Banks across Europe often claim smaller businesses are too expensive to service and their needs too diverse. Yet small and medium-sized enterprises (SMEs) are the backbone of Europe’s economy. They represent 99 per cent of all businesses in the European Union and employ 67 per cent of the workforce.

Despite representing a significant and profitable opportunity, SMEs face financial exclusion that leaves them unable to compete with bigger players. Lack of access to affordable banking solutions limits SMEs’ potential and hampers their growth. In turn, because SMEs play an important role in economies around the world, this exclusion has a negative impact globally.

Finding the right prescription

SMEs struggling to access suitable and affordable banking is nothing new. The brightest and hungriest firms have, for many years, faced this challenge. But when you factor in the coronavirus pandemic, which is forcing thousands of those businesses to shut down for weeks or months at a time, bringing cash flow to a standstill overnight, more than once within a year, the picture grows bleaker still.

With little cash left in the accounts and government support not always going far enough, SMEs need additional funding to pay rent, utility bills and payroll, not to mention ordering stock for anticipated customer demand. They also need cost-effective payment and foreign exchange services. However, unable to provide a long credit history or report consistent revenue, many SMEs find their usual bank can’t help and they are left unable to gain access to the services they need.

With the aim of exploring the specific challenges facing SMEs and identifying the opportunities for the financial services sector to support a post-COVID SME bounce-back, Banking Circle commissioned a new white paper, Bounce-back Banking: Five markers for success in delivering SME financial services.

The research revealed a significant gap between SME needs and the quality of advice and service they receive. Since new regulations and tougher restrictions came into play after the last global recession, banks have found it more difficult to offer financial services to smaller businesses. The wide range of business models, distribution and ambitions also means no two firms are alike, making them difficult for banks to serve. The result is SMEs are left out in the cold.

As a consequence, some European SMEs have been turning away from banks in certain service areas and more could follow. To remedy this situation, banks should think creatively about service provision, especially in areas like cross border payments and foreign exchange. Partnering with specialist providers reduces cost and enables tailored services through existing banks’ digital channels.

As the Banking Circle white paper explains, money transfer companies have grown rapidly by offering cheaper, faster transactions; others have experienced rapid growth for their lending solutions. Now, as established institutions utilise their customer relationships, brand trust, liquidity and clearing capabilities to hit back, they are working with financial infrastructure providers such as Banking Circle to be able to offer banking solutions that better serve SMEs, while maintaining profitability.

Achieving total financial inclusion for SMEs requires a joined-up ecosystem, where various financial providers connect their solutions

Preparing for the bounce-back

When banks first started, market requirements were very different, and no one could have imagined the

cross border, digital, international trading landscape in which we currently find ourselves. The once-pioneering systems and in-house servers on which banks are built now present a significant challenge in deploying new software and applying best practices.

