The positive achievements that businesses seek from digitalization reflect the enormous opportunity for growth that digital capabilities offer – and that industry clearly needs.

Broker Morgan Stanley, in its September 2016 research report ‘Disruptions and productivity growth in the next decade of the digital revolution’, reported US business could move from being 27 per cent digitalized to 43 per cent digitalized within five to ten years.

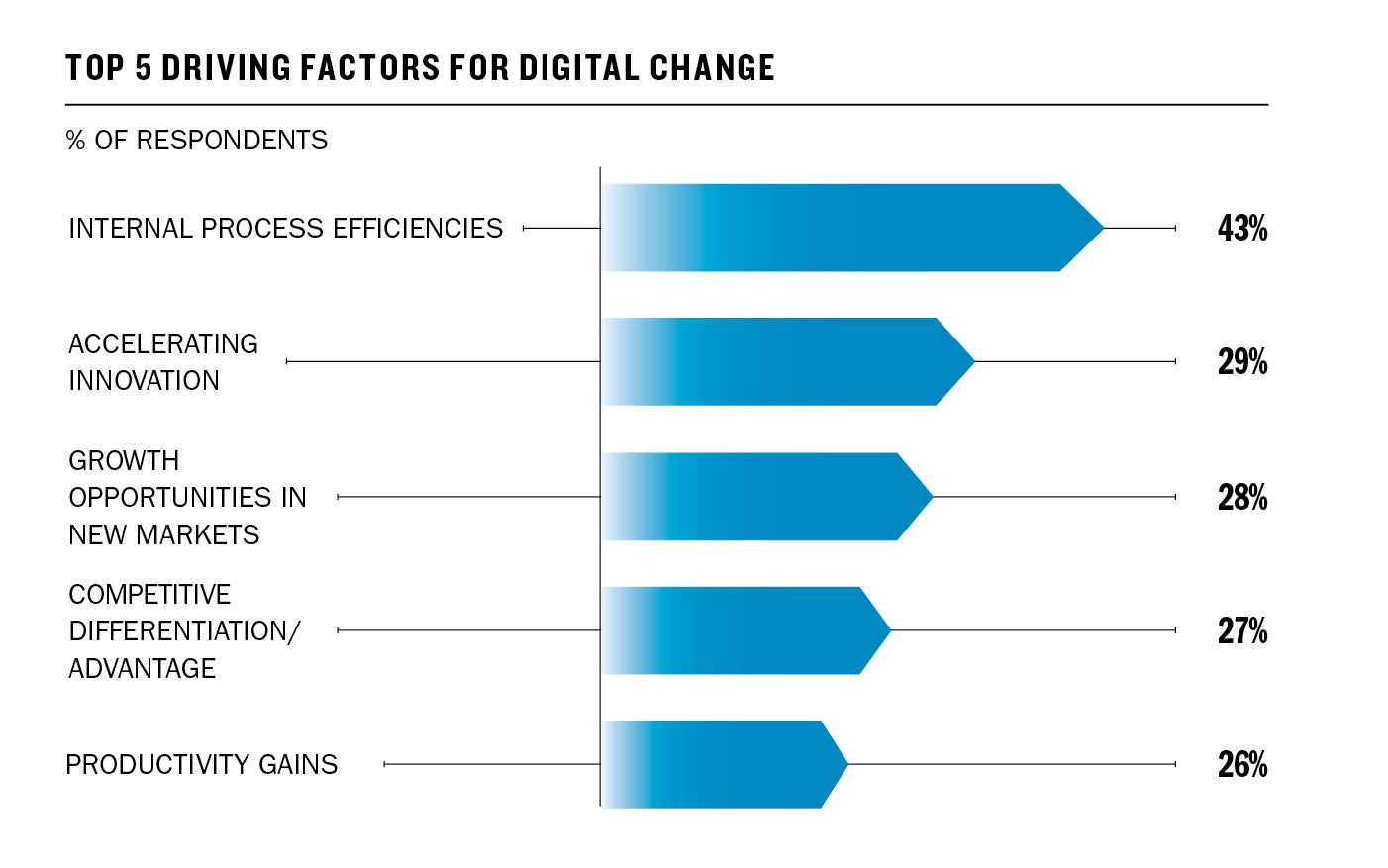

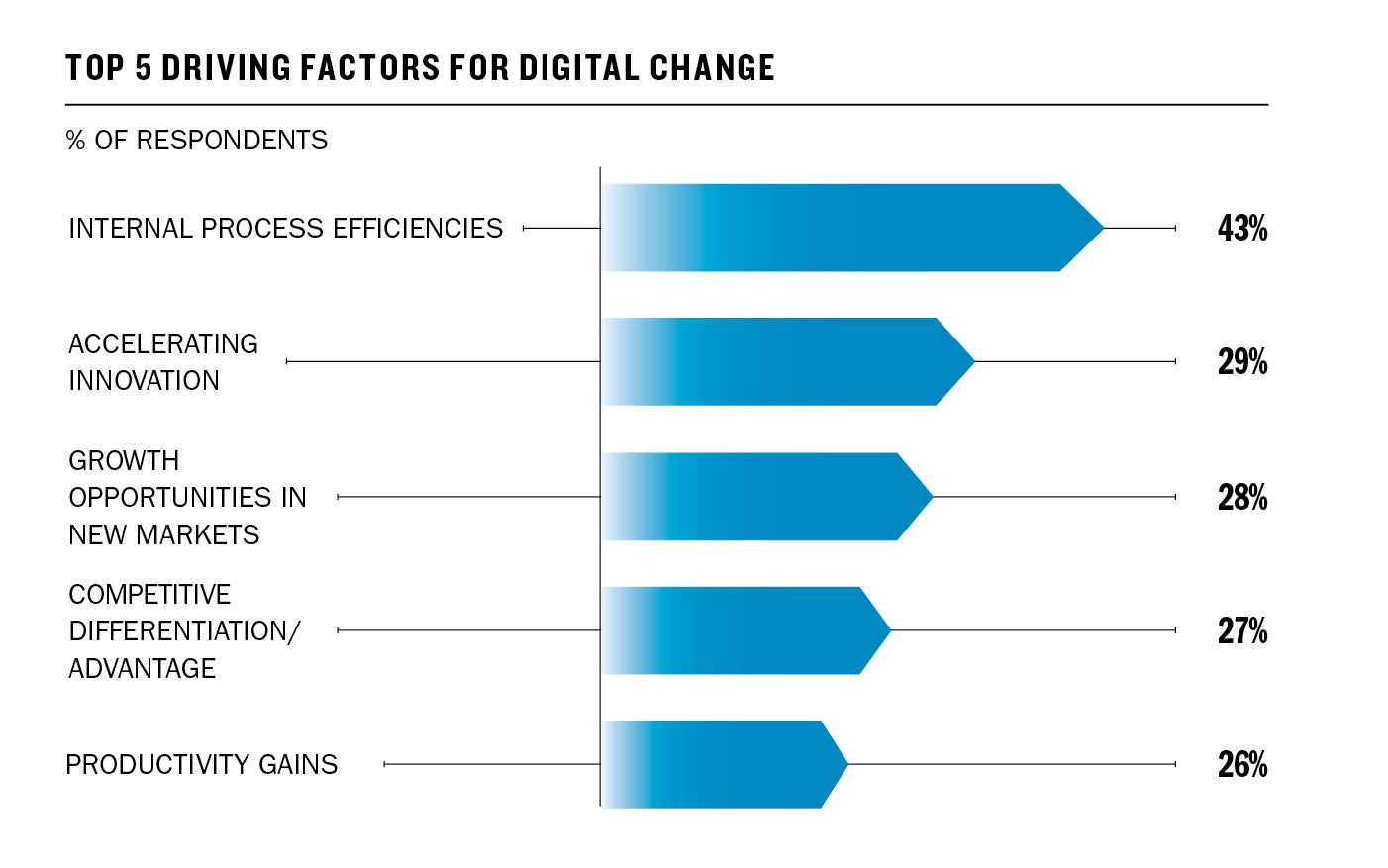

For businesses seeking to benefit directly from digitalization, the revolutionary nature of this transformation is apparent. In the research, companies across the board see a positive growth story stemming from innovation. They report the primary factor driving digital transformation as being internal process efficiency, with 43 per cent citing this in their top five factors. Along with the other most popular choices – accelerating innovation (29 per cent); growth opportunities in new markets (28 per cent); competitive differentiation (27 per cent); and productivity gains (26 per cent) – it shares a balance of top-line and bottom-line growth.

