It might sometimes feel like every day some artificial intelligence, big data-powered bot is eating your business one digital bite at a time.

Digital disruption has created change at an unprecedented rate in the retail and financial sectors. According to the Deloitte Retail Volatility Index, since 2009-10 the top 25 retailers, excluding Amazon, have lost 0.9 per cent of their combined concentrated market share, equating to $41 billion in retail sales in 2015. That’s $41 billion of sales lost in the space of five years.

Paul Johnston Group director of strategy and growth The Qubix Group

The same Deloitte research estimates that $200 billion more of retail sales is being taken from traditional retailers by digital-savvy firms such as Amazon. You only have to look at Walmart’s recent acquisition of jet.com for further evidence of the industry redefinition taking place. Walmart is paying $3 billion in cash, plus $300 million in stock for key jet.com executives, for an online shopping business that has been live for a little over a year.

But it’s not only retailers that are being eaten by digital. Many boardrooms in the banking and financial services industry are wondering if they still have a sustainable business model. The fintech disruption trend is completely upending a trillion-dollar industry and changing the fundamental premise of how people think about every aspect of their financial journey.

Paul Johnston, group director, strategy and growth at The Qubix Group, provider of business intelligence and big data solutions to many of the world’s largest organisations, says: “Many of these businesses are completely unprepared to react to the disruptive forces preying on them. Or frankly they are ill-equipped to find a way forward that doesn’t end in their more digital-savvy competition winning.”

So if you’re a member of the executive team at a retailer or financial services business trying to survive, what can you do, what are the bold strokes besides buying in talent and platforms? How do you create your own unfair digital advantage?

So if you’re a member of the executive team at a retailer or financial services business trying to survive, what can you do, what are the bold strokes besides buying in talent and platforms? How do you create your own unfair digital advantage?

“Banks and retailers have unprecedented volumes of data locked away in various silos,” says Mr Johnston. “Finance has high-quality business-model insight; marketing holds weblogs and campaign analytics; IT will have rich data, such as point-of-sale feeds; and then there might be credit and loyalty card transactions, returns data, basket analysis, social media monitoring – the list goes on.”

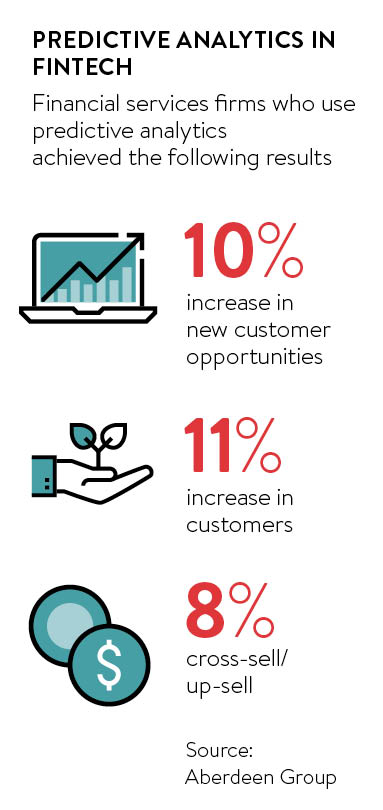

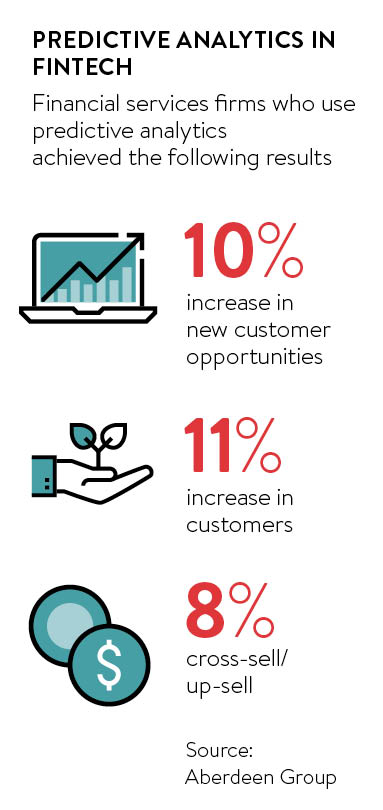

But he says: “Without adopting predictive analytics, the executive suite has a rear-mirror view of what has already happened. It’s the wrong focus. Leaders today need to drive the business looking forward by getting answers to questions like what can we do to increase sales next week by 5 per cent and what’s the probability of success? In the digital age, prediction will create their unfair advantage.”

One of the bold strokes retailers can make, Mr Johnston suggests, is to organise their processes to optimise the insights they can gain from the flow of data through their business. “This requires

executives to view the business not just in the traditional manner of stores, product categories or customer segments, but as rivers of data flowing that can be captured and turned into a powerful source of actionable insight as quickly as possible.”

