The window displays in EcoWorld on the north-west end of Singapore’s Orchard Road invite investors to “Explore a New Island” and capture its “Island Energy”. The island in question is the Leamouth Peninsula, a piece of land jutting out into a bend in the Thames, not far from the once – and probably still – unglamorous Canning Town in London’s East End.

Upper middle-class Asian investors, particularly those from Singapore and Hong Kong, have been major contributors to the spike in demand for London property over the past decade. Both city-states’ real estate markets have been overheating for years, as economic growth surged ahead and bumped against the physical constraints of their tiny size. Overseas investors exacerbated the problem. Money from China has flooded in and crowded out locals, who in turn have looked to the UK to invest their ready cash.

Asian banks fuelled the trend with mortgages, and Asian developers took huge positions in London real estate, marketing the property directly to Asian investors with glossy brochures, high-end drinks parties and glamorous shopfronts. London-based developers took roadshows to South-East Asia, setting up stall in high-end shopping malls in Kuala Lumpur, Jakarta and Manila, as well as Singapore’s glitzy Marina Bay.

Falling commodity prices, sanctions and an economic slowdown have dented the ambitions of some of London’s key buyers – Russian, Chinese and West African investors. A 60 per cent fall in the oil price led to a commensurate fall in Russian enquiries, according to estate agents. But the global elite in the rest of the world still wanted in, despite rising taxes and the uncertainty ahead of the referendum on European Union membership.

We’ve been selling quite a lot. Anything from £300,000 to 800,000, that’s what investors like to jump on. Anything above that, the yield’s very low…

Like many in the financial markets, property investors in Asia did not expect that the UK would vote to leave the EU on June 23; when they did there was an immediate sense of panic. United Overseas Bank, Singapore’s third-largest lender, temporarily stopped lending for London property; its rival DBS said that it was advising its borrowers to be cautious.

This is likely to be short-lived, says Richard Levene, director of international properties in Colliers International’s South-East Asia business. “It does slow down [when there is political risk]. But the older people who used to buy London property maybe five years ago, but stopped, are coming back in because the pound is so low… Some developers are offering better discounts,” he says. “We’ve been selling quite a lot. Anything from £300,000 to 800,000, that’s what investors like to jump on. Anything above that, the yield’s very low… that’s the sort of stuff that sells in Singapore or Hong Kong.”

