From excessive boardroom pay and sexual harassment to exploitation in the Third World, businesses that prize short-term profit over long-term reputation have found to their cost, in an era of social media, there is nowhere to hide.

Terry Saeedi, partner and pensions specialist with law firm Clyde & Co, says while the spotlight on more responsible executive behaviour is a challenge for some, a root-and-branch rethink of what constitutes a good investment is to be welcomed.

“Pressure from European and global institutions, together with social and environmental activism, is not only changing how we view the role of business, but also demonstrates that a focus on environmental, social and governance (ESG) factors should be part and parcel of an investment strategy, not an optional extra,” she says.

With all available research showing that companies that choose to do the right thing by workers, suppliers and society both prosper financially and outperform their peers, the business case for responsible investing is unanswerable.

“For corporates and trustees looking to make long-term, sustainable investment decisions for their workplace pension schemes, such firms are clearly a better bet,” says Ms Saeedi.

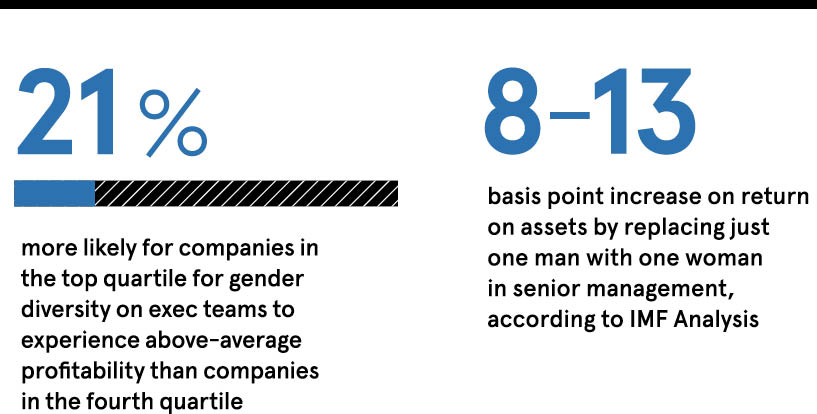

Although environmental concerns loom large in ESG, she believes that a fairer gender balance in organisations, particularly in the upper echelons, is a less contentious yardstick.

“While the entire debate over how to address climate change continues to rage, there can no longer be any doubt that firms with a higher level of gender and ethnic diversity in the workforce and on the board are more profitable,” says Ms Saeedi.

“I would argue gender balance has become a useful prism for looking at issues of corporate governance more widely and clearly demonstrates that far from being soft and fluffy, there is a pressing financial imperative behind ESG.”

With the UK stewardship code, which dictates how fund managers hold to account the companies they invest in, soon to be overhauled and the role of pension fund trustees to include any ESG factors deemed to be “financially material”, 2019 looks set to become a pivotal year.

“Trustees are responsible for £3 trillion-worth of investments in the UK, and have a huge opportunity to influence boards and help build a better society for all of us,” says Ms Saeedi. “But in terms of executive behaviour, there are specific areas worth keeping an eye on.

“I believe executive pay will prove an even more incendiary issue this year, as will non-disclosure agreements used to silence victims of sexual harassment. The debate over the living wage will inevitably become louder and businesses will also need to demonstrate they are making adjustments for a low-carbon world if they are to avoid attracting greater risk.”

Ironically, many of the underlying principles of ESG are already enshrined in the UK Corporate Governance Code, yet as Ms Saeedi points out, it has proved all too easy to overlook them in the past.

“There is mounting pressure on directors to explain why they make particular decisions and although this duty has existed for a long time in law, it’s very heartening to see it move to the top of the agenda,” she says.

With as much as £1.7 trillion of the total value of UK-listed companies thought to be banked in their reputations, any business which ignores the pressing societal and environmental issues of the day is vulnerable to a fall from grace.

“While trustees’ duties on ESG are tightening up, there is also an increasing focus on what steps employers should be taking with the contract-based schemes they select for their employees, in particular default fund strategies, and we are very keen to help them,” says Ms Saeedi.

“This is a difficult area in which the law is still developing and at Clyde & Co we can draw upon a wealth of experience from 50 offices in six continents to help guide our clients through.”

For more information please visit clydeco.com