Leo Pharma is a mid-market company that puts its money where its mouth is when it comes to innovation. Last month it took all its 150 employees in the UK and Ireland away from their day-to-day jobs to participate in an “Innovate and Celebrate” day in a bid to get them thinking about how the company, which specialises in treatments for skin conditions, could do some things differently.

“We need to be more creative and clever in what we do,” says managing director Geraldine Murphy. The aim is that making changes and implementing new ideas will help to maintain or increase sales and profits in the years ahead.

The innovation day is a good example of how the best mid-market companies strive to involve all their workers in the innovation process- a necessity when they typically have limited resources and funding to devote to research and development. As these companies must work harder to win and retain customers, and ensure their products remain best-in-class, most realise that innovation must be a constant priority.

It can take many different forms; as well as referring to the development of new products or services, it can also mean improving or enhancing processes within the business, or at the supply-chain level.

While innovation may be more visible in some sectors than others, Ajay Bhalla, professor of global innovation management at Cass Business School, City University London, believes that it is an essential consideration for every mid-market company no matter what type of business it conducts.

The nature of innovation for this sector has changed considerably in recent years, he says. Whereas it once required substantial investment with staff all working in one place, technology has allowed employees to be dispersed geographically, but still maintain effective working relationships.

Mid-market companies are increasingly able to spread the cost and risk of innovation by working with customers to develop new products or services. Multinational firms, such as Procter & Gamble, are making this process easier by actively encouraging its smaller suppliers to collaborate with its staff. “A lot of mid-market companies are finding that they don’t need the financial or market muscle of large companies to have effective [innovation] strategies,” says Professor Bhalla.

ATTRACTING TALENT

An increasing number of graduates now want to work for smaller companies, rather than the titans of the corporate world, he argues, because they are less bureaucratic, react to unexpected challenges more nimbly, and encourage employees to come up with their own ideas and put the best ones into action.

But senior management must remember that, although their workers may have high levels of job satisfaction, this does not automatically result in innovation.

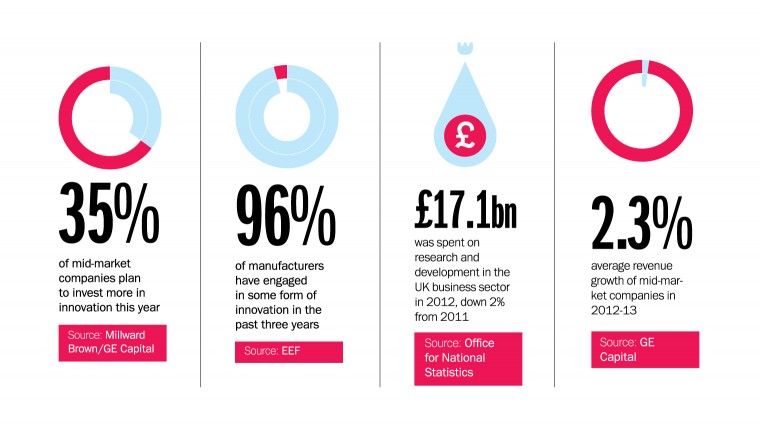

The best-performing companies of any size spend a greater proportion of their revenues on research and development to fund innovative practices. However, mid-market firms face a greater challenge than larger companies because they lack their scale and have to take the risk of funding work that might not improve the bottom line.

Nevertheless, Professor Bhalla says that “mid-market companies cannot ignore continuous innovation… they don’t often have that many ‘cash cows’ – mature products that can generate streams of cash – and therefore need a stream of new products and processes”.

Matthew Fell, the CBI’s director of competitive markets, points out that mid-market companies generate a larger proportion of their revenues from new products. He says it is important that they adapt their innovation style as they grow, putting in place more formal management structures and better corporate governance.

The best-performing companies of any size spend a greater proportion of their revenues on research and development to fund innovative practices

Mid-market companies can also benefit their innovation process by forging links with higher education; often universities can be unaware of their existence. Waterstons, a medium-sized IT consultancy based in Durham, sought to stem the brain drain of graduates from universities in the North East of England by developing closer ties with universities in the region. It now offers paid internships to the best students, many of whom are offered jobs when they graduate.

MANUFACTURING

A sector for which innovation is particularly crucial is manufacturing, where spending on research and development averages 8.8 per cent compared with just 1.1 per cent across the wider economy. Many UK manufacturers fall into the mid-market category and innovation is less an option than a prerequisite for remaining in business, according to Felicity Burch, senior economist at EEF, the manufacturers’ organisation.

“They have to keep innovating to keep up with the competition – most manufacturers operate in overseas markets and are competing with the best in the world. If they don’t want to compete on price, they need innovation to differentiate their product and ensure it is of the highest quality,” she says.

Many mid-market companies focused their efforts on process innovation in the wake of the economic downturn, she adds, because returns are evident more quickly and there is less risk involved: “Product innovation can take a lot longer and you don’t necessarily know what returns you’re going to get from it.”

A third kind of innovation that is now more common is service innovation, which could take the form of working with a customer to design a component that will seamlessly integrate into one of their products.

One mid-market company that makes electronic products, including switches for the construction industry, is now having to install them for its customers because the product has become so complex, which has also helped to improve profitability. “The more product innovation you do, it can lead to other forms of innovation,” says Ms Burch.

Innovation can be found in some unexpected quarters. As well as developing new drugs and treatments, Leo Pharma has used social media to target information at sufferers of skin conditions.

Ms Murphy says: “It’s important for us to bring new and innovative medicines to market, but it’s just as important to bring innovative support mechanisms to patients – it’s not just about the drug, but the whole patient experience.”

Innovation extends to the way the company conveys information about its products to medical professionals. Rather than spend money on a large force of sales representatives, Leo is increasingly using digital promotion techniques to reach dermatologists and GPs.

While many mid-market companies are innovators in all senses, more could be done. Britain lags behind its international competitors in research-and-development spending by business, and better support for mid-market firms to take advantage of government schemes could help the UK narrow that gap.