A global asset

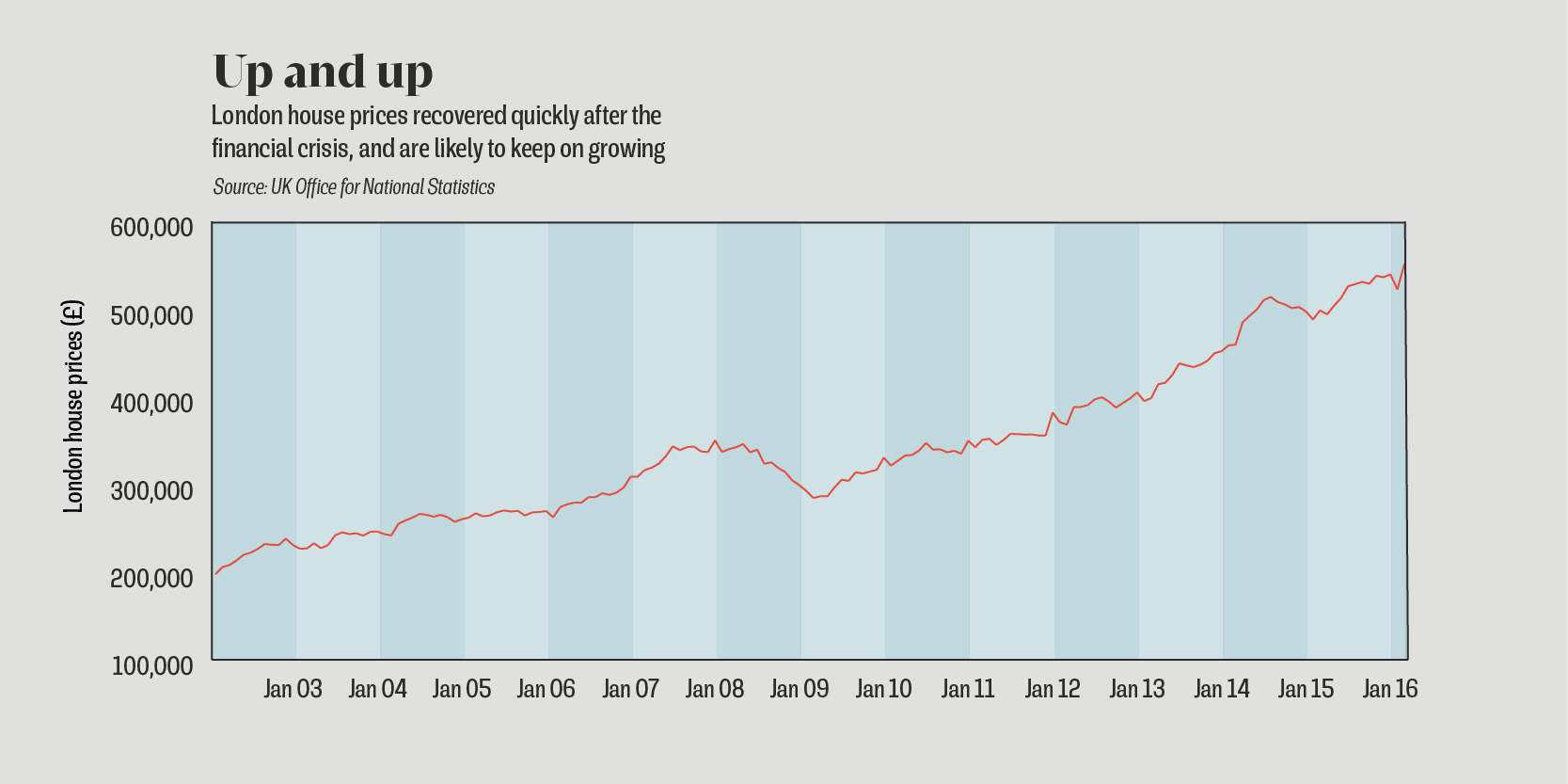

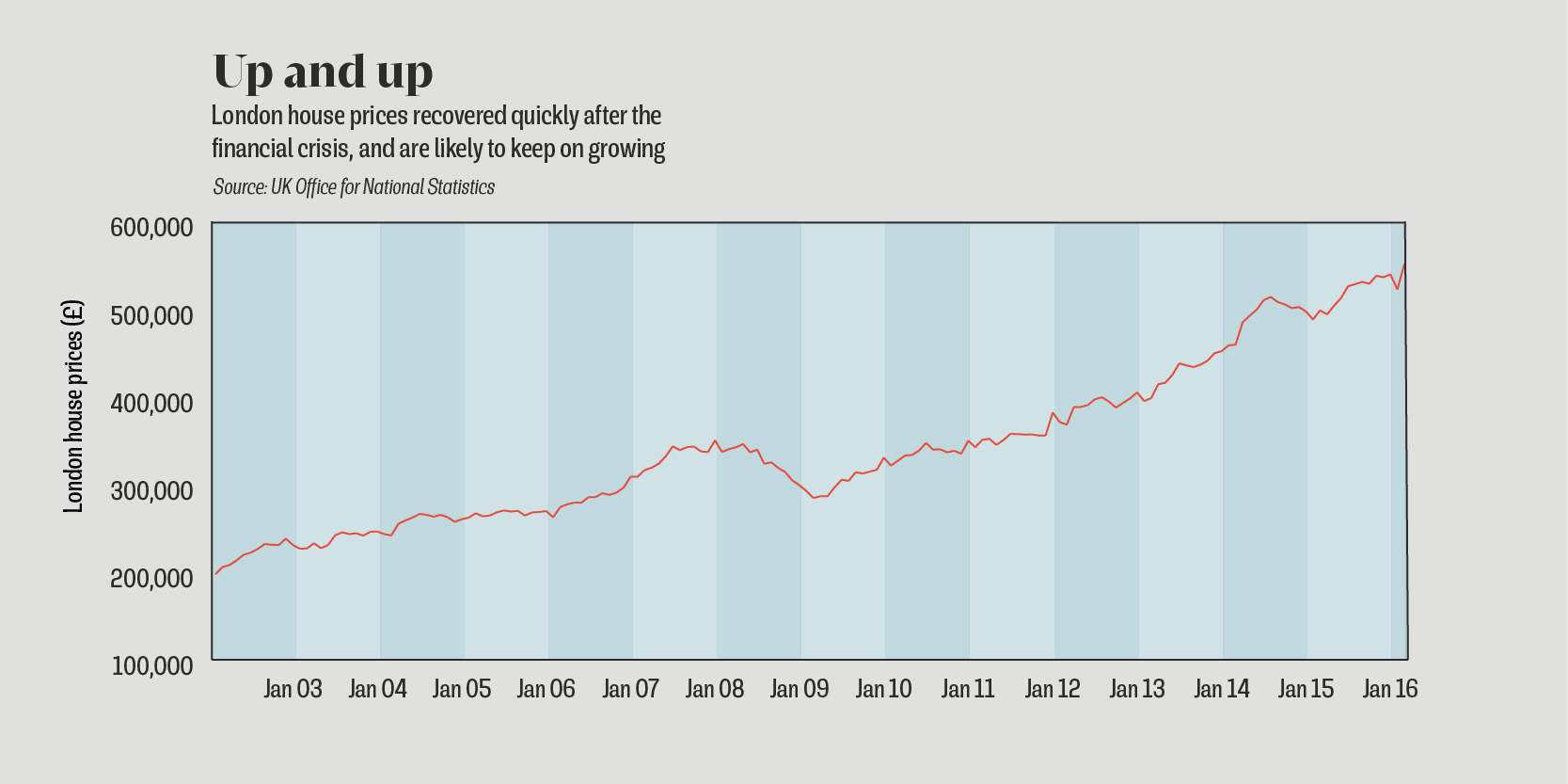

Central London residential property is a global asset, in many ways divorced from what happens in the UK economy. Taxes – such as the increased stamp duty on the upper end of the market – did make a difference to the number of buyers coming in from overseas, but the extraordinary growth in the value of the assets, which has been upwards of 8 per cent per annum for most of the past decade.

Since the referendum, the market looks ripe with bargains, albeit only for those whose assets are not already denominated in sterling. The pound has nosedived since the June 23 vote, falling more than 10 per cent against the US dollar and the Singapore dollar.

That is bringing immediate interest – estate agents say that their phones are ringing off the hook – and property investment companies are quickly revising their forecasts.

“We had assumed that would there be a remain vote and the market would harden… but we thought it might happen in September or maybe even into next year,” says Naomi Heaton, chief executive of London Central Portfolio, a real estate advisory company. “Suddenly, sterling was making properties up to 10 per cent cheaper if you were a dollar-denominated investor.”

The nearest analogue to the post-referendum panic is the 2009 credit crunch, Heaton says. Back then, there was a short-term weakening in the market, which quickly turned around.

“The market did slip against the worst crisis that we’d seen in a generation. Then it rallied, then it surged, and it outperformed any other financial market. That was despite the issues that we were having in the UK and globally. The difference this time is that these are UK-centric issues, not global issues.”

[embed_related]

