The auto-enrolment legislation applies to all employers. There is no “do nothing” option as there are no opt-out rules for employers and hefty fines can be imposed. On the face of it, enrolling employees may seem like a simple thing to do. But, while this in itself can be achieved without too much fuss, complying with all the rules is far more of a challenge, particularly for businesses without dedicated in-house pension departments. This is because the rules and regulations are complex.

For example:

• All employers will be required to carry out new employee assessments regularly, some of which will need new data to be stored and analysed, including the specific state pension age of employees

• New employee communications must be carried out, with mandatory content for three different categories of worker

• Contributions must be calculated and paid in respect of each employee – those from the employer and employee

• Opt-out and opt-in requests must be processed

• New record keeping rules apply, with some records needing to be kept for a minimum of six years.

All in all, the rules are detailed and arduous. As an indication of this, The Pensions Regulator, the body responsible for overseeing workplace pensions, publishes well over 250 pages of guidance notes to help employers.

To help you understand the issues and to provide easy-to-digest information, we have published a number of guides which you may find useful. Click on the front covers below to follow the links to the documents.

AN ALL-IN-ONE SOLUTION

The last of the documents highlights the amount of time small to medium-sized businesses will need to devote to auto-enrolment, should they choose to try and do it all themselves. It is so much time as to represent a genuine threat to businesses’ core activities.

We recognise this and so our service provides a complete solution. We’ll help companies comply with all their legal responsibilities and we do much more besides. We provide corporate consultancy so you can set a strategy with our expertise, taking advantage of options and design features, such as use of “postponement” to defer your auto-enrolment implementation. This consultancy will give you confidence and makes the practical set up easier and more efficient.

We’ll help companies comply with all their legal responsibilities and we do much more besides

We provide a complete software package to handle all the logistics. Called CREATE, our software handles all the analysis, communications and record-keeping. CREATE also provides a range of helpful information and online videos to support your employees. This is backed up with a Telephone Helpline – a very valuable service in itself as it stops time being taken up within your business and prevents rule breaches; for example, auto-enrolment coercion rules and the wider Financial Conduct Authority requirements.

In short, we help employers and employees with a complete auto-enrolment service.

COST SAVINGS

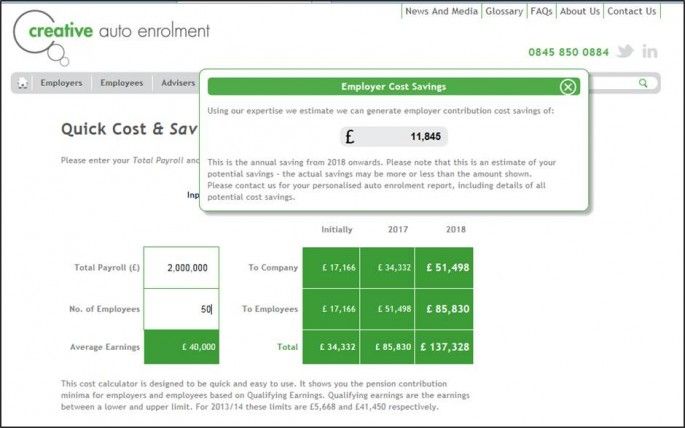

In addition to helping employers fulfil their onerous responsibilities, we also consult on and deliver ways for employers and employees to save money. For example, we use an HM Revenue & Customs-approved process to automate the payment of pension contributions by salary exchange.

We don’t know of any other service provider who offers this.

By automating salary exchange – our process also provides the necessary documentation – the savings, compared to payment of pension contributions by the net payment method, can really stack up. For a quick guide, visit our online calculator by clicking on the picture. All you need to enter is your payroll and number of employees.

For our complete end-to-end service to solve your auto-enrolment challenge and to keep your costs low, please call us on 0845 850 0884

Creative Auto Enrolment

www.creativeautoenrolment.co.uk