It’s not easy. Mr Johnston believes that many businesses have the wrong analytics approach with results taking too long, costing too much and with teams who don’t have the digital DNA required. “The need to create change and bring in a digital DNA was I’m sure part of the Walmart justification to spend a tidy $3 billion,” he says.

Companies need to start operating as “predictive enterprises”. Mr Johnston says: “Moving beyond just business intelligence, which can be a rear-view mirror of past performance, to mastering the field of predictive analytics will drive more profitable decisions and business forward in an entirely new way.”

[embed_related]

Predictive analytics uses many techniques, such as data-mining, machine-learning, modelling and artificial intelligence, to analyse current data to make more accurate predictions of future outcomes.

Becoming a predictive enterprise, by thinking fully digitally, is the only way to create a sustainable unfair advantage, says Mr Johnston. “With improved prediction comes a better return on investment, and an increase in the probability of additional sales, of more satisfied customers and of better-fit employees,” he says.

Ultimately, the sustainability of a business will depend on how accurate its predictive capabilities become and how fast it moves to capitalise

However, it’s not easy orchestrating data streams to build predictive capabilities. It’s well documented that businesses across all industries are having great difficulty building a reliable, accessible, usable set of data for their teams to feed on.

But a successful enterprise will be based on more accurate prediction. Mr Johnston says: “Ultimately, the sustainability of a business will depend on how accurate its predictive capabilities become and how fast it moves to capitalise.”

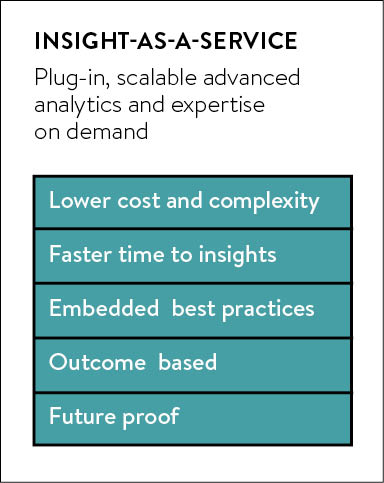

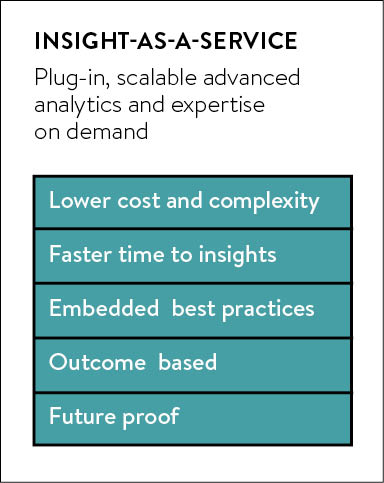

Another strategic challenge is that most vendors don’t really want a shared risk-and-reward relationship with their clients. But companies such as The Qubix Group are changing the paradigm and offering an insights-as-a-service model that is directly tied to financial impact. This new breed of service provider has taken its cue from the software-as-a-service cloud-computing movement and pioneered a new way to deliver data-driven business value as a service faster than is possible with a traditional approach.

In this new model, the provider will design and host a smart compute platform. Businesses simply have to provide access to the raw enterprise data streams needed; the provider then cleans and enriches this with other public data, such as social media feeds, anonymised data, competitive data and comparative data, which the enterprise lacks. An army of data scientists takes over using strategies such as predictive and behavioural analytics to deliver actionable revelations that would otherwise not have been discovered.

In this new model, the provider will design and host a smart compute platform. Businesses simply have to provide access to the raw enterprise data streams needed; the provider then cleans and enriches this with other public data, such as social media feeds, anonymised data, competitive data and comparative data, which the enterprise lacks. An army of data scientists takes over using strategies such as predictive and behavioural analytics to deliver actionable revelations that would otherwise not have been discovered.

Mr Johnston says: “While many businesses are data driven and have big data, this new as-a-service model means the provider can test the insight for value or scale insight-driven action across every part the business in a fraction of the time and cost.”

Simply, analysis has little value if it doesn’t provide meaningful insight. Insight has little value if it doesn’t trigger action. And action has little value unless it’s tied to desirable business outcomes. Insights-as-a-service reflects that logic and, as a result, its purpose is to enable and expedite top-line and bottom-line impacts.

“In the fight back to not be the latest upended business, leaders can now leverage a previously unavailable digital model where the cost of the target outcome is lower, the speed to results is faster and the value of the outcome is higher,” Mr Johnston concludes. “By adopting a different analytics strategy, it is possible to create your own unfair digital advantage.”

For more information please visit www.qubix.com/predict