While chairing the London Market Group, Steve Hearn, articulated a view held by many in insurance that there is a “relentless march of technology and an ever-increasing amount of data”, adding that he was convinced “true specialty insurance business requires an intense exchange of information and cumulative underwriting expertise”.

His comments made two years ago in the influential Boston Consulting Group London Matters report pre-empted the technology revolution in insurance, on the cusp of which the industry stands today. The tools to enable this revolution are in place: efficient distribution through innovative web-based platforms; predictive analytics engines that drive pricing and risk selection; and market data feeds which expand each company’s knowledge beyond their own experience.

No single tool from this insurtech box has the power to transform the market, but together they do. The challenge is linking them through a common language, which will allow insurers to bring all three elements together to empower their expert underwriters.

No single tool from this insurtech box has the power to transform the market, but together they do. The challenge is linking them through a common language, which will allow insurers to bring all three elements together to empower their expert underwriters.

Insurers have shared risk information since the 18th century. But today the vast experience of the insurance sector cannot be harvested for analysis because the market is a modern Babel through its reliance on multiple incompatible data schemas.

No single tool from this insurtech box has the power to transform the market, but together they do

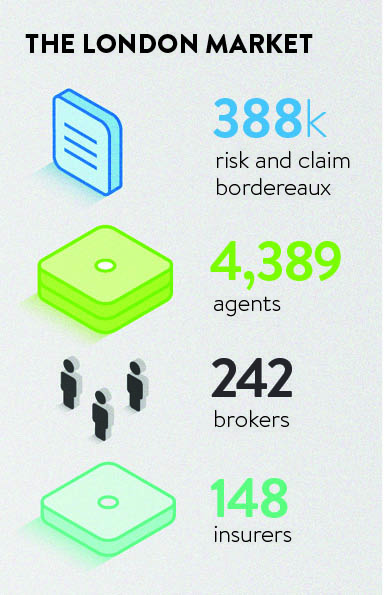

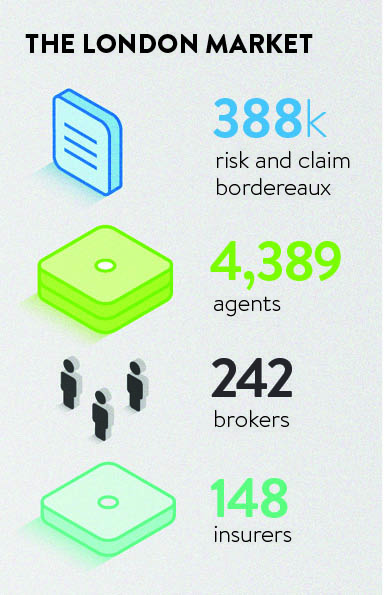

Insurers receive risk data in thousands of incompatible formats with 148 insurers, 4,389 agents and 242 brokers in the network of trading parties in Lloyd’s and the London Market alone. With an estimated 388,000 risk and claim bordereaux being shared between these parties each year, the amount of disparate data is growing exponentially. With no common standard applied across the market, the number of data schemas is vast, and this incompatibility makes it nearly impossible for companies to test insurtech systems quickly and efficiently.

The solution adopted by some insurers is a federated data model, which converts all the data received from distribution agents into one common format compatible with their analytics systems. This fourth insurtech tool solves the incompatibility problem by harmonising data and linking the members of the network.

It allows insurers to exploit insurtech distribution by enriching each company’s private cache of risk information with data from trading partners and independent market feeds. The resulting trove can be run through predictive systems that provide more sophisticated ways to assess and monitor the value of each and every risk dynamically, whether on or off the books, and to feed it back to distribution partners.

This approach allows insurers to identify past patterns within the data and use these insights to forecast future underwriting performance.

The impact of insurtech will be felt in two key areas. Firstly in the distribution of insurance products; for example by connecting insurers to the internet of things where products can be created to leverage the enormous reserves of generated data.

Second is risk analysis and management. By exploring and exploiting the historical data unleashed in the federated data model, underwriters can assess risk at a much more granular level to identify the specific drivers of profit and loss. Companies such as Logical Glue for credit risk and Shift Technologies for claimant fraud are already doing this, but the sector has real difficulty taking advantage of these advances because insurers cannot shoehorn their data into insurtech systems.

A future where the data translation challenges are overcome means digital distribution will extend beyond pioneering motor aggregators into every segment of insurance. Predictive analytics will sit alongside actuarial analysis and capital modelling. Market data feeds will flow harmoniously to help companies’ benchmark their own experience. Data will be captured at source, wherever a policy originates, and immediately converted into a form useful to all.

The result will be insurance products that are cheaper and more appropriate for the customer, bespoke even. Ultimately, a networked data grid will allow the free flow of trading information between any partners in the ecosystem. The London Insurance Market is celebrating its 328th year as a highly sociable network, but before digitisation is possible the trading data must be unlocked.

For more information please visit www.quantemplate.com