While these are not surprising goals, the method of achieving them has changed. The concept of providing a managed service on an ongoing basis – first championed by Rolls Royce 55 years ago as “power by the hour” – can now be applied through digital technology to every aspect of business. From Philips’ “lighting as a service” employed at Schiphol airport, to streaming music, firms are engaging in one-stop-shop service models that are predicated on ongoing delivery to users.

Productivity gains and increased levels of innovation support the potential seen by Morgan Stanley’s analysts. However, the real key to competitive advantage is to provide what your rivals cannot. Firms need to offer a differentiated service rather than target scale or cost.

Key to this is openness. Half the companies surveyed report an increase in the number of customers who want remote access to mission-critical business systems or data. This reflects the growing comfort with digital business at a consumer level, and the ease with which digital service providers have gained popularity.

Firms that embrace this open approach can thrive as access is reciprocated with customers. Solving problems for clients, instead of cherry picking services to offer, builds better relationships. The specific technologies that are sought out also support the thesis that digital-first businesses are seeking to empower their staff and customers in new ways.

Moving from a capital expenditure base to operational expenditure makes it easier for the user to engage and realize value from its partners. De-risking expenditure in this way builds a stronger relationship with the supplier and customer.

Most desirable capabilities

Chief among the technologies sought out for investment is big data and analytics (47 per cent). This captures many types of data-focused systems but broadly reflects the need for flexibility around data that legacy technology is unable to provide.

Chief among the technologies sought out for investment is big data and analytics (47 per cent). This reflects the need for flexibility around data that legacy technology is unable to provide

Relational databases, for example, have historically required that data is structured as it is stored. If a new query is needed, the data must be stored again based on a new structure. Big data and analytics, by contrast, allow for much more freedom of storage and retrieval. The ability to analyze data sets in parallel also generates faster results and allows for deeper analyses. Realizing more granular insights at low levels of investment becomes a virtuous circle of understanding – creating leads for new activity and better knowledge of relationships and process.

Enterprise resource planning, which 38 per cent of respondents rate as a top capability for investment, creates self-awareness within a business and sets up the capacity to change

Equally, enterprise resource planning (ERP), which 38 per cent of respondents rate as a top capability for investment, creates self-awareness within a business and sets up the capacity to change. It increases efficiencies and productivity that support the process of change, by boosting awareness of a firm’s current capabilities and mapping its structure more effectively.

In contrast, hardware-based digital technologies are far lower down the list for investment. Drones, 3D printing and virtual or augmented reality are a priority for just 5 per cent of respondents. Connectivity with devices via the internet of things (IoT) continues to rank high (in third place with 36 per cent of respondents). This suggests that firms are still exploring how hardware can be brought into the process of digital transformation, rather than committing to task-specific tools like 3D printers, which would need to prove return on investment in a more defined way.

Delivery and direction

Transforming an enterprise to benefit from these capabilities requires that a business carries forward its people and technology in the process of digitalization. The biggest barrier that respondents cite is a psychological rather than logistical one: namely, aversion to change, a concern for 42 per cent of respondents.

Overcoming this barrier can only be achieved if businesses are leading transformation from the top down: having a clear direction from the board of directors. But this must also be coupled with the grassroots growth of skills and understanding, so that the workforce is empowered by digitalization.

That will require strategic planning to move firms from the state of being enabled through to enhanced, as well as a cultural change to ensure that the business is remoulded around its digital capabilities.

Senior management must be explicit as to the goals of digital transformation and the wider context for the business. To fully engage the workforce in reskilling, leaders must share their vision for the digitalized enterprise to build trust in both projects and the end goal.

Most desirable capabilities