health concerns. GlaxoSmithKline, Royal Mail, WPP and Reed Elsevier reported mental health statistics in 2014. The hope now is that many more follow in their footsteps for the benefit of both the business and the workforce.