As in 2009, there will be a bifurcation of the commercial and residential markets. Commercial property is far more exposed to a domestic downturn, as tenants go out of business or scale back. Within days of the referendum vote, several large commercial property funds, representing more than £15 billion in property assets, and including Standard Life, M&G Investments and Aviva Investors, were closed to redemptions – essentially, investors were told they could not take their money out. According to a report in the City A.M. newspaper, Aberdeen Asset Management, which also gated its fund to redemptions, appointed a broker to sell a £150 million property in Oxford Street to cover the demands from its investors.

If, despite interest rates falling, mortgages become more difficult to obtain, which is very likely, there will be a stagnation within the domestic market.

The depth of the crisis may not be as great as the fevered headlines in the financial press suggested – as Heaton says, the funds are taking the precaution of stopping a run on their funds before it gathers pace and forces them into a fire sale – but there could be real pain ahead for the domestic market, which could exacerbate existing divisions and inequalities in the market.

“There will be potential problems, but those will be felt by the Greater London area and the rest of the UK. If there’s a downturn in the economy, if people feel poorer, if people lose their jobs. If, despite interest rates falling, mortgages become more difficult to obtain, which is very likely, there will be a stagnation within the domestic market. It’s not that Brexit isn’t going to have a fallout,” she says.

Greater London house prices have fallen already, according to a number of measures, including the Royal Institute of Chartered Surveyors, which said on July 14 that confidence amongst estate agents was the weakest since the financial crisis.

“The underlying downturn in the economy is clearly going to affect commercial property, it’s clearly going to affect property which is underpinned by the domestic market,” Heaton says. “But what we’ve found is that Central London is largely vaccinated.”

Main photo: Chris Ratcliffe/Bloomberg via Getty Images

A global asset