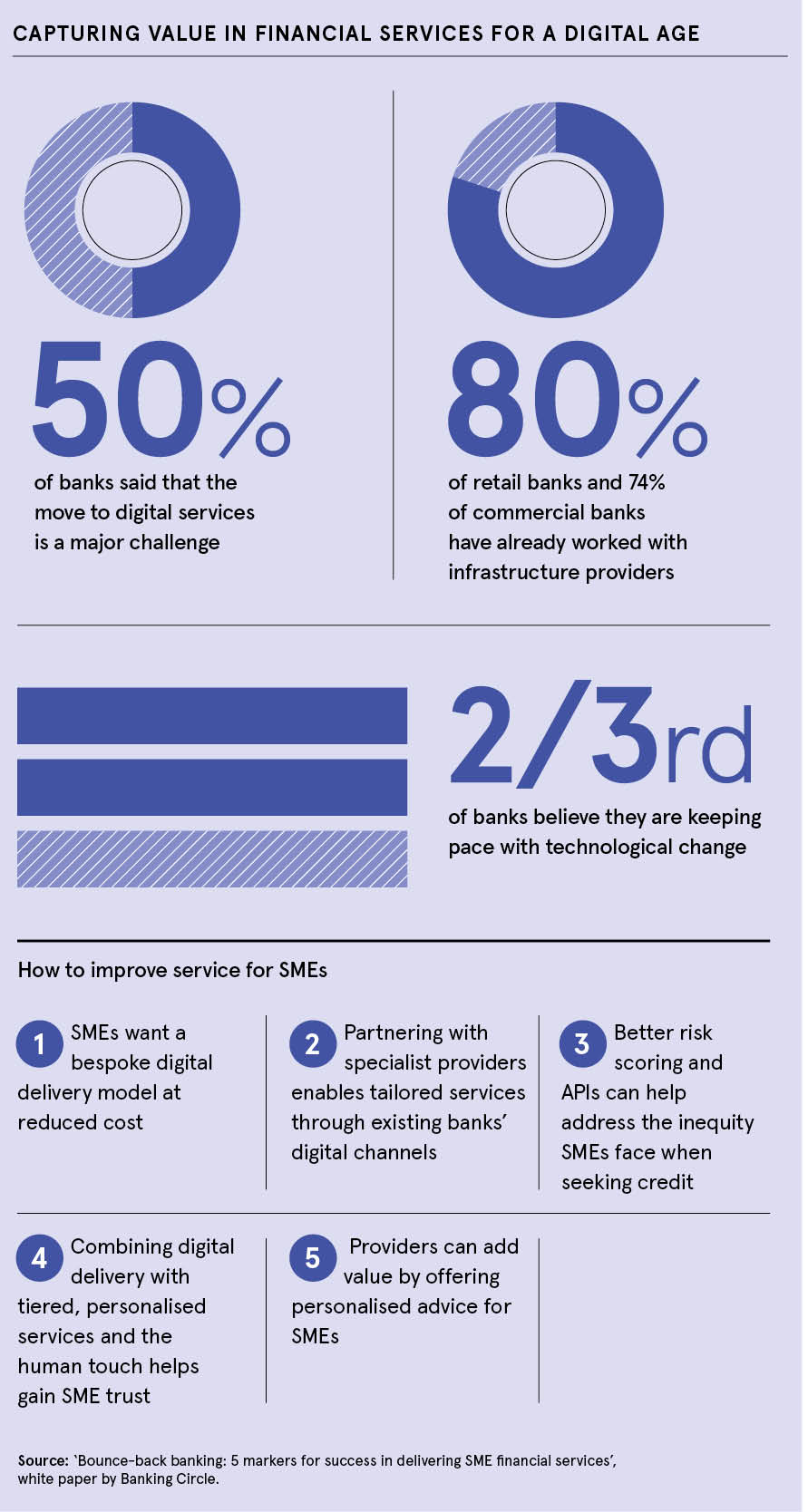

Fifty per cent of banks told us in the research we conducted earlier this year that the move to digital services is a major challenge, yet two-thirds believe they are keeping pace with technological change. However, smaller companies are turning to alternative providers for faster, cheaper solutions; almost half (48 per cent) of SMEs have looked elsewhere for banking solutions that better suit their needs.

Future-proof vision

No single provider can successfully meet the diverse needs of the entire SME community. Ultimately, achieving total financial inclusion for SMEs requires a joined-up ecosystem, where various financial providers connect their solutions. Making these connections will be of vital importance to global economies as we look to recover from the worst health crisis in a century and one of the biggest economic shocks in history.

Partnering with specialist providers within the financial ecosystem reduces cost and enables tailored services through existing banks’ digital channels. Our research found 80 per cent of retail banks and 74 per cent of commercial banks have already worked with infrastructure providers.

Financial infrastructure providers such as Banking Circle are focused on developing the technology to process payments directly and to integrate with a vast network of local clearing and payments schemes. Using decoupled architecture, we can easily update or replace individual pieces of architecture with limited impact on the rest, so we can quickly add more functionality and work within new geographies.

This means we are uniquely placed to give banks and payment businesses the ability to provide their business customers with faster and cheaper cross border banking solutions.

Inadequate access to cross border payments, foreign exchange and bank accounts is putting precious SMEs at serious risk more than ever before. Providers of all types need to make changes so they can provide better solutions for smaller businesses.

To find out more about how financial services providers can improve their service for SMEs, download the white paper at bankingcircle.com

